BCR Review – Who is BCRCorp.Com.AU Broker?

BCR Review, Forex trading is especially popular nowadays. There are many FX brokers to choose from. Some are good, and others are not so.

Anyhow, picking the right one can be demanding in terms of time and money. To save you trouble, we have analyzed and suggested the one in the upper league.

If seeking online trading services, you will find BCR’s offer entirely appealing. It is not surprising since this online financial trading company is well-known for rendering excellent service.

Some of the main advantages of trading with the BCR broker are funds’ safety, reliable trading platform, encouraging trading conditions, plenty of trading instruments, and exceptional customer support.

Since this is an honest review, we must also single out a drawback; in this case, it is BCR’s limited means of education.

In the following BCR review, we will discuss all of these and answer the next question: who is BCRCorp.com.au broker?

| Headquarters | Australia, BVI |

| Regulation | ASIC, FSC |

| Instruments | Forex, Metals, Commodities, Indices, and Shares |

| Platforms | MT4 |

| EUR/USD Spread | 1.6 pips |

| Minimum Deposit | 300 USD |

| Base Currencies | AUD/USD/GBP/EUR |

| Demo Account | Yes |

| Education | News, webinars, how-to, FAQs, glossary |

| Customer Support | 24/5 |

Is BCR Legit? Regulation and Security

So, let’s begin by answering the following question: is BCR regulated? Yes, for sure. In fact, the first virtue of BCR is the guaranteed protection of funds, which is achieved by complying with legislation and holding several broker’s licenses.

Namely, this forex provider is authorized to provide online financial trading services and is regulated by ASIC (Australian Securities and Investment Commission) and BVI FSC (British Virgin Islands Financial Services Commission). As it can be deducted, this company is registered in Australia (Bacera Co Pty Ltd) and the British Virgin Islands (BCR Co Pty Ltd).

For the record, Australia is one of the most stringent jurisdictions, and being an ASIC-licensed broker is extremely important in terms of regulation.

It is pretty challenging to be approved by this premium financial market regulator, e.g., one of the prerequisites is maintaining minimum operating capital of 1.5M AUD.

Also, traders are covered by a compensation scheme offered by ASIC (up to 100,000 AUD). On top of this, BCR keeps your funds in a tier-one bank, deposited into something that is called a segregated account. In plain English, your money is held separately from BCR’s capital.

That is a precautionary measure of the risk management system to secure traders in the case of the broker’s bankruptcy.

In addition, this brokerage firm minimizes risks associated with trading by enforcing negative balance protection, which means that an investor can’t lose more money than initially deposited.

BCR Deposits and Withdrawals

When it comes to BCR withdrawal, as a legitimate broker, BCR is unambiguous about accepted means of payments, withdrawal fees, and processing time.

So, clients can deposit money through more than eight funding channels, including credit/debit cards, bank wire transfers, UnionPay, and electronic wallets (such as PayPal, Skrill, and Netteler).

Speaking of depositing, a BCR minimum deposit is 300 USD, which is acceptable and justified by outstanding service, 20-year-long experience, and a great deal of safety.

There are no withdrawal issues, and drawing out funds is fast and easy, same methods as deposits, which is important for anti-money laundering.

Regarding related fees, this broker is transparent about them and doesn’t charge for deposits and withdrawals. Of course, customers cover incurred transaction costs related to and depending on selected payment methods. As for payoff turnaround time, ranges from instant to 1-2 business days.

Trading Platforms at BCR

If wondering what trading platforms are provided by BCR, you will be impressed with its offerings.

Particularly, you will enjoy trading on its BCR trader (internet-based trading platform or downloadable desktop version) and BCR app (mobile trading application) that are based on proven trading software, MetaTrader 4 (MT4) created by MetaQuotes.

BSC trading programs utilize a user-friendly interface, are accessible on all devices (Windows, macOS, iOS, and Android), are multilingual (22 languages), and consist of advanced features such as expert advisors (automated trading on your behalf), stop loss (capping buy/sell prices to minimize the risk of loss), social trading (copying most successful traders), lots of technical indicators, and real-time market analysis.

Not only that, BSC trading platforms support plenty of trading instruments such as follows.

- Forex: AUD/CAD, CHF/JPY, EUR/GBP, NZD/USD, USD/CHN.

- Metals: silver, gold, palladium, platinum, copper.

- Commodities: crude oil, natural gas, corn, wheat, rice.

- Indices: GER40, UK100, HKG50, US30, FRA40.

- Shares: Exxon Mobil, AT&T, CISCO Systems, General Electric, Intel Corporation.

