Uptos Review: Learn More About This Scam Broker

Uptos Review, Uptos is yet another offshore broker operating from the lawless zone that SVG represents. Apparently, they’ve attempted or already successfully defrauded a number of traders. We knew there must be a strong reason they’d been placed on several blacklists:

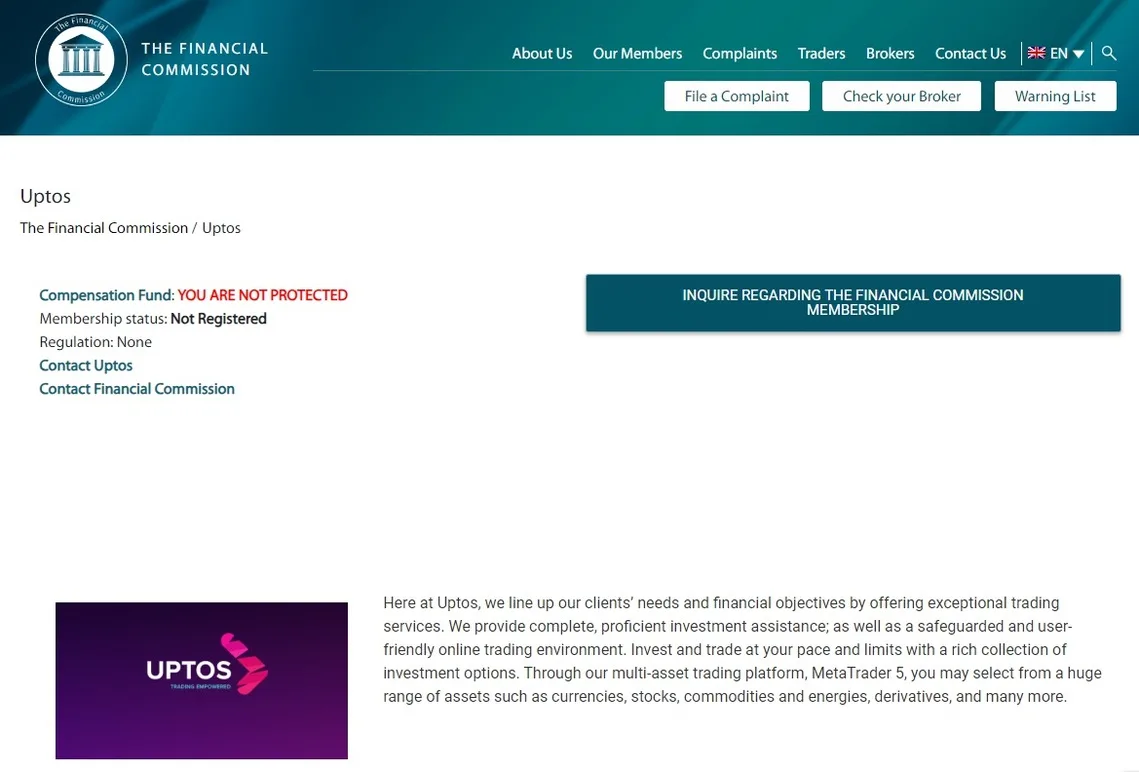

FINACOM:

