EZInvest Review: Who Is This EZInvest and Should You Trust Them?

All crucial elements required to make an informed selection will be covered in this EZInvest review. We discuss the brokers’ regulations, the traders they work with, the benefits and drawbacks, and much more. To find out everything there is to know about EZInvest and its platform, continue reading.

Additionally, read our TradeMarkets review to meet another regulated broker worthy of overviewing.

Who Is EZInvest? All About www ezinvest com

EzInvest is the trading name of WGM Services Ltd, a financial services provider registered at Themistokli Dervi 42, appr 104, Nicosia, Cyprus, and subject to the regulation and oversight of the Cyprus Securities Exchange Commission (CySEC) under license number 203/13. The headquarters of WGM Services Ltd is situated in Nicosia, Cyprus, at Ellinas House, 5th Floor, 85 Limassol Avenue, Aglantzia 2121. Residents of the United States, Canada, or the United Kingdom are not the intended audience for the information and services on this website.

| General information | |

| Name | EzInvest (WGM Services Ltd) |

| Regulation status | Regulated by CySEC |

| Warnings from Financial Regulators |

|

| Website link | eu.ezinvest.com |

| Active since | 2022 |

| Registered in | Themistokli Dervi 42, appr 104, Nicosia, Cyprus |

| Contact info | Phone

+357 25 123 281 Compliance email www.instagram.com/ezinvest_official |

| Trading platforms | Sirix web trader, MT4 |

| Majority of clients are from | Mexico; Ecuador; Brazi; Peru; Spain |

| Customer support | 24/5 customer support by calling +357 25 123 281 , via Live Chat, or by email |

| Compensation fund | ICF |

EZInvest Regulation Info: Is EZInvest Legit?

EZInvest is permitted to offer investment services throughout the European Economic Area (EEA) because it is governed by the Cyprus Securities and Exchange Commission (CySEC) under CIF license number 203/13.

Under CySEC (the Cyprus Securities and Exchange Commission) legislation, brokers may operate in Mexico, Ecuador, Brazil, Peru, and Spain, among other countries. However, doing business in these countries may entail getting additional permissions and abiding by local legal regulations. Brokers must meet specific requirements and obtain authorisation in each jurisdiction where they operate because every country has a separate financial regulatory body.

For instance, they would need to be governed by the Comisión Nacional Bancaria y de Valores (CNBV) – National Banking and Securities Commission – or the Comisión Nacional del Mercado de Valores (CNMV) – National Securities Market Commission – to conduct business in Mexico or Peru, respectively.

EZInvest Broker Profile: A Deep Look Into ezinvest com

A brokerage firm called EZInvest deals in commodities, equities, indices, cryptocurrencies, and foreign exchange. In addition to the Sirix web trader, they also provide many instructional resources, leverage of up to 1:200, and the MT4 trading platform.

| Account types | Silver, Gold, and Platinum pack |

| Financial Instruments On Offer |

|

| Maximum leverage | 1:30 – 1:200 |

| Minimum Deposit | €1,000 – €99,000 |

| Commissions/Bonuses | $/€/£7 per |

| Mobile app | Yes |

| Desktop app | Yes |

| Autotrading | Yes |

| Demo account | Yes |

| Education or Extra tools | Economic Calendar, Margin Calculator, Trading Glossary, Web TV |

