LeaderFinancing Review – The Story Behind This Scam Broker

LeaderFinancing review will show you everything you need to know about this UK-based broker. They claim to be globally licensed and regulated with several awards. However, we have strong reasons to believe this is not true, for the reasons we are going to explain in this article.

This shady trading provider is not the only thing we are going to discuss. You will find out how to choose a legitimate broker, where to find one, and what things you should pay attention to.

| Company | LeaderFinancing |

| Website | LeaderFinancing.Com |

| Address | United Kingdom |

| [email protected] | |

| Phone | Not available |

| Minimum Deposit | 250 USD |

| Leverage | Not available |

| Bonuses | Available |

| Regulation | Unregulated |

| Warning | Not available |

LeaderFinancing Regulation and Security of Funds

LeaderFinancing provided us with some obscure information about their legitimacy – 15+ years of experience and thousands of satisfied clients. Of course, they added an address in the UK to increase its credibility.

But they don’t offer a licensed number. Without that there is no real proof they are legit. If a company is not regulated in your jurisdiction, you cannot count on the support of the Financial Ombudsman or a compensation fund.

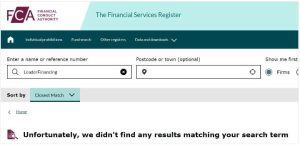

The company didn’t disclose its owner, and we don’t have a single legal document to point us toward a legal jurisdiction. However, we tried finding the name LeaderFinancing in the FCA’s register, and they don’t exist.

Not to mention that if you are not able to verify your new broker’s identity in the registers of any official regulatory institution, for example, the FCA in the UK, you hardly have any reason to believe anything “the broker” might claim, including if its purported London address is genuine or not. And that also renders the website completely anonymous as well.

If you have any information about this scam broker and its operations, we urge you to share it with us. Your story can help us pressure the authorities to react and ban fraud.

LeaderFinancing advertises itself as a leading crypto and Forex brokerage. In reality, this company falsely claims to be UK-based and has no authorization from the FCA or any other regulator for its activities.

If you want to invest, we can help you choose the right broker. We have a list of credible trading providers at the end of this article.

Trading Platform Overview of LeaderFinancing

Leaderfinancing claims to be offering some award-winning platform, but in reality, we were not able to access any trading platform whatsoever, even after we registered our trading account.

The absence of any proven and professional trading software, for example, the industry standard MetaTrader4 or MetaTrader5, is yet another clear sign that you are dealing with a scam.

Look for trading companies that use trading platforms like MetaTrader 4 and MetaTrader 5. The MetaTrader 4 platform meets the highest security standards. Data exchange between the client terminal and the platform servers is encrypted.

The fifth generation of the MetaTrader platforms, MetaTrader 5 offers increased functionalities and features from its predecessor and quickly became one of the most popular trading platforms by online foreign exchange traders and brokerage services around the world.

Account Types at LeaderFinancing

Customers can choose from one of the four LeaderFinancing trading accounts:

- Bronze – $10,000

- Silver – $25,000

- Gold – $50,000

- Premium – $100,000

Each account brings more perks, such as VIP trading signals, higher leverage, and guiding sessions. However, none of the trading terms, such as leverage, are displayed, only vaguely mentioned.

The minimum deposit is $250, but you get no benefits until you upgrade to the Bronze account. Scam brokers often use this trick to pressure you to deposit more before understanding that you’re falling into a trap. When you enter their scheme, it’s hard to get out with your money.

Deposit and Withdrawal Options

On its website, LeaderFinancing claims to accept payment methods such as Visa, Mastercard, Maestro, and wire transfers.

After we registered we attempted to fund our account. First, we had some different currencies to choose from and had to fill in the amount we wanted to invest. No information about the payment method, however.

A lot of reputable brokers accept different payment methods like credit/ debit cards, and bank transfers, as well as popular e-wallets such as Skrill, Neteller, PayPal, and also cryptocurrencies.

First of all, the above-mentioned options usually give you the chance to file for a chargeback (Visa/Mastercard) or open a dispute (e-wallets) in case you have been a victim of a scam.

Crypto transactions on the other hand are 100% irreversible and anonymous at the same time, so you can’t return your money no matter what. This is the reason that most scammers want you to use them and offer this payment method as the only option.

If you come across such a broker be careful, as this is a clear sign of fraud. Scammers usually try to prevent you from having your money back and crypto payments are one way to achieve it.

If you had a bad experience with this or any other financial swindler, we could assist with the issue.

How the Fraud Is Conducted

Scam brokers like LeaderFinancing are all about making a false impression that you are dealing with a credible firm. After that, they count on deceiving people into leaving personal details. If you open an account with such an entity, you should expect endless phone calls. Scammers will constantly try to approach you and make you deposit money as quickly as possible.

Remember that urgency is always a treacherous sign, so it’s probably a scam if someone is pushing you constantly into making a deposit.

In the worst-case scenario, you’ll deposit, and scammers will persuade you to trade instead of you. They will present you with magnificent profits generated – false, of course, and you’ll get excited, asking to take your money back.

As you probably guess, they won’t let you do so and will try to get another deposit from you, promising that much more lucrative gains are waiting. Or, they can ask for a false tax, saying that withdrawals are only possible if you cover the charge in advance. If you pay, you’ll increase the amount stolen from you, but if you keep asking for your money, you’ll soon realize it’s a scam.

LeaderFinancing Summary

LeaderFinancing is allegedly a UK-based broker company. However, the FCA’s register doesn’t recognize their name. This means they are operating illegally. Unregulated brokers should be avoided.

We weren’t able to access their trading platform, so there aren’t many things we can say about them. At least not positive ones. Their minimum deposit is not something to go crazy about, as well.

FAQs About LeaderFinancing Broker

Is LeaderFinancing a Legit Broker or a Scam?

LeaderFinancing is a scam entity. They are unregulated, and they are hiding their personal details.

What Methods Can I Use to Fund My LeaderFinancing Account?

Allegedly, you can fund your account using s Visa, Mastercard, Maestro, and wire transfers. We can’t confirm this story.

What Trading Instruments are Available at LeaderFinancing?

With LeaderFinancing you can trade currency pairs, cryptos, commodities, indices, and shares.