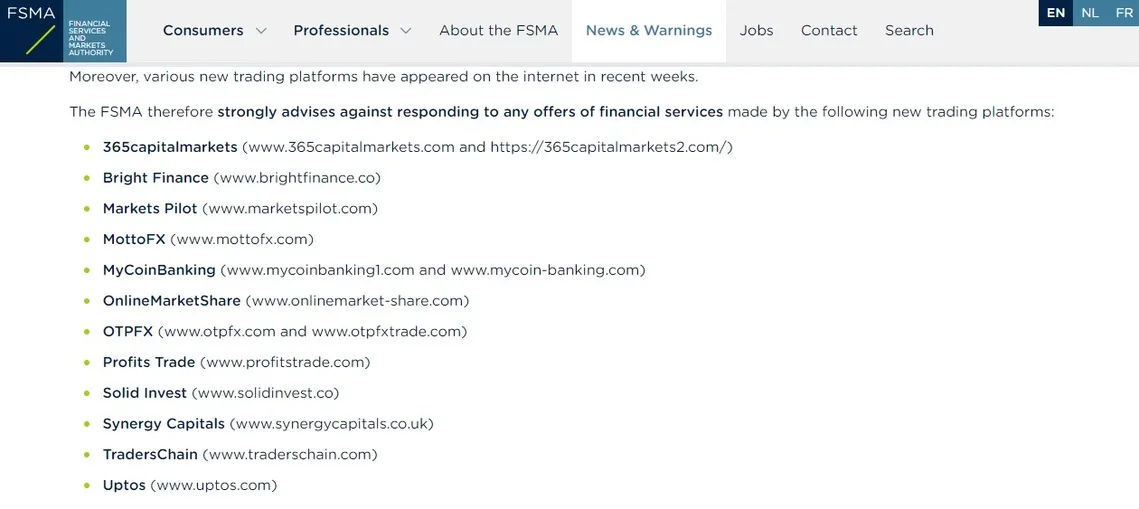

FSMA:

How come the Uptos site is still operational with this many warning is beyond us. But their reign of scam won’t last long. Our Uptos review is yet another warning to our investors and readers not to allow getting trapped in this unscrupulous scheme.

| Company | Uptos Ltd |

| Regulation | Unregulated |

| Warning | FINACOM, CONSOB, FSMA, AMF |

| Website | uptos.com |

| Address | Saint Vincent and the Grenadines |

| [email protected] | |

| Phone | +18552962786 |

| Minimum Deposit | $250 |

| Leverage | 1:400 |

| Bonuses | N/A |

Uptos Regulation and Security

The warnings clinging onto Uptos are proof of their illegitimacy and illegal bank transfers. Considering that EEA brokers were the ones issuing these public alerts, we can assume Uptos focuses on EU traders.

The warnings clearly state that Uptos operates without being properly authorized by the jurisdictional regulators. Additionally, they’re robbing their clients by retaining their deposits and not allowing withdrawals. Cabrill is another broker we’ve already reviewed that has the same reputation.

Uptos behavior in its entirety represents law breaking in every aspect of the regulatory frameworks in the EU. Some of the licensing standards that Uptos evidently doesn’t meet are segregation of clients’ funds through separate bank accounts. Uptos freely manipulates and misuses the funds deposited by their customers.

Risk-reducing measures purposefully expose traders to lower risks. These are leverage restrictions to 1:30 and negative balance coverage. In case of a company failing to perform all payouts due, customers are safeguarded by compensation funds.

Prevention of more funds being abused is also done by banning all the bonuses among EU brokers. With that, ESMA and MiFID ensure the brokers are fully transparent, provide even stronger customer protection and follow all AML measures.

Uptos is definitely not an example of one such broker. SVGFSA cannot regulate them and oversee their activities, so they’d need another license. However, they do not own it. Searching the registers of FCA, ASIC, CySEC, BaFin and NFA shows that. And the warnings solidify our belief of this broker being a complete scam.

