ActivTrades Review: All ABout ActivTrades.Com

Our readers can find in this ActivTrades review all the benefits and downsides of investing with this long-time ago established broker. Since 2001 they are building their reputation as a trusted and reliable broker. Moreover, they have spread all across the world.

But to see what makes this broker stand out in the broker’s ocean, you have to read this review carefully. With multiple assets, stable trading software and many featured security measures standards have risen to the highest level.

Who Is ActivTrades Broker?

ActivTrades PLC is primarily registered in London, United Kingdom. Since 2001 they were establishing offices all across the world. Now they have it in Brazil, Portugal, Italy, Luxembourg, Bulgaria and the Bahamas. All these entities are subsidiaries of ActivTrades PLC.

Important to realize is that the company has multiple domains for every necessary region. Thus, they are not offering services to US citizens. With multiple contact options, they made themselves available to their clients 24 hours, 5 days a week.

| ActivTrades | |

| Legal name: | ActivTrades PLC |

| Regulation: | Regulated |

| Registered in: | UK, Brazil, Bahamas, Bulgaria, Portugal, Italy, Luxembourg |

| Established: | 2001 |

| Website: | www.activtrades.co.ukwww.activtrades.euwww.activtrades.com |

| Financial Authorities Warnings: | N/A |

| Contacts: | Phone: +44 (0) 207 6500 567, +1 242 603 5200, +44 (0) 207 6500 567E-mail: [email protected], [email protected] chatOnline message form |

| If a withdrawal is possible: | Yes |

| Fees: | Only a 9 GBP withdrawal fee for a wire transfer |

| If Active on Social Media: | Yes – Facebook, Twitter, LinkedIn, Youtube |

| Investor Protection: | Yes – Negative balance protection, insurance of funds, Tier 1 segregated bank accounts |

Regulation and Fund Safety – EU vs. Bahamas

As with any other broker, we mainly focus on Tier 1 regulations. For example, FCA, BaFin, ASIC, CMVM and CONSOB. Indeed, ActivTrades has multiple regulated entities. Primarily ones in the UK, but also Portugal and other mentioned countries. However, ActivTrades Bahamas regulation is another topic. Offshore regulations don’t have strict requirements. Neither funds protection measures.

The main difference between EU and Bahamas regulation is seen through leverage. While EU regulators allow maximum leverage of 1:30, offshore entity offers up to 1:400. Also, all traders outside of Europe are trading with the offshore entity. That means lower security standards. Still, this broker manages to do their business genuinely even though some traders are claiming otherwise.

Thus, FCA states that there has been disciplinary or regulatory action involved with this company.

ActivTrades Broker Profile

Generally speaking, the ActivTrades platform has quite an attractive offer. With a vast of instrument classes and favorable trading conditions, they became popular very quickly.

Even though the company offers cashback, there are no bonuses available. Mainly because of ESMA regulations for European entities. Also, popular brokers worth checking you can find in our FXFlat, Admiral Markets and LegacyFX reviews.

ActivTrades Leverage

As shown above, ActivTrades leverage differs depending on regulation and your country of residence. In general, EU regulators limit EU entities in some way. However, they can still have Pro accounts that allow traders to have higher leverage.

Of course, that is allowed after prospecting traders’ capabilities and knowledge. A downside of ActivTrades broker is that all non-EU residents must trade with offshore conditions and regulations.

ActivTrades Spreads

Another key point is ActivTrades spreads. Even though they have generally very low spreads, those vary again on regulations and the entity you are trading with.

For example, EUR/USD spread is 0.63 pips while crude oil starts at 3 pips. Quite an attractive offer and most importantly you can check it out through a demo account.

ActivTrades Trading Platform – MT4 and MT5

Besides fascinating proprietary web-based platforms, traders can use ActivTrades MT5 and MT4 platforms. ActivTrades Meta Trader 5 is one of the most popular choices. Primarily due to the availability of advanced features like algorithmic trading through Expert Advisors and copy trading. Unfortunately, they lack social trading as one of the most popular choices nowadays.

But ActivTrades Meta Trader 4 doesn’t lack also important features. Most importantly, all platforms are available for all Android and iOS devices. So, it solely depends on personal preferences regarding which one you will use. With lightning-fast executions, more than 90 indicators and high reliability you can improve your trading results drastically.

| Trading platforms: | MT4, MT5, Proprietary |

| Account types: | Individual, Professional, Demo, Islamic |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:400 |

| Minimum Deposit: | $500 |

| Commissions/bonuses: | Up to 5 EUR commission for shares / No bonuses available |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Educational webinars, seminars, manuals |

ActivTrades Traders Reviews – Sharing Experiences

ActivTrades reviews look quite positive. Almost 80% of the reviews on Trustpilot come with the highest rating. However, there are a few of those complaining about withdrawal issues.

Whether this is true or not you have to decide yourself. Where’s the smoke there is a fire as well. On the positive side, if you are trading with the regulated broker you can always file a complaint to the regulator and solve the issue. But if you have any withdrawal-related issues you can find a solution together with our experts. Get in touch to find out how.

How Does the Broker Find Customers?

With more than 100.000 traders, according to the company, it’s easy to develop a network. With brokers’ very attractive offers for affiliates, they can get new clients fast. In addition to that, they are running multiple social media accounts. So, practically they can get new clients everywhere.

