CPT Markets Review: Is ZA.CPTMarkets.Com a Legit Broker?

CPT Markets is a part of the major group that is owned by CPT PTY LTD. Besides this, there is also CPT Markets UK and CPT Markets Limited, based in Belize.

The problem lies in the two offshore locations which are South Africa and Belize. Mainly, the office located in South Africa is regulated by the Tier 2 regulator Financial Sector Conduct Authority and the third office is a complete offshore entity regulated by the Tier 3 regulator from the Belize named Belize International Financial Services Commission.

And as you guessed, all the locations have different leverages, commissions, spreads, minimum deposit requirements, and trading conditions. Because of that, we have decided to conduct this CPT Markets review so you will get a total insight into this brokerage.

| Broker Status: | Regulated offshore broker |

| Owner: | CPT Markets UK, CPT Markets Limited, CPT Markets PTY LTD |

| Websites: | Za.cptmarkets.com |

| Regulated by: | FCA, FSCA, IFSC |

| Headquarters Country: | South Africa, UK, Belize |

| Operating Status: | Active |

| Foundation Year: | 2008 |

| Trading Instruments: | Forex, crypto, commodities, indices, shares |

| Trading Platforms: | MT4, MT5 and cTrader |

| Mobile Trading: | Yes |

| Minimum Deposit: | $500 or $0 (offshore) $100 (UK) |

| Deposit Bonus: | N/A |

| Maximum Leverage: | 1:1000 (offshore) 1:30 (UK) |

| Islamic Account: | Yes |

| Free Demo Account: | Yes |

| Accepts US clients: | No |

Is CPT Markets Regulated? Security and Regulation

In terms of the CPT Markets regulation, this is a very tricky question to answer. Mainly because the CPT Markets is located in the UK, South Africa and Belize. CPT Markets UK was founded in 2008 in London, and its previous name was Citypoint Trading Ltd. The entity is still registered with the UK’s Financial Conduct Authority (FCA).

CPT Markets PTY LTD is regulated by the South African Financial Sector Conduct Authority and that way they are holding a Tier 2 regulation. But the main problem where a lot of customers have voiced their complaints and problems lies in the offshore location of Belize. Even though they have a license from the Belize International Financial Services Commission, that is considered a Tier 3 regulation and doesn’t offer that much security and safety.

With all of this said, the safest and the best option is the CPT Markets UK, as they are the only one that holds the Tier 1 regulation by none other than the major watchdog Financial Conduct Authority (FCA). And if by any means, you don’t want to start your trading journey with the CPT Markets, you can always opt for the FBS brokerage. They are regulated by the CySEC.

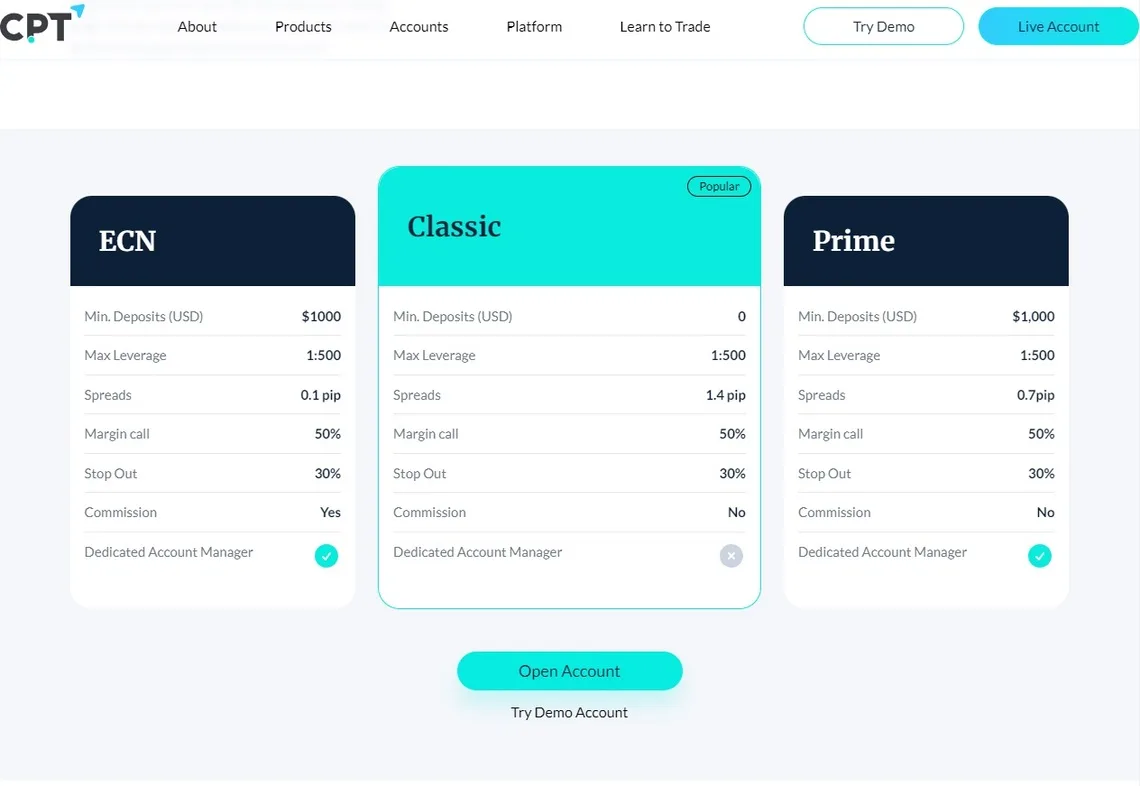

What are Available Accounts at CPT Markets

As for the trading accounts, CPT Market offers the two following account types:

- Classic

- Prime

The minimum deposit requirements change from location to location so we will list them below.

