Amana Capital Review: All About AmanaCapital.Com

Locating a reliable broker is essential when trading online. We explore the broker in-depth in our thorough Amana Capital review so that you have all the knowledge you need to make an informed choice.

The other companies we are examining are also beneficial to our readers. Check out our reviews of LCG London Capital Group, XTB Broker, and SVK Markets.

Who Is Amana Capital Broker?

This broker is a reputable brokerage firm registered at Kristelina House, 3rd Floor, Office 302 12 Archiepiskopou Makariou III, Mesa Geitonia 4000, Limassol.

Incorporated in 2010, Amana Capital is a member of the financial services group. With offices in Dubai, Beirut, Cyprus, and London, it offers brokerage services on international markets.

| Amana Capital | |

| Legal name: | Amana Capital Limited |

| Regulation: | Regulated by FCA. DFSA. CySEC. LFSA. FSC |

| Registered in: | The Republic of Cyprus with the

Department of Registrar of Companies under the number HE 281953 |

| Established: | 2010 |

| Website: | amanacapital.com.cy |

| Financial Authorities Warnings: | None |

| Contacts: | 24/5 live chat support (Telegram, Messenger, Whatsapp)

Phone: +357 2525 7980 Cyprus +971 4276 9525 UAE +961 1370 940 Lebanon +60 8750 4553 Malaysia |

| If a withdrawal is possible: | Yes |

| Fees: | Overnight fees on leveraged assets

Clearning fees on regional stocks |

| If Active on Social Media: | Yes |

| Investor Protection: | Investor Compensation Fund |

How Are You Protected at Amana Capital? Security and Regulation

The safety of trading with a broker like Amana Capital is one of the first things a prospective trader needs to determine. Identifying the regulatory bodies that keep an eye on a brokerage’s operations is one of the best ways to gauge its level of safety.

In each of the obligatory legal systems where the broker conducts business, Amana Capital is subject to regulation by the respected local authorities through its five primary bodies:

- ACG International Limited – C118023192 license from the Financial Services Commission of Mauritius

- AFS Global – LFSA of the Labuan Financial Services Authority Malaysia – license number MB/18/0025 Amana Financial Services UK Ltd.- FCA or Financial Conduct Authority, with license number 605070

- DFSA or Dubai Financial Services Authority license number F003269 is held by Amana Financial Services Dubai Ltd

- Amana Capital SAL Holdings- CMA or Lebanese Capital Markets Authority, with license number 26

- Amana Capital Ltd- CySEC or Cyprus Securities and Exchange Commission, with license number 155/11

The UK clients of the broker are protected by the Financial Services Compensation Scheme (FSCS). Qualified UK investors are safeguarded by this program in the event of broker bankruptcy. The FSCS will be able to pay eligible clients if that happens.

EU clients are safeguarded by the Investor Compensation Fund (ICF), which ensures that qualified clients can get reimbursement or compensation in the event that the broker fails.

In addition, Amana Capital is offering qualified LFSA and FSC clients free insurance coverage.

Amana Capital Broker Profile

All the information we have found so far for this broker review, suggests that trading with this broker is safe. Upon checking Amana Capital’s website, we can see its numerous regulated sources, physical presence, and excellent customer care, all of which are accessible through different platforms.

| Trading platforms: | MT4, MT5 |

| Account types: | Individual, Joint, Corporate |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:500 / 1:30 |

| Minimum Deposit: | No minimum amount |

| Commission/bonuses: | Mostly free, some are from $0.02/$50 deposit bonus |

| Mobile app: | Amana App |

| Desktop app: | Amana App Web Trader |

| Auto-trading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Webinars |

Amana Capital Demo Account

The demo account interface is perfect for traders who wish to learn how to trade without taking risks or losing any money. With the Amana Capital Demo Account, you may experience forex trading with zero risk.

Traders must download the trading platform and log in using the provided account information in order to access the Amana Capital demo account. It offers virtual funds for traders to practice trading and develop expertise in a live trading environment.

Demo accounts can be used by beginners to become accustomed to live trade and actively participate in trades in order to improve their trading techniques and tactics. Advanced traders can also use the Amana Capital demo account to investigate the products and services that it offers.

Amana Capital MT4

The MetaTrader 4 platform is adaptable enough to match your level and trading approach, whether you’re an expert trader or you’re just beginning to explore financial markets. The platform, which is used by millions of traders worldwide, provides cutting-edge technical analysis tools, automated trading capabilities (Expert Advisors), and mobile trading applications.

Additionally, it has a user-friendly design that enables users to examine their orders, trades, and balances as well as stay up to date with the most recent market developments.

The broker MT4 trading platform provides:

- Tools for technical analysis and current financial news

- High-grade encryption with 128-bit

- Historical data and current quotes for analysis

- Options for flexible charting with programmable settings

- Script-based automated trading capabilities

- Features for effective trade management

Users need to visit amanacapital.com to get to the broker login page and enter their information to access their trading accounts securely and easily.

Is Amana Capital Broker Safe?

We are positive that this broker is legitimate after reviewing their regulations. They also employ trustworthy trading software.

The majority of their offerings can be traded without paying a commission. You can test it out using the company’s demo account, which is available online. There is no minimum deposit requirement and the company offers great customer support available through various platforms.

Amana Capital Review: Traders Sharing Experiences

Normally, these Amana Capital issues would be regarded as a red flag, but based on the review’s substance, we might agree that there isn’t enough information in this particular circumstance. Only 20% of the 10 reviews total on TrustPilot are positive.

