FXFlat Review – Who is Behind FXFlat.Com Broker?

FXFlat is a German broker with a top-tier license and regulation. A good partner for first-class trading offers a level of reliability that reaches all your expectations. Back in 1997, the company was first established as a CFD and Forex broker. Today, this broker enables you to trade a variety of instruments on over 135 global markets.

As an independent financial service provider, FXFlat got the necessary approval for their business from the Federal Financial Supervisory Authority (BaFin) in 1998.

Transparency and investor interests are at the highest level at FXFlat. The client’s trading goals and preferences are respected and the environment is adjusted to every investor’s preferences.

Our FXFlat review explores the pros and cons of trading at FXFlat, so stay tuned.

We would appreciate it if you would read our comprehensive analysis of licensed brokers’ BCR, EVFX, and Spreadex.

| Headquarters | Germany |

| Website | FXFlat.Com |

| Year of foundation | 1997 |

| Regulation | BaFin |

| [email protected] | |

| Phone | 0800-039352800800-00393528 |

| Instruments | Currency pairs, Index CFDs, Crypto CFDs, Stock CFDs, Commodity CFDs |

| Platforms | MetaTrader 4 and 5, Trader Workstation |

| EUR/USD Spread | 0.7 |

| Minimum Deposit | $200 |

| Base Currencies | US Dollar, Euro, Yen, Pound, and Swiss Franc |

| Demo Account | Available |

| Education | Available |

| Customer Support | 24/5 |

How Are You Protected at FXFlat? Regulation and Security

BaFin is a supervisory authority overlooking the activity of German banks and financial services providers, insurance undertakings, and securities trading. FXFlat has a license from BaFin for performing transactions and offering financial services and products in the EEA.

This implies that the brokerage company fulfills the standards of customer protection, funds security, and transparency. With FXFlat, customers can enjoy the highest safety protocols, protection of data, and control of transactions.

Contracts with top-tier banks allow for keeping the invested capital in segregated bank accounts. The company itself does not have access to clients’ funds and therefore cannot misuse them for illegal transactions.

The risk of loss is reduced by implementing measures like leverage restriction and negative balance protection. A compensational plan is carefully designed to ensure the customers do not lose their investments in case of the company collapses.

All safety measures and protection criteria are additionally enhanced by the MiFID rules. This regulatory framework provides subsidiary customer protection methods and mandatory transparency considering the money flow.

With the described measures, FXFlat functions on a level of high protection, transparency, and user safety.