EZInvest Account Types

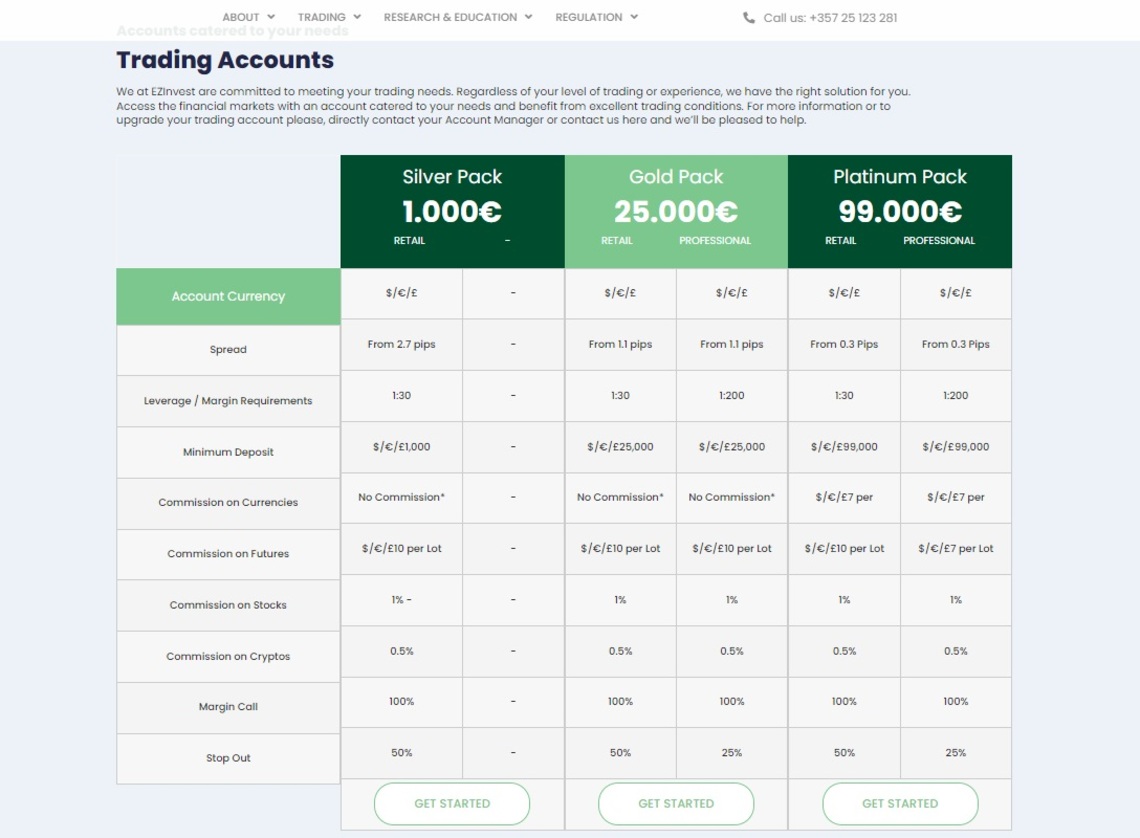

There are three account types on offer which are:

- Silver pack: With this account type, you can benefit from spreads starting at 2.7 pips, 1:30 leverage, no commission on currencies but $10 per lot of commission on futures, 1% commission on equities, and 0.5% commission on cryptocurrencies. The stop-out level is 50%, while the margin call is 100%.

- Gold pack: Spreads start at 1.1 pip for a minimum deposit of $25,000; leverage is 1:30 and 1:200; commission on futures is $10 per lot; commission on equities is 1%; commission on cryptocurrencies is 0.5%; margin level is 100%; and stop out is 50% and 25%.

- Platinum pack: Spreads starting at 0.3 pip, leverage of 1:30 and 1:200, commission on stocks of 1%, crypto commission of 0.5%, margin level of 100%, and stop-out levels of 50% and 25% are all available with a minimum deposit of $99,000.

Is EZInvest Good?

EZInvest is a legally operating company, and traders have a generally favorable opinion of them. Given its recent arrival on the market in 2021, they have amassed over 100 reviews, which is impressive. They are transparent since they give specific information about the commission they charge. They are also registered and offer a reliable trading platform.

Overall, it is secure to deal with EZInvest, especially since it has a compensation fund and is governed by CySEC. However, there are superior choices out there, such as perhaps AvaTrade. Before making an investment with any broker, it’s crucial to conduct research and weigh your options.

Who Trusts EZInvest? An Inside Look at Their Trader Community

In an EZInvest review on Trustpilot, over 140 people have left reviews for the broker, who has an overall rating of 3.5 stars. Even though the majority of the reviews are positive, it’s crucial to note that more than 10% are unfavorable, revealing some potential problems.

Some of the unfavorable evaluations highlight problems with withdrawals and grievances about the conduct of account representatives. One review, in particular, mentions a distressing encounter and says: “EZInvest and their Accounts Managers M Cardi and M Papin have stolen 247,000 euro from me. STAY AWAY from this company. They push you to invest more and more money, they give you misleading advice, they control your computer with programs and open your online banking to see how much you have… They will find a way to make you invest everything from fear of losing what you already put in the trading account. I am trying to get my money back, but they are giving me no answers.”

These negative testimonials raise questions about the broker’s practices and bring to light potential issues with client service, account management, and withdrawal procedures. Prospective traders should carefully read through such reviews and conduct in-depth research before working with any broker. Additionally, traders should prioritize choosing reputable, regulated brokers to reduce the likelihood of encountering such issues.

A Look at EZInvest’s Traders They Serve

With success, EZInvest has grown its clientele in a number of nations, including Mexico, Ecuador, Brazil, Peru, and Spain. Engaging in active social media activity is one of their successful techniques for luring new customers. They frequently share discount codes and deals, increasing their visibility and giving new traders reasons to sign up for their platform. By being active on social media, EZInvest builds relationships with a wider audience, connecting with traders in various locations and encouraging a sense of community among its customers.

Deposits and Withdrawal Methods

A few of the straightforward payment options that EZInvest provides its traders with include credit and debit cards, e-Wallets, and bank wire transfers. It’s important to know that the site doesn’t take cash payments. Traders should make sure that the money put matches the currency in their accounts in order to avoid any discrepancies.

On EZInvest, processing deposits often takes just a few seconds to a few minutes. However, in particular situations where extra information is required for verification purposes, the processing time may be extended.

EZInvest Pros and Cons

| Pros | Cons |

|

|

Long Story Short – EZInvest

In conclusion, EZInvest is a licensed brokerage firm that provides a variety of trading opportunities, such as FX, stocks, commodities, indices, and cryptocurrencies. It is vital to keep in mind that while it is overseen by CySEC and permitted to operate within the European Economic Area (EEA), it might not be in other nations including Mexico, Ecuador, Brazil, Peru, and Spain. Before using the platform, traders who are interested in EZInvest’s services should do extensive research and take local restrictions into account.

To ensure a safe and trustworthy trading experience, it is always crucial to put working with registered and recognized brokers first. Find the ideal broker for your trading requirements. Get in touch with us right away for professional advice and the best options that suit your preferences and objectives. Make an appointment for a free consultation right away to advance your trading career. Together, let’s make trading easier and more lucrative!

FAQ Section

What is EZInvest?

EZInvest is a brokerage firm that offers trading services in forex, stocks, commodities, indices, and cryptocurrencies.

Is the EZInvest trading platform secure?

The MT4 (MetaTrader 4) and Sirix online trader platforms, both known for their strong security features, are both used by the EZInvest trading platform, so the answer is yes.

Does EZInvest Support LiveChat?

Yes, EZInvest provides LiveChat support for its clients.

What you will need to open an account with EZInvest?

You must fill out the registration form and enter your personal information in order to open an account with EZInvest.