Whether it’s a paid advertisement about an upcoming event, the latest news or whatever attractive offer they come about. But their visitors mainly come from countries like:

- Brazil

- Italy

- Germany

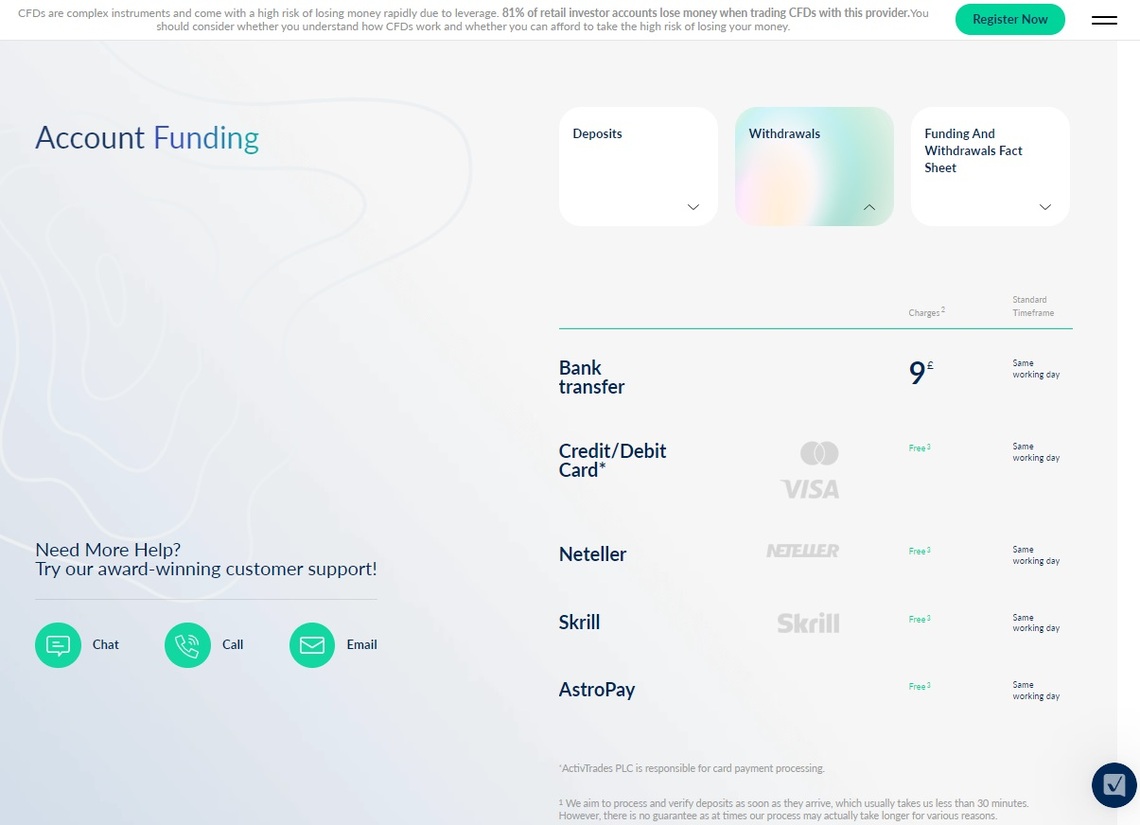

How Can I Withdraw My Profit?

Withdrawal options are the same as depositing ones. Traders can choose between:

- Bank transfer

- Credit and Debit cards

- Neteller

- Skrill

- AstroPay

Even though they claim all methods except for bank transfers are without fees, there is a disclaimer. To be precise, under special circumstances, the broker may apply charges on the account balance. According to the broker, ActivTrades withdrawal processing time takes up to 30 minutes. But it can take longer if unexpected issues happen.

ActivTrades withdrawal maximum amount in 30 days is 50.000 EUR. Important to realize is that profits are processed through bank transfers.

Our Safe Trading Verdict of ActivTrades broker

Traders are mainly looking for brokers with high-security standards and high overall ratings. To be honest, ActivTrades has many advantages over some other brokers. Still, some ActivTrades reviews might raise suspicion. Ultimately, the decision is yours if you will trust this broker or not.

In any case, our specialized team is there to provide you with all the necessary information about brokers. After you go through our list of trusted and reputable brokers you can sign up with any of them. But it’s good to review others as well. Also, if you ever had an issue with the broker, feel free to let us know. The fund recovery process might be exhausting, but it’s worth the time.

Don’t hesitate to contact us already today. Our online chat is the fastest way for booking your first consultation. Most importantly, the first consultation is free. We are waiting for your message.

FAQ Section

Is ActivTrades Trustworthy?

Yes. Still, you have to make sure which entity is responsible for your account. Only then you know what laws, regulations and conditions are applied to your account.

How To Start Trading Safely?

As you can see from the example, only with Tier 1 regulated brokers. However, if you are unsure about choosing the right one, let our professionals explain you in detail.

How Can You Help Me Choose the Best Forex or Crypto Broker?

Considering your residence country and your preferences, you have to choose a broker wisely. However, without any commitment and costs, you can get advice from our team. Contact us today!