Milton Markets Review – Unregulated Gray Zone Brokers Strike Again

Any business done with offshore brokers is most likely predestined to fail. Lose regulations and lack of licenses are the major reason for that, but certainly not the only one. While their offers may seem very lucrative and utmost attractive, nothing they truly provide has any value or meaning. For a full story on this disastrous scheme, we advise you to read our Milton Markets review entirely.

Whole Group Is Suspicious

The brokerage brand we’re inspecting today is Milton Markets, owned and operated by Milton Markets LLC, a SVG-based company without a valid license, only a SVGFSA registration. Previously owned by Milton Markets LTD, the broker was registered in Vanuatu. In today’s records the firm is shown as struck off by VFSC.

Milton Global is the next member of the group as a Seychelles brokerage with the FSA license from the jurisdictional regulator.

Lastly, Holiway’s Investment Ltd is the last company in this group, no longer offering any investment services and ancillary services due to CySEC revoking their investment license for regulatory breaches.

| Broker name | Reliable Broker Must Have | |

| Legal name: | Milton Markets | Transparently displayed in the disclaimer or legal documents |

| Regulation: | Unregulated Offshore Broker | Within your legal jurisdiction – local regulator |

| Registered in: | SVG | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2015-10-29 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | https://miltonmarkets.com/ | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | N/A | None |

| Contacts: | Social Media, Online Chat | Phone, email, social media, web form |

| If withdrawal is possible: | Highly unlikely | Yes |

| Fees: | Hidden fees | Transparent fees – list of spread and commissions |

| If Active on Social Media: | Vaguely active on social media | Often present on social media |

| Investor Protection: | None | Compensation fund |

Absence of Licenses

Milton Markets was registered in SVG in 2021. However, a sole registration doesn’t help much where a brokerage license is mandatory. Since SVGFSA doesn’t regulate brokers, Milton Markets cannot provide their services without a Tier 1 license in many jurisdictions.

For example, to represent a reputable and reliable brokerage, they need at least one premium license, like FCA, ASIC, CySEC, BaFin or another. That would mean investments are stored in segregated bank accounts, clients have access to the financial ombudsman and compensation funds and their trades are placed under reduced risk.

This way, Milton Markets is an illicit broker without proper fund protection, no negative balance insurance and no compensation scheme.

Detailed Offer

Depending on your trading preferences, the Milton Markets offer doesn’t sound necessarily bad. On the contrary. More courageous and experienced traders can unlock leverage of up to 1:1000. Furthermore, the firm claims they charge no fees and commission, while also ensuring a negative balance protection.

All that just being potential fabrications though, as web presentations of offshore brokers often only sound attractive and deliver zero of the promised tools and equipment.

