AMarkets Review: Fraud Behind AMarkets.Com

AMarkets looks like a website of a legitimate broker. It is very informative and quite comprehensive. The broker supports many trading platforms, and seems to check out when it comes to the legal background… But it only seems so.

When you put a little effort into checking the company’s background, you will find that their regulation is not valid. Furthermore, there are multiple warnings issued by financial regulators from the EEC. Find out more about this fraud in our AMarkets Review.

| Company | AMarkets LTD |

| Regulation | Unregulated |

| Warning | CONSOB, CMNV |

| Website | AMarkets.Com |

| Address | SVG (alleged) |

| [email protected] | |

| Phone | +44 330 777 22 22 |

| Minimum Deposit | $100 |

| Leverage | 1:3000 |

| Bonuses | 100% up to $10 000 |

Is AMarkets a Reliable Broker? Regulation and Security

AMarkets claim to be legally registered and authorized by the financial regulator of St. Vincent and the Grenadines to conduct broker-related business. This would all be nice and dandy if any part of it were true.

Unfortunately, the database of SVG Financial Services Authority does not contain any information about AMarkets, meaning they are not registered. Furthermore, you should be aware that the FSA stopped regulating brokers a while ago because they lack the resources and manpower for such an arduous task. This means that the claims of AMarkets registration and regulation are null and void.

You should note that the website of AMarkets gives a disclaimer that they do not offer their services to many nations worldwide. Interestingly enough, the website is properly translated to many of these nations’ official languages.

AMarkets supports negative balance protection and client fund segregation. They also seem to incorporate a compensation fund, which is well within the financial framework of the EU. One of the points where they diverge from European regulation is the extremely high leverage of 1:3000, where the maximum allowed in the EU is 1:50. Another is the presence of a bonus, which is banned by EU regulators. It doesn’t help that AMarkets has accrued the warnings of Italian CONSOB and Spanish CMNV.

Broker’s Trading Platform Overview

As we mentioned before, AMarkets offers a variety of trading platforms. This company offers renowned MT4 and MT5 trading software. The platforms are available on all operating systems, including mobile devices running Android and iOS.

MT4 and MT5 are industry standard programs for a reason. MT4 was first put online in 2005 and has seen incremental development over the years. It supports multiple timeframes, interactive charts, and one-click trading.

MT5 is a new development, optimized for current hardware. This versatile app sports the highest market execution speed of any platform currently in use, as well as automated trading and embedded strategy testers.

