Errante Broker Review: Exploring the Advantages and Disadvantages

Once you understand the pros and cons of any broker it’s easy to determine if it’s reliable or not. With quite recent registration in 2019, Errante broker is still building its reputation.

However, there are already some warning signs we are about to see. We have seen many offshore regulated brokers with similar scenarios. But stay tuned with our Errante review to find out more.

Who Is Errante Broker?

Errante trading brand is owned by Errante Securities Ltd. This company is incorporated in Seychelles in 2019. The name itself indicates what regions might be their priority. But first comes the security that we are about to discover.

As the broker registered with CySEC they should comply with European laws and regulations. But if they do, you will find out soon. Important to realize is that the broker has two domains, one for European traders and one for others.

Also, don’t miss the chance to expand your trading knowledge by reading our TopEU, FXP360 and Fintech Market Pro reviews.

| Errante | |

| Legal name: | Errante Group |

| Regulation: | FSA Seychelles, CySEC |

| Registered in: | Seychelles |

| Established: | 2019 |

| Website: | Errante.com |

| Financial Authorities Warnings: | N/A |

| Contacts: | Phone: +44 203 519 4635 e-mail: [email protected] Online form Live chat |

| If a withdrawal is possible: | Potential issues |

| Fees: | Withdrawal fees up to 2%/$15 for crypto / Penalties up to 5% for inadequate withdrawal |

| If Active on Social Media: | Yes – Facebook, Instagram, Twitter, LinkedIn, Youtube, Telegram |

| Investor Protection: | Segregated bank accounts for deposits, negative balance protection |

Regulation info

As we can see, the company lists only two regulatory institutions. Those are FSA and CySEC. Indeed, both entities are listed in dedicated registers. However, under different names. There is Errante Securities Ltd in Seychelles and Notely Trading Ltd in Cyprus. Different regulations bring different security and trading conditions.

However, the broker didn’t acquire any trusted Tier 1 license. Such as FCA, BaFin or ASIC. This means that traders can’t enjoy maximum protection in trading. Nevertheless, Errante broker provides funds protection measures. For instance, negative balance protection and segregated bank accounts. Thus, they have the right not to apply negative balance protection!

https://fsaseychelles.sc/search-business/errante-securities-seychelles-limited

https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/86468/?uuid=15042020131631

Errante Broker Profile

Errante forex trading company provided its traders with the best trading software. Starting with Meta Trader, but also cTrader. Obviously, they are exploring what traders like. However, the most important aspect is the leverage. While in Europe it’s limited to 1:30, offshore you don’t have any restrictions. Therefore, you can get with an offshore entity up to 1:500.

In combination with their right not to apply negative balance protection, it might get you into a big debt. All this wouldn’t be possible with a Tier 1 licensed broker. As for the trading conditions, those are highly competitive. Thus, some Errante broker reviews reveal that those could be irrelevant.