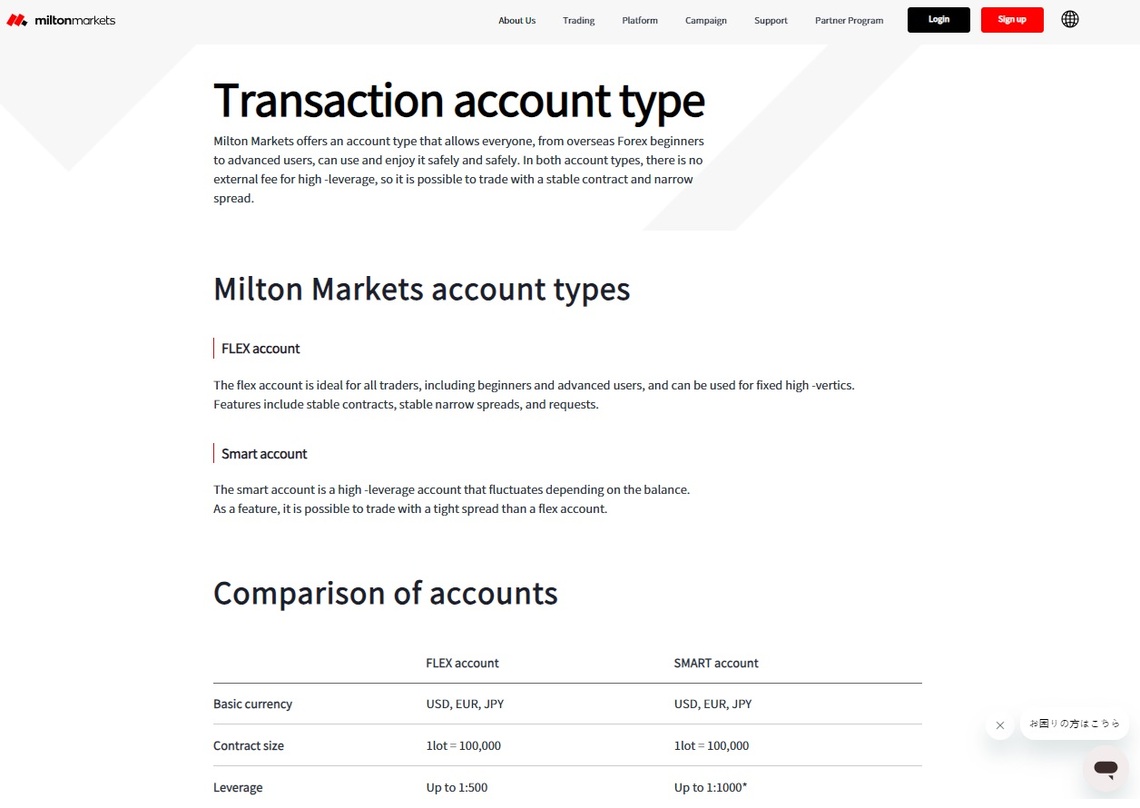

Two account types offer trading on MT4, with the spreads from 1 pips, with minimum deposit starting from only $50.

| Trading platforms: | MT4 |

| Account types: |

|

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:1000 |

| Minimum Deposit: | $50 |

| Commissions/bonuses: | Occasional, currently none |

| Mobile app: | Available – MT4 |

| Desktop app: | Available – MT4 |

| Autotrading: | No |

| Demo account: | Available |

| Education or Extra tools: | None |

Why Milton Markets is Not Safe

The absence of a license doesn’t just mean that the company lacks an authorization to operate in the majority of world’s markets. It also pulls a variety of other concerns and regulatory breaches.

By that we mean the risk-reducing measures not being fully installed. Leverage is proven to go up to 1:1000, and no negative equity insurance can easily get customers indebted. Furthermore, if the company failed, compensation funds wouldn’t be there to reimburse the financial damage. This company is by all means unreliable and unsafe.

In that sense we’d rather recommend Rockfort Markets Ltd.

Insufficient Reviews

Although Milton Markets predates 2015, they do not seem to be overly active and acquiring a lot of customers. Whatever was the reason behind that – bad marketing campaigns or poor general service, not many users seem to be posting about them.

Their Trustpilot page has only a couple of reviews with the final rating of 3.8 out of 5. Strangely enough, no new user experiences were posted past some point in 2021. All of that makes us believe this broker was done long before their group started shutting down for good.

JP Markets is another brokerage with fewer reviews and therefore less trustworthy than multi-regulated and acclaimed broker powerhouses.

Ways to Reach End Users

Milton Markets is another one of those infamous offshore brokers that is vaguely present on social media where they advertise their services. These platforms seem to be their preferred hunting grounds, where the boiler room agents can easily collect the victims’ contact info and relentlessly pester them to invest via phone, email and social apps.

One valid strategy to use in order to avoid falling for suspicious deals is by rationally judging the situation. If you ask yourself how realistic these deals are in practice, you’ll soon realize they cannot be true or as lucrative as advertised.

These are the countries where the broker seems to get most of traders to sign up with them:

- Australia

- United States

- Japan

- Canada

- United Kingdom

Account Funding and Withdrawals

As if the inability to open a new account wasn’t worrying enough, we quickly learned that no legal documentation that covers money transfers exists. Milton Markets doesn’t publish any kind of information that pertains to depositing and withdrawing cash. This is a severe regulatory and AML breach to pay attention to.

It is probably left on phone salesmen to discuss these actions with. Such severe lack of transparency is another solid reason not to trust or get involved with Milton Markets.

Reasons To Say No To Milton Markets

First things first, we focused on explaining what a lack of license means for a brokerage brand and what kind of risk you take upon yourself by choosing to invest with one such firm. Not only will your funds not be protected from financial manipulation, but your personal data could easily become subject to identity theft.

Trading here brings no realistic profit, as the trading conditions are presented as unrealistic and overly attractive, with little to no practical application.

What Our Experts Have to Say

There’s plenty of reliable brokers out there that have bigger experience and better trading conditions. You can choose between hundreds of them rather than signing up with this suspicious brand with cloudy history and regulatory issues.

If you need professional advice on choosing a new broker to start with, we can help you. By carefully analyzing your trading preferences and needs, our trading experts can offer you constructive feedback and advice which broker to invest with.

FAQ Section

What Is MiltonMarkets Broker?

This is an offshore broker without a proper license and with plenty of regulatory issues. If you need a reliable brokerage to start investing with, we can offer you free advice on that.

Is MiltonMarkets Brokers Legit?

No, Milton Markets is not a legit broker as they own no license. Looking for a reputable broker instead? Contact us for the right recommendations.

What Are The Trading Platforms Of MiltonMarkets Brokers?

The website offers trading on MT4 for various devices, which is not a bad platform but other brokers have more advanced and rich offers of software.