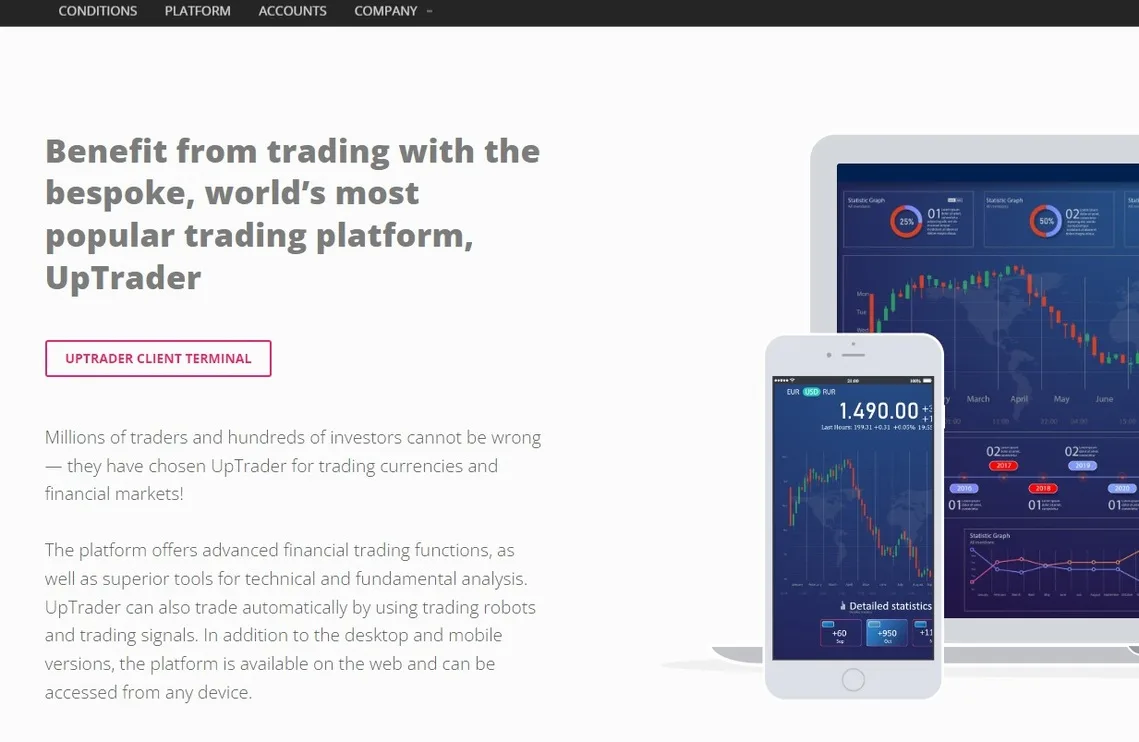

Broker’s Trading Software Overview

Uptos evidently likes to handpick their victims, so our request to join their website was rejected. We were directed to the support agent for contact. This issue has prevented us from investigating the miracle called the UpTrader. It seems to be a proprietary app, developed by the broker itself. It also apparently works on desktop, web and mobile platforms.

The website speaks of it as if it was some revolutionary discovery in the field of online trading. As impressive as it may sound, don’t forget the blacklisted Uptos doesn’t have a license for such endeavors. And they’re probably using the software they built to have better control of it and manipulate the data in it easier.

The Deposit and Withdrawal Process

Account funding page at Uptos doesn’t quite clarify which payment services are available. The page actually has nothing to do with deposits and withdrawals and is just named that way. Information shown on it speaks of yet more irrational benefits of trading with Uptos.

Because our access to the user panel was also restricted we couldn’t attempt to place a deposit. Terms and Conditions explain the account funding takes from 1 to 5 business days. On the other hand, withdrawals have the minimum amount of $50 and take the same amount of time to complete.

As for the fees, they appear casualty and with Uptos reserving the right not to justify or explain them. There are transfer fees, commissions, processing fees, overnight, rollover fees, daily inactivity fees, termination fees and spreads of all sorts but, of course, imprecise. The annual interest rate Uptos charges is 4%.