The majority of reviews concentrate on withdrawal issues, however, some of them appear to be false because they cite the same business.

We could conclude that the company is not hooked on writing false evaluations about itself without a significant quantity of reviews.

How Does Amana Capital Platform Reach Clients and Who Are They?

The broker employs a multi-platform approach to cater to the diverse needs and preferences of traders. Clients of Amana Capital can use the company’s online trading platform using web browsers and mobile apps.

Since they were founded in 2010, they have gained recognition for delivering a secure trade environment. Amana Capital operates from these countries:

- United Arab Emirates

- Lebanon

- Kenya

- Egypt

- United States

To a wide spectrum of clients, including individual and institutional traders worldwide, the broker offers specialized solutions and a comprehensive range of trading instruments. If you want to learn how to trade and find a reliable broker, contact us today.

Funding Method

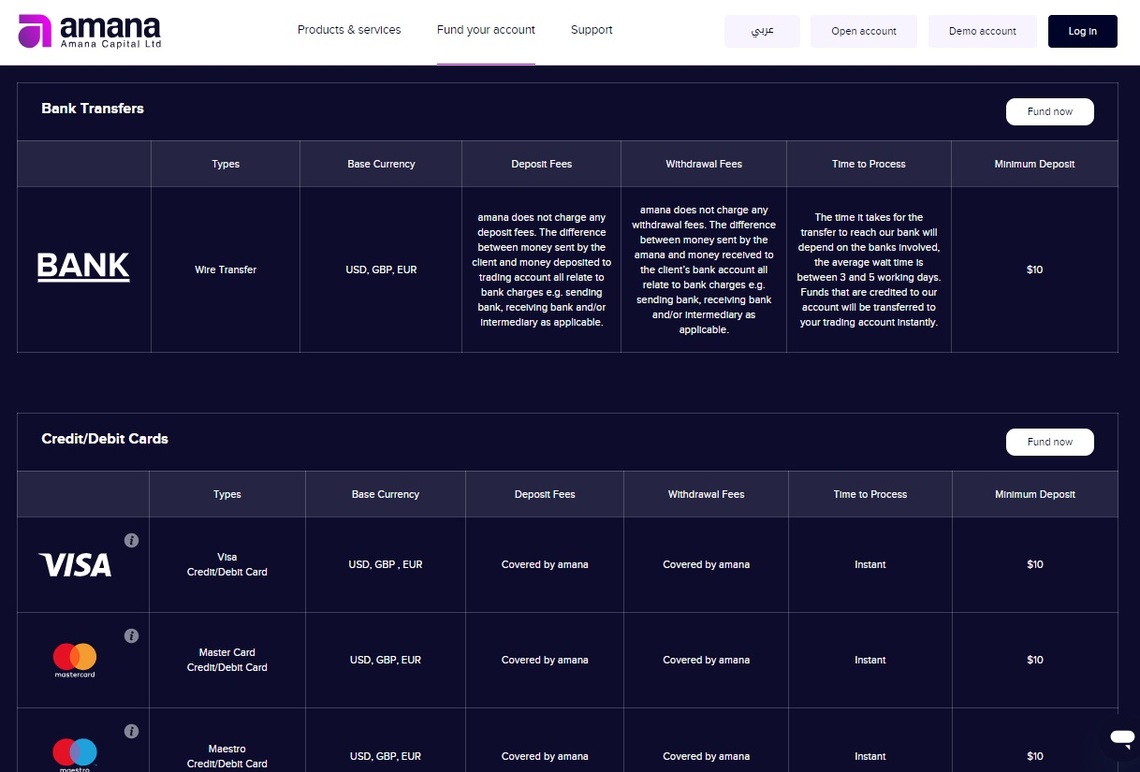

This broker offers a total of 15 funding methods for clients to deposit or withdraw funds into their trading accounts.

These methods include bank wire transfers, credit/debit cards, and popular online payment systems such as Skrill. Netelle, and other. The broker ensures secure and convenient transactions, allowing clients to choose the most suitable option for their needs.

Amana Capital Minimum Deposit

The broker offers a variety of account types with no set minimum deposit requirement, giving its customers choice.

Because there is no minimum deposit requirement, traders are able to select an account that fits their trading style and financial constraints. This strategy encourages diversity and guarantees that traders of all experience levels can make use of the opportunities and services provided by Amana Capital.

Our Safe Trading experts’ opinion of Amana Capital broker

This Amana Capital review is a result of our extensive study, and we have a favorable impression. We can easily say that Amana Capital is a trusted broker who places a high value on security and safety.

The transparent and competitive broker fee structure gives traders a clear idea of the costs associated with trading different financial instruments.

The broker is subject to respected regulatory agencies across several legal systems, assuring adherence to stringent financial requirements. Amana Capital offers a complete trading experience with a user-friendly trading interface, a variety of financial instruments, and aggressive trading conditions.

Contact us to schedule a free consultation if you are a trader looking for a secure and effective trading environment.

FAQ Section

How is My Security Ensured When Using Amana Capital?

The broker is governed by reputable regulatory bodies in numerous legal systems, ensuring compliance with strict financial criteria. A local regulatory body keeps an eye on them to stop any malicious or overly reckless behavior by the broker.

How To Start Trading Safely?

The main source of safe trading is through regulated brokers. Contact our staff to learn which ones best suit your trade preferences and your country's legal requirements.

How Can You Help Me Choose the Best Forex or Crypto Broker?

To make the best recommendations, we evaluate your trading needs, preferences, and degree of expertise. Importantly, there are no costs or obligations associated with our consultation.