| Trading platforms: | MT4, MT5, cTrader |

| Account types: | Standard, Premium, VIP, Tailor made |

| Financial Instruments On Offer: |

|

| Maximum leverage: | Up to 1:500 |

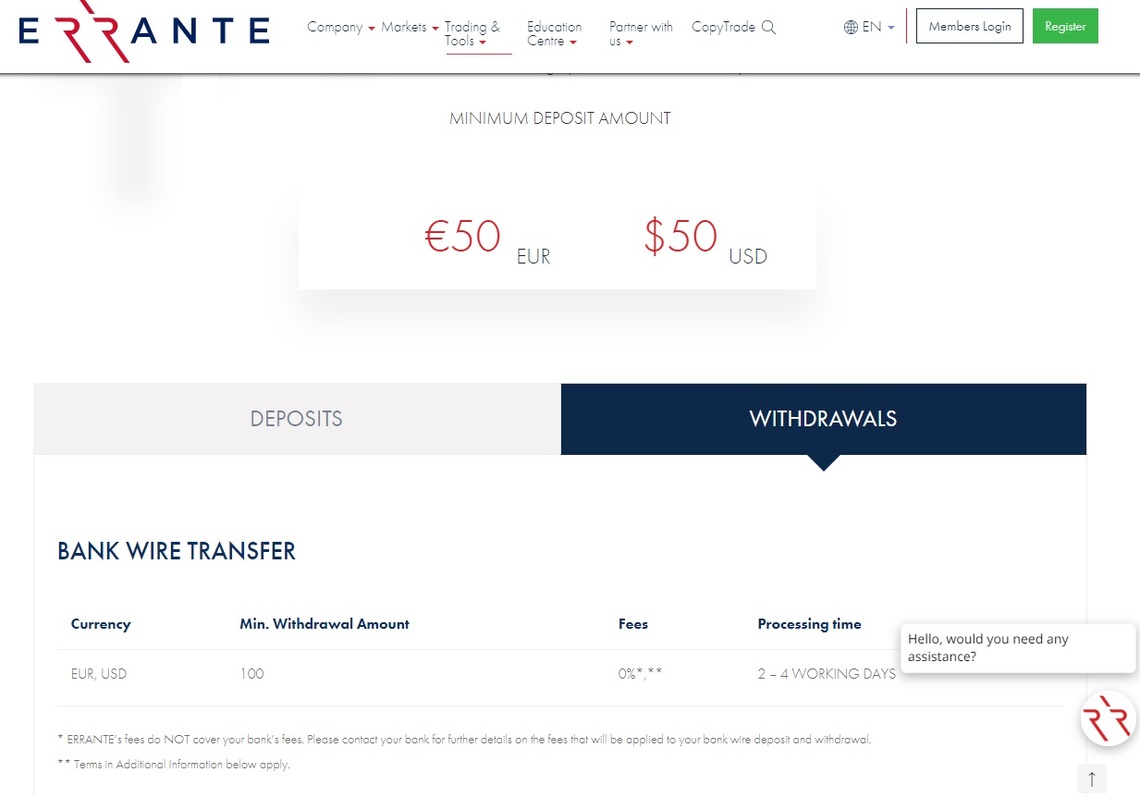

| Minimum Deposit: | $50 |

| Commissions/bonuses: | $0 commission on most accounts, non-precise for Tailor made / No bonuses |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Available |

| Education or Extra tools: | Webinars, Educational Videos, Market analysis, Calculators and Calendars |

Errante Broker Reviews: Examining User Opinions and Feedback

As can be seen, many traders complained about the same thing. Generally speaking, if there is smoke there is a fire. But you have to make your own opinion. You shouldn’t let anyone impact your decision. But it’s all right to hear other opinions.

Apparently, the Errante fx broker is holding profits and even blocking traders’ accounts. This is quite alarming, but take a look yourself. In case this doesn’t satisfy your requirements, feel free to book a meeting with our experts. Free of charge we can find you the most suitable broker options.

How Does Errante Trading Platform Reach Clients and Who Are They?

Brokers mainly promote their services as marketing campaigns. Mainly on social media platforms like Facebook and Instagram. But recently they started building credibility over LinkedIn.

After all, some brokers contact their traders directly through Telegram nowadays. Especially if they have communities there. In general, their traders mainly come from South American areas like:

- Brazil

- Mexico

- Peru

- Chile

- Colombia

If you are looking for a trusted broker by your side, contact us to get more valuable information. Live chat is also available for the fastest results.

Deposits and Withdrawal Methods

There are many different funding options available with this broker. Which is quite positive. Even though some of those are less secure. Anyway, those are:

- Bank/Wire transfers

- Debit and Credit cards

- E-payments (Skrill, Neteller, Sticpay, Perfectmoney, Advcash)

- Cryptos (BTC, ETH, XRP, USDT)

But withdrawals are those that traders are pointing to as a potential issue. Even though the company has transparent fees there are some strange clauses.

In case of a withdrawal request up to 72 hours after depositing without significant trading activity or (when traded with us for arbitrage, an additional 5% fee/penalty will be charged.In case of a withdrawal request after 72 hours from deposit time without significant trading activity or when traded with us for arbitrage, an additional 3% fee/penalty will be charged.

Have in mind that a Tier 1 licensed broker wouldn’t penalize you for making a withdrawal of your money.

Pros and Cons of Errante Broker

Generally speaking, trading conditions and software are quite attractive here. Also, there are trusted CySEC regulations for European traders with all requirements met. However, there is an offshore entity that might be speculative. At least based on Errante forex broker reviews.

It’s not even close to reliable if the broker can just block your account for any reason. Therefore, you should choose a broker wisely.

Our Safe Trading experts’ opinion of Errante Broker

In this case, we give credit to the broker for choosing cTrader and Meta Trader as the main software choices. But if you can’t withdraw the profits made with those, that’s another topic. In general, that’s why we always recommend Tier 1 licensed brokers with maximum trader protection.

If you want to know more about those, our experts are available for consultation. Most importantly, it’s non-obligatory and costs $0. Book yours already today!

FAQ Section

Is Errante Broker legit?

Considering their licensing yes. But if you review other conditions and user-experience reviews you could find potential flaws.

How To Start Trading Safely?

In general, you should look for a broker with maximum protection for traders and realistic trading offers. Give our team a chance to present you with some of those.

How Can You Help Me Choose the Best Forex or Crypto Broker?

After an in-depth analysis of your preferences but also fears, we can filter you the best brokers matching your needs. Without any requirements or costs. Get in touch today!