FXFlat Deposits and Withdrawals

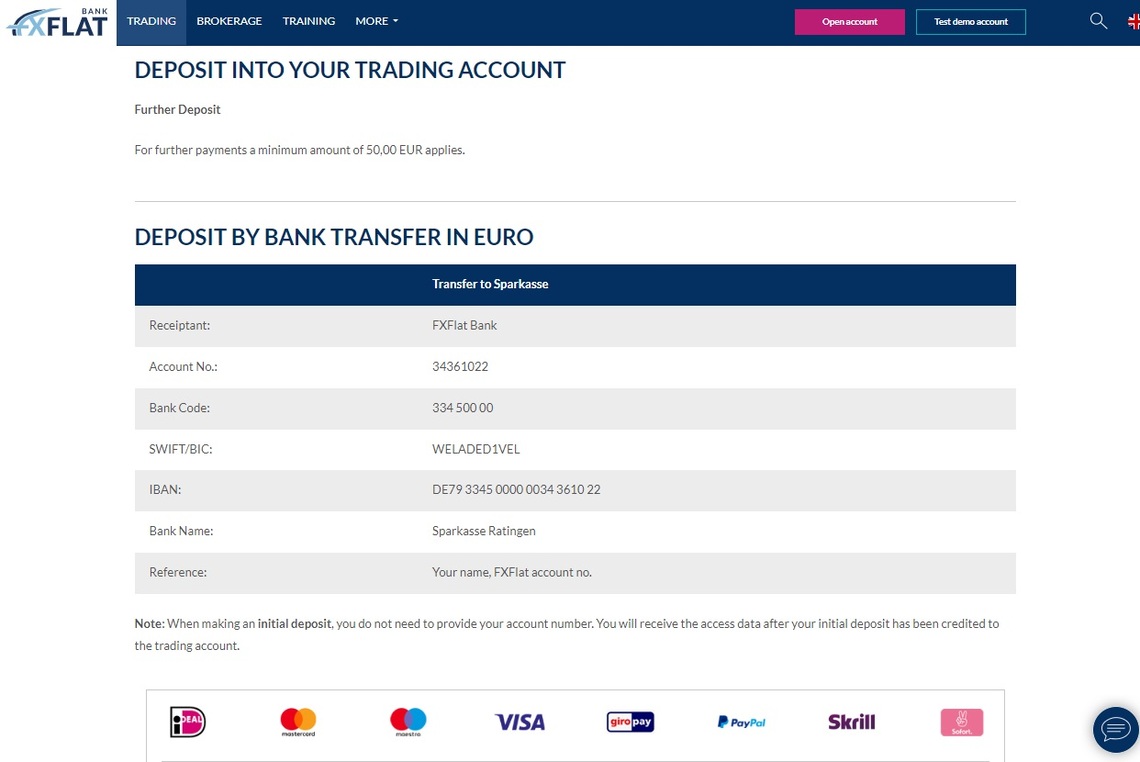

Depositing at FXFlat is instant and fee-free while the minimum amount for first-time deposits is $200. All further payments can be as low as $50. Several payment methods are listed as the site presents them:

- Bank wire transfer (essential bank info to make a payment is on the site for several major global currencies)

- Credit/debit cards (Visa, MasterCard, Maestro)

- E-wallets (iDeal, PayPal, Giropay, Skrill, Sofort)

All of the deposited capital is kept safely under the strictest security protocols.

With a regulated broker like FXFlat, you won’t have to worry about withdrawal guarantees. Your funds are available for withdrawal in accordance with your preferences.

As long as the desired amount is inferior or equal to the margin requirement, withdrawing can be at any given time.

The processing time takes up to 2 business days after the request but E-wallet withdrawals are basically instant and do not take more than 15 minutes.

For withdrawals to credit/debit cards, customers have to wait for between 1 and 5 business days for the funds to arrive. In the case of a bank wire transfer that time is estimated to be 3 to 5 business days.

Trading Platforms Overview

Solid evidence of the reliability and professionalism of FXFlat is the multiple options for trading software, all available on the web, desktop, and mobile:

- MetaTrader 4

- MetaTrader 5

- Trader Workstation

Metatrader 4, MetaQuotes software released in 2005. To this day, MT4 has remained one of the leading and most popular online trading solutions. The functional complexity and proven reliability have ensured global popularity among both brokers and traders of all experience levels.

MT4 options and tools allow users to develop trading strategies to become successful online traders. The special focus is on Expert Advisors, that provide the possibility to automatically execute trades.

MetaTrader 5 is treated as the MetaTrader 4 successor, but also an entirely new and independent platform. As a matter of fact, a close comparison proves MT5 has more built-in technical indicators, symbols, timeframes, order types, and graphical objects.

The Economic Calendar is a progressive feature not supported on MT4. All in all, professional traders agree about MT5 is superior to its predecessor.

Trader Workstation allows gaining an edge in every market, especially for trading stocks, futures, options, and ETFs at quite attractive rates. This trader is available for both individual and corporate accounts while downloading for desktop and mobile usage is also an option.