The CPT Markets UK: Minimum deposit – $100

CPT Markets South Africa: Minimum deposit – $0

CPT Markets Belize: Minimum deposit – $500

Besides the two account options you have, you can also test out their trading platform and their conditions by using their Demo account. This is a great thing to have because it allows the clients to test out the platform without depositing real money.

The leverage also depends on the location of the brokerage you choose to trade with. For the UK it cap’s at 1:30 as by the FCA and ESMA rules. For South Africa the cap is at 1:500 and for Belize, the cap is at 1:1000.

As you can see, at the offshore location, the leverage is set way too high and that can present a major problem if you are an inexperienced trader. That’s why we suggest you start trading with the CPT Markets UK.

Trading Instrument Available

Besides all potential issues, they have quite a solid instrument range available. Whether you are looking for risky options or safe ones, you can find something suitable. CPT Markets offer five major classes of instruments and those include the following ones:

- Forex – EUR/SEK, USD/GBP, AUD/USD

- Commodities – Brent oil, gold, natural gas

- Indices – S&P 500, AU200, BE20

- Shares – American Express, Master Card, General Motors

- Cryptocurrencies – BTC, XRP, USDT

As for the leverage, we have mentioned that it changes from the location you are dealing with. For the UK it caps at 1:30, for South Africa it caps at 1:500 and for Belize, it caps at 1:1000.

Trading Platforms Overview

In regards to the trading platform, CPT Markets has a few to offer. From popular options like MT to lesser-known platforms, this broker has it all.

You can choose from the following:

- MetaTrader 4

- MetaTrader 5

- cTrader

The MetaTrader platforms are already well-known and have been in use for quite some time now. They give users an interface that can easily be customized to fit their style. It also has one-click trading, live-streamed prices, and many chart types. You can even decide to open a demo account if you want to test this platform before committing to trading with this broker.

Both MT4 and MT5 are available for both PC or laptop for either IOS or Android users. There is also a mobile app that will let you trade wherever you are, whenever you want.

In case you are unfamiliar, MT4 and MT5 are essentially the same, with key differences in some features. For instance, on MT5, you will be given a stunning 61 pending order types, market depth, automated trading using Expert Advisors, and tools from the MQL5 community.

As for the cTrader, this platform is not yet in use, but the broker has announced on their website that it will be soon available.

Funding Methods

On the CPT Markets website, we saw that they are offering the following deposit methods:

- Visa or Master credit or debit card

- Wire transfers

- Neteller

- Skrill

This is a great variety of funding methods available. When it comes to the fees, CPT Markets stated that both deposits and withdrawals are free of fees.

Additionally, the withdrawal process depends on the funding method and can be instant, within 24 hours for the E-wallets and credit/debit, and between three to five business days which is for the wire transfers.

All in all, that is a solid wait time for the withdrawals.

Research and Education Offered

On the broker’s website under Learn to Trade tab, you can see market updates that include:

- Market Overview

- Knowledge Articles

- Economic calendar

These are for learning fundamentals and technical analysis, learning how to make well-informed trading decisions or forecasting the potential volatility.

Besides this, the broker currently works on developing webinars and video guides so you as a trader can learn from experts.

This is a good variety and it is certainly beneficial for both beginners and advanced traders who are looking to upgrade their skills. We advise you to always choose brokers like this one or SVK Markets that took time to make educational material for their clients.

CPT MarketsCustomer Service

The customer support is overall amazing, with included phone number, email address and Chat both that you can contact them with. The only downside is that the company is only available to contact 24/5 but again, we shouldn’t complain about that much.

On the CPT Markets website, you can also see all the details for all of the branches and it doesn’t matter if you are a client of the UK, Belize or the South Africa branch as you can reach any of the listed offices.

CPT MarketsOverall Summary

In conclusion, CPT Markets is a well-established broker that has been in business for a long time. They do have multiple entities, from which one is based in the UK and regulated by Tier 1 regulator FCA.

The other one is based in Belize, which is offshore, and regulated by Tier3 regulator IFSC. This one has a high minimum deposit requirement of $500 and the leverage of 1:1000, which is common for brokers operating offshore.

As for the entity based in South Africa, we thoroughly covered it in this review. They are regulated by Tier2 regulator FSCA and have a minimum deposit requirement of $0.

Regarding their educational materials, their library is impressive and currently growing which is always a good sign.

Lastly, they offer both MT4 and MT5 and announced that cTrader will be available soon. All in all, their growth is amazing but there is still a lot of room for improvements.

FAQs About CPT Markets Broker

Is the CPT Markets a Reliable Broker?

CPT Markets has multiple different entities, but we recommend you work with the one that is regulated by FCA, as it is the most reliable one.

How Long Does a CPT Markets Withdrawal Take?

The withdrawals from CPT Markets should take around 2-4 business days, but that can vary depending on a few factors.

What Account Types are Available at CPT Markets?

CPT Markets offers two different account types which are classic and prime that vary depending on a minimum deposit and spread.