Available Account Types

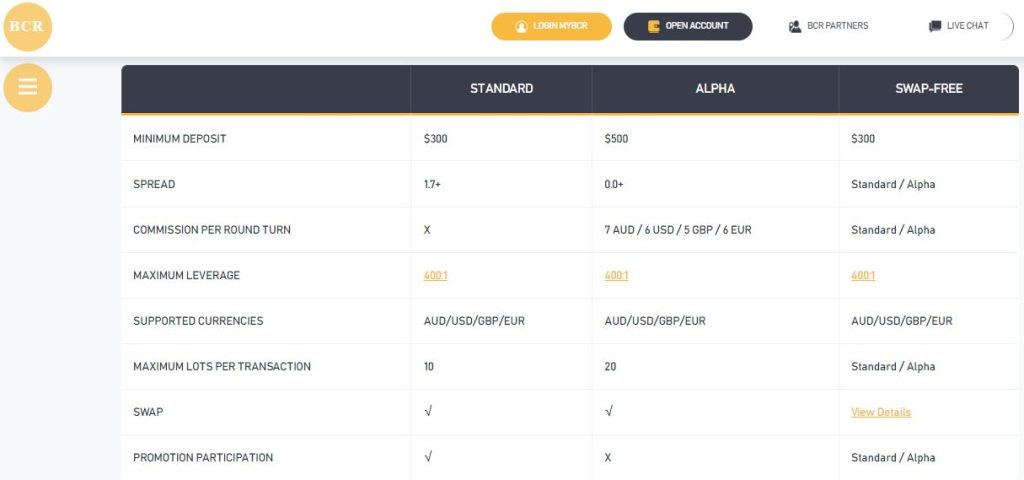

In relation to available trading accounts, BCR offers three types of live trading accounts and a demo account option. The latter is ideal for practicing trading for free, allowing you to test your strategy and trading platforms/conditions. The former includes the following accounts.

- Standard: $300 minimum deposit, spreads starting at 1.7 pips, 1:400 max leverage, and no trading fees.

- Alpha: $500 minimum deposit, 1:400 max leverage, and a trading commission of 7 AUD/ 6 USD/ 5 GBP/ 6 EUR.

- Swap-Free: $300 minimum deposit, 1:400 max leverage, and the trading commission is the same as for Standard/Alpha.

Additionally, traders can manage their accounts on MyBCR, a clients’ portal enabling quick deposits and withdrawals, market analysis, economic calendar, and more that contribute to a profitable trading experience.

Educational Resources

For traders who want to stay in the loop, BCR provides lots of trading resources, including market, live (news related to markets), BCR market insight (webinars), education (FAQs and how-to), and an economic glossary.

On the negative side, for those who are new to online trading, BCR could extend its educational program and provide more learning materials. For instance, its main competitors offer online trading courses and teach traders about markets, trading instruments, and platforms.

We can say that BCR will suit more seasoned traders and those with at least some trading experience, while newbies will probably need some time to learn the ropes with BCR.

Customer Service

Fast, timely, and knowledgeable customer service is very significant for this business. Sometimes there can be an issue with your account or a bug in trading software, and customer service agents should be at your fingertips.

With respect to this, BCR understands clients’ needs and offers a customer-oriented service. Its multilingual, 24/5, and continual customer support is comprised of professionals and is available via online live chat, phone, and email.

If you go through many positive reviews on the internet, not only that you won’t find any complaints about the broker but you will see that many customers praise BCR’s customer-focused approach among other things.

BCR Overall Summary

To summarize this BCR broker review with primary facts about this brokerage firm. The broker is an offshore-based broker (formed in the British Virgin Islands) holding several trading credentials (a top-ranked ASIC license and a BVI FSC license).

You can invest with this broker with peace of mind since you are covered by ASIC’s indemnification program and protected by BCR’s risk management tools.

Trading with this globally awarded broker is worthwhile because of the beneficial terms of exchange and first-class trading platforms. Additionally, if you need assistance, you will always get it timely and professionally from its around-the-clock customer support.

On the point of criticism, BCR could improve its education offer by providing more resources for novice traders. Anyhow, this broker is an excellent choice for safe and profitable trading.

Buying/selling online is risky, and you should be aware of the involved dangers, one of which is fraudsters. Therefore, be careful about easy earnings and always select trusted and regulated brokers such as BCR.

FAQs About BCR Broker

Is BCR a Regulated Broker?

Yes, it is, BCR is licensed by high-ranking ASIC, and also by BVI FSC.

What Is the Minimum Deposit at BCR?

BCR requires a 300 USD minimum deposit, which is possible to fund via credit/debit cards, e-wallets, and wire transfers.

Does BCR Offer Demo Account?

Yes, it does. A demo account option is available with BCR, enabling you to experience real trading for free.

What Trading Accounts Are Available at BCR?

This broker offers three types of trading accounts: Standard ($300 deposit), Alpha ($500 deposit), and Swap-free ($300 deposit).

What Are BCR Fees?

BCR doesn’t charge fees for deposits and withdrawals but expects to have transaction costs depending on respective payment methods.