AMarkets Account Types Available

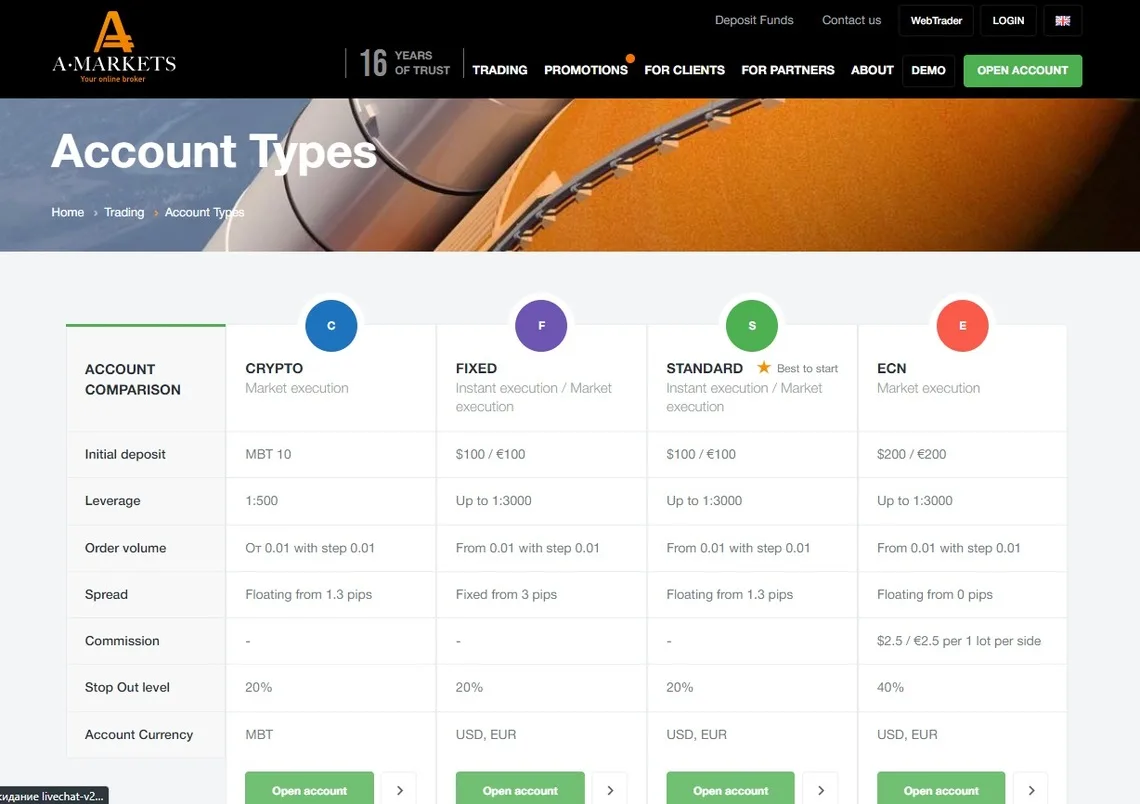

AMarkets has a good variety of trading accounts to choose from. This brokerage also has a demo account and a swap-free Islamic account for people trading under Shariah. The minimum deposit is relatively low for a scam broker, but the spread is quite pricey.

We can see the accounts and their trading parameters here:

- Crypto – Min. deposit MBT 10, leverage of 1:500, floating spread from 1.3 Pips

- Fixed – Min. deposit $100/€100, leverage of 1:3000, fixed spread 3 Pips

- Standard – Min. deposit $100/€100, leverage of 1:3000, floating spread from 1.3 Pips

- ECN – Min. deposit $200/€200, leverage of 1:3000, floating spread from 0 Pips, commission of $2.5/€2.5 per 1 lot per side

High leverage on these accounts leads to an increased risk of asset loss. Such large leverage is comparable to other fraud brokers like Valuta Markets. All these unfavorable factors will lead to rapid financial loss in your trading accounts.

AMarkets Funding Methods Available

AMarkets supports many different payment methods, on par with some of the regulated brokers. After checking these funding methods, they all seem legitimate.

These funding methods include Bank Cards (Visa, MasterCard), Bank Wire Transfers, E-Wallets (FasaPay, Neteller, PerfectMoney), as well as some Crypto Transfers (BTC, LTC, ETH, USDT). The deposits are commission free.

The withdrawals are not outlined clearly enough on the website, however. This might mean that the withdrawals are dependent on a certain trading volume, or have hidden fees and charges. AMarkets does have a few scam warnings looming, so you should exercise caution when dealing with this broker.

How Does the Scam Implement?

Although AMarkets seems to have all the merits of a regulated broker, they lack any legal precedent to offer their services to customers. This is not unlike other scam brokers, like PrimeXBT. The scammers want you to believe everything is in order, but in reality, they are a bunch of sophisticated thieves

Scam brokers are also known to manipulate market data on their platforms. When you combine this with high leverage, you’re guaranteed to lose your entire deposit in a few clicks of a button. The absence of clearly outlined withdrawals also raises some suspicion – withdrawals are likely to incur large taxes or transaction fees.

AMarkets Summary

AMarkets is one of those scam brokers that go the extra length to make their website and trading conditions look believable. Unfortunately, the company lacks any regulation. They may adhere to most of the strict European standards, but in fact some regulators from the EU have issued a scam warning about the company.

You will find that their demo account does not represent realistic market situations, and that it is just a bait for victims. A high leverage, combined with tailored market information will lead you to one financial loss after another.

FAQs About AMarkets Broker

Is AMarkets Regulated?

No, AMarkets is a completely unlicensed brokerage.

Is My Money Safe with AMarkets?

No. Even though some safeties do exist, this unregulated broker is a fraudulent entity.

Does AMarkets Offer a Demo Account?

Yes, AMarkets offer a Demo account for their traders.