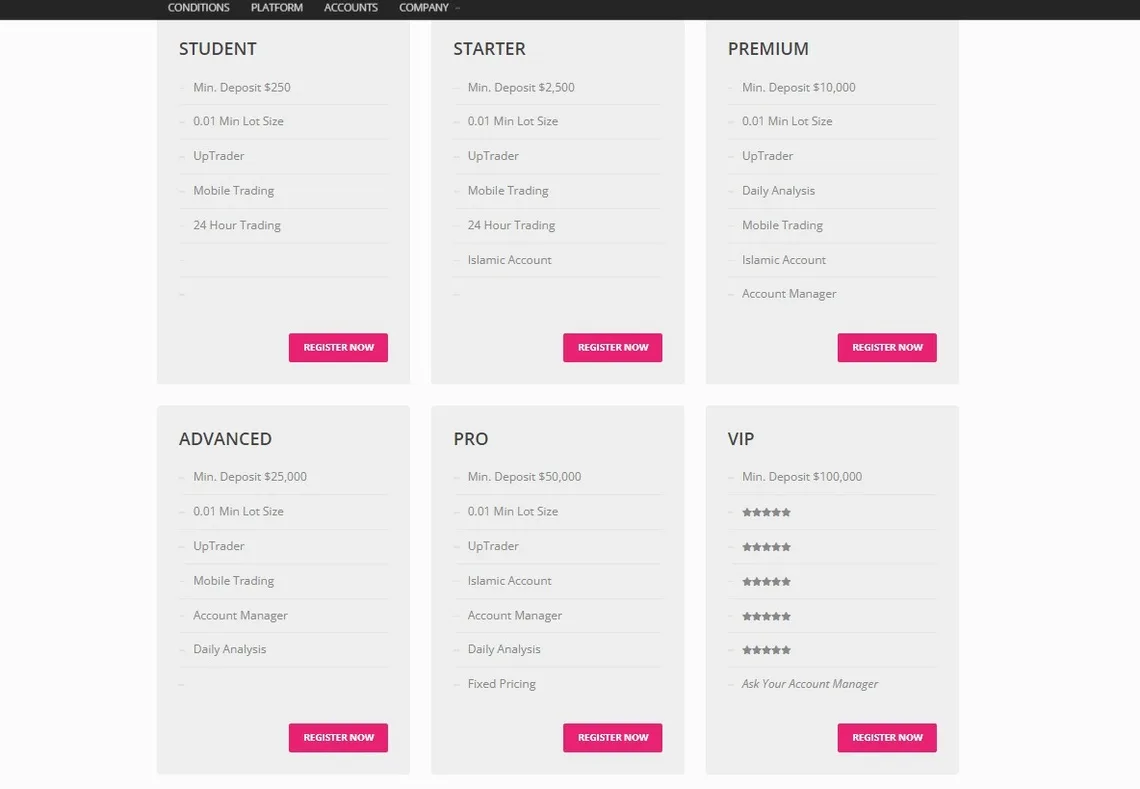

Account Types at Uptos

The thought of enjoying low floating pricing, no slippage, reliable order execution and much more does sound tempting. However, do not quickly fall for such shallow bunch of words. Uptos does have to attract new victims somehow.

Here are the account types available:

- Student – $250

- Starter – $2,500

- Premium – $10,000

- Advanced – $25,000

- Pro – $50,000

- VIP – $100,000 (no features revealed, have to contact account manager)

How Does the Scam Implement?

Uptos describes a fairly lucrative trading condition and environment along with a relatively low deposit requirement. At some point it may look like the broker is just the one you need as a reliable Forex partner. However, the truth is much, much more grim than that.

Although they’re extremely secretive about it, Uptos does mention in their Terms and Conditions all the terrifying kinds of fees they charge. They don’t even have to disclose the exact sums, just the number of them is enough to raise a red flag instantaneously.

Occasionally, the broker will also offer bonuses and promotions. Non-deposited funds are supposedly non-withdrawable and pull an array of special conditions. Beware of these especially. Swindlers will use them to stall your withdrawals and avoid payouts until nothing is left of your funds or initial investment.

Uptos Summary

Expertise level sometimes matters less if the trader doesn’t pay attention to the broker’s legal status and regulations. Even a professional could fall for the scheme that a con artist so skillfully designs. That’s why reading this Uptos review is mandatory if you’re ever contacted by the agent or affiliate of this unscrupulous firm.

Furthermore, we advise you to always verify if the broker you’re interested in had the requisite permit. Without it, they’re as reliable and trustworthy as a pickpocketer.

FAQs About Uptos Broker

Is Uptos Broker Regulated?

No, this broker does not hold any licenses issued by the regulatory bodies. They’re even blacklisted as untrustworthy and prone to scam.

Is my Money Safe with Uptos?

Without a proper authorization, no brokerage house could guarantee safety of funds. It’s just an empty promise without a license to confirm it.

Does Uptos Offer a Demo Account?

The site doesn’t advertise a Demo account, only live trading accounts with the minimum deposit being $250.