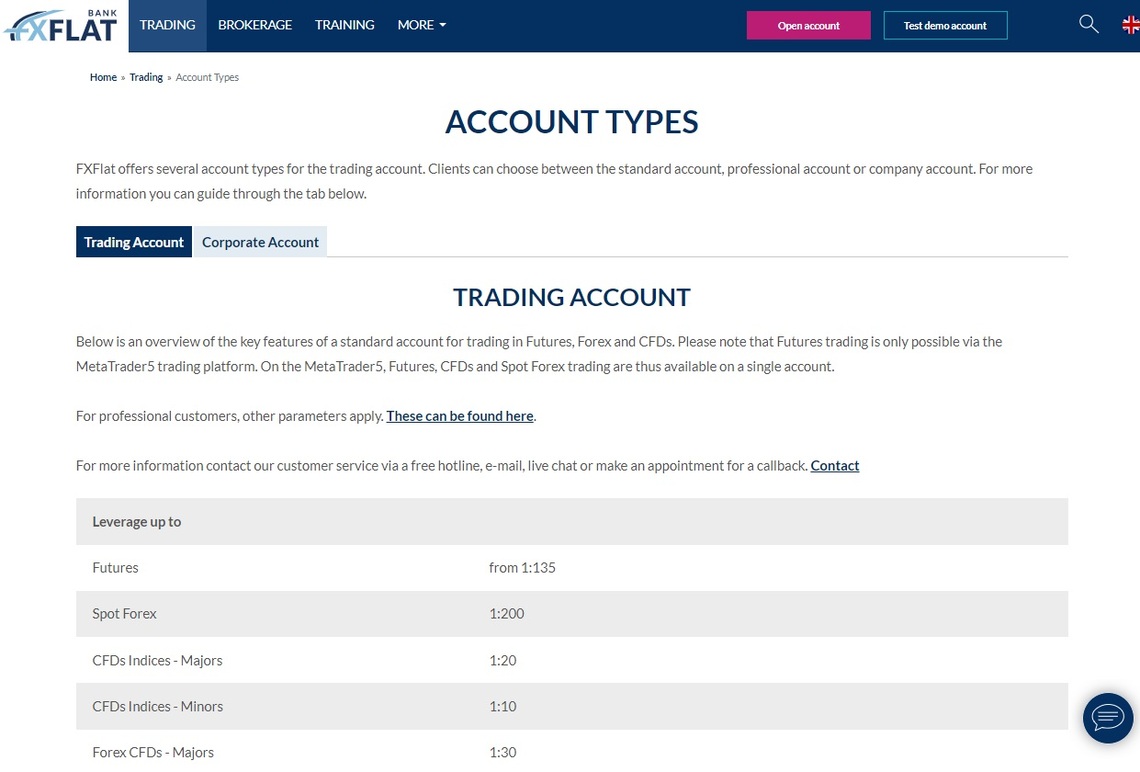

Available Account Types

To avoid confusion, FXFlat enables one Standard account type.

Users can trade from Demo accounts or invest directly and start a Live trading account. Furthermore, Standard account types can differ in terms of the trading platform chosen. That’s why you will have a choice between a MetaTrader 4 and MetaTrader 5 Standard account on one hand and a Workstation Standard account on the other.

The major differences refer to instruments available for different platforms. For example, Futures trading is only possible on the MetaTrader5 trading platform. The minimal deposit for the Standard Live account is $200.

Long-term investors can open Professional accounts. This kind of account also has two possibilities: Professional Classic Account and Professional Amana Account. Again, differences apply in terms of leverage and instruments available on each platform.

FXFlat Fees and Spread

Conveniently for investors, no deposit and withdrawal fees apply. The broker also clearly states that customers will not be charged a commission for idle accounts.

FXFlat, known for very tight spreads. This means trading costs are low. For example, EUR/USD spreads start at 0.7 pips, Gold spreads at 0.24 pips, and Bitcoin at 35 pips.

The FXFlat spreads on crypto are some of the most competitive on the market currently. Considering that plenty of other brokerage houses offer spreads of 50 pips on Bitcoin, FXFlat offers far better trading costs.

Educational Resources

For a globally popular broker serving thousands of customers around the world, FXFlat has limited educational resources. The only way of helping new traders build up their trading experience is through webinars.

Live lessons are very informative and useful. Users who miss them can still access the YouTube channel to watch them afterward. Opinions of experts and guidance are practical and concrete. The only downside to it is that these webinars are in the German language. Only clients who can benefit from it are german-speaking investors.

Popular brokers usually offer articles written by professionals, trader’s glossaries, tutorials, and other resources. In comparison to that, FXFlat doesn’t offer rich educational tools.

Customer Service

The importance of the role that company’s staff plays is critical. Encountering difficulties while trading is a normal occurrence. This broker makes it clear how the customers are able to contact them and what their purpose and working hours are. Non-invasive yet highly helpful, customer support is at every trader’s disposal.

FXFlat customer service channels:

- Phone support at 008000-0393528 – multilingual and available 24/5

- Email service at [email protected] – for explaining issues in particular and getting a detailed response

- Live chat – available on the website for direct messages and immediate answer

FXFlat Overall Summary

First and foremost, what makes FXFlat a reliable broker is the existence of regulation. The license given by BaFin guarantees the broker is supervised in their brokerage activities, all transactions, and trading process.

You will be safe to trade at FXFlat, knowing your funds are handled under the highest security measures. In accordance with that, depositing and withdrawing funds are fast and secure. The processing time is minimal while the fees only apply in some particular cases.

FXFlat also offers leading trading platforms in the industry that will allow you access to a range of global markets, the best liquidity, and execution speed. MT4 and MT5 are available for all devices.

With the reliable, friendly yet highly professional staff, your trading experience will definitely be improved greatly.

The only disadvantage we’d mention is the limited educational tools. However, if you’re an experienced trader looking for a flexible and responsible broker, you can choose FXFlat and you will not regret it.

FAQs About FXFlat Broker

What Are FXFlat Fees?

FXFlat charges no fees for processing deposits and withdrawals. There’s also no inactivity fee. Trading costs are amiable for traders compared to other brokers.

Is FXFlat a Regulated Broker?

Yes, FXFlat was regulated by BaFin and has been in their register of licensed brokerage enterprises since 1998.

What Is the Minimum Deposit at FXFlat?

The minimum funding requirement at FXFlat is $200. After this initial deposit, further payments don’t have to be higher than $50.

Does FXFlat Offer Demo Account?

Trading virtual funds on a Demo account is available for a period of 1 month (30 days).

What Trading Accounts Are Available at FXFlat?

There’s a Standard trading account that can offer slightly different possibilities depending on the trading platform chosen. There’s also a Demo account and a Corporate account option.