VARIANSE Review – All About Varianse.Com Broker

VDX Capital Ltd, the owning company of Varianse.com is a legitimate UK brokerage enterprise with multiple regulations. Although the company has existed since 2004, Varianse is a trading brand that started operating in 2015. Clients in over 100 countries from all over the world have entrusted this online financial services provider with their funds.

Varianse has won more than a few awards after just a few years of providing online trading services. This is proof enough of this industry giant is one of the most quality monetary services providers in the ever-evolving Forex market.

For a detailed report on this company’s full offer, we recommend you to read our Varianse review.

| Headquarters | UK |

| Regulation | FSC, FCA, LFSA |

| Platforms | cTrader, MetaTrader 4 |

| Instruments | Forex, Indices, Metals, Energies, Equities, Crypto |

| Demo Account | Provided |

| Minimum Deposit | $500 |

| EUR/USD Spread | From 1 pip |

| Base Currencies | EUR, USD, GBP |

| Education | Articles |

| Customer Support | 24/5 via email, phone, and live chat |

VARIANSE Regulation and Safety of Funds

As a trading name of VDX Ltd, Varianse is regulated under several financial authorities:

- Financial Conduct Authority (FCA) in the United Kingdom

- Financial Services Commission (FSC) in the Republic of Mauritius

- Labuan Financial Services Authority (LFSA) Malaysia

Surely the most influential of the mentioned regulatory entities is FCA. The UK financial watchdog does a good job of keeping an eye on the derivatives markets, securities trading, and banking services. At the same time, the institution enforces certain standards which future licensed brokers have to meet if they intend on running a legitimate business.

First off, an initial deposit of 730.000 GBP is a must. This serves as an assurance that the firm plans on running a serious brokering business. Next in line is the implementation of the highest security standards and the safekeeping of clients’ funds through segregated accounts.

Along those lines is the leverage restriction to 1:30 and negative balance protection. A compensation fund is there to make up for clients’ losses with up to 85.000 GBP. In the end, the Financial Ombudsman protects clients in case of dispute and stands up for their rights as investors.

FSC and LFSA have considerably less strict regulatory rules. That’s why international clients that fall under these regulations will have access to increased leverage of up to 1:500. Professional traders that have perfected the risk-management strategies have a chance at winning big.

On the other side are the beginner traders who are at a greater risk of losing. We advise all international clients to first gather all the relevant data before taking any investment risks.

VARIANSE Trading Instruments

Trading at Varianse brings the benefit of paying zero commission and starting with the tightest spreads on the market. Whatever may be your preferred financial instrument, less or more popular, Varianse probably offers it. And under very affordable conditions at that. Take a look what are the most wanted tradable asset groups:

- Crypto (Bitcoin, Ethereum, USD coin, Avalanche, Cardano, Compound, Kusama, Polygon, Stellar, Tezos, Uniswap)

- Metals (Gold and Silver)

- Currency pairs (EUR/USD, EUR/GBP, CAD/JPY, GBP/AUD, CHF/SGD, USD/MXN)

- Energies (Brent Crude Oil, West Texas Oil)

- Equities (Autodesk Inc, Comcast Corp, Electronic Arts, Hasbro Inc, NortonLifeLock Inc)

- Indices (AU200, CN50, DE30, EU50, FR40, JP225, UK100, US30, US500)

Account Types Available at VARIANSE

As one of the most advanced ECN brokers, Varianse lives up to its status. The customers can enjoy razor-sharp spreads and best-performing software included in each account type.

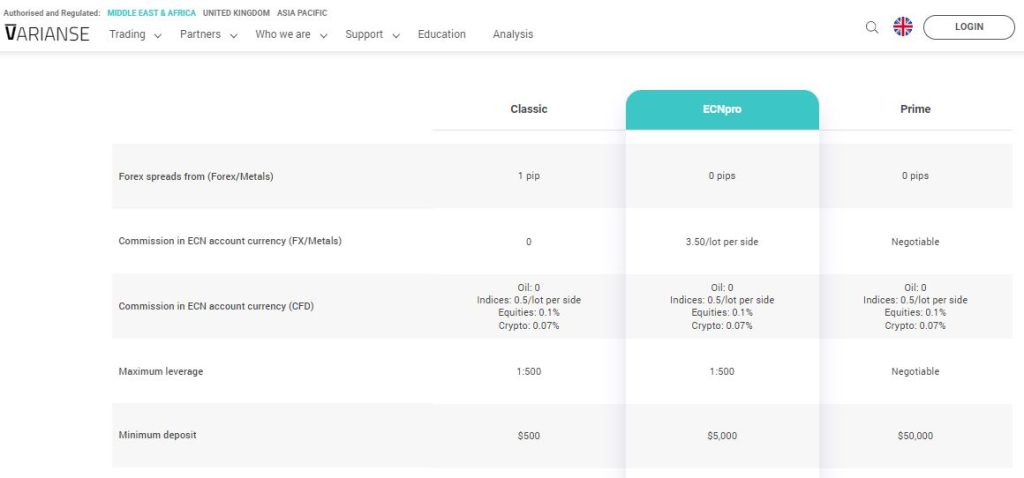

Let’s do a quick comparison of the following account types:

- Classic – $500

- ECN Pro – $5.000

- Prime – $50.000

The classic account is the cheapest account type, so it makes sense that it allows the least of the advanced features. The key characteristic is the spreads that start from 1 pip, with maximum leverage being 1:500.

ECN Pro is the account that has a richer offer of services included, but for a higher cost. Spreads on this account type are 0.0 pips, while the commission is $3.50 per round. The leverage also goes up to 1:500, but there are features that Classic accounts do not provide, like Full Market Depth and FIX API.

In the end, the most expensive, but also most generous in offers is definitely the Prime account type. Spreads also start at 0 pips, but the commission is negotiable. Prime accounts have all the options that the other two accounts have but also unique ones that come only with this price.

Some notable features that aren’t given with the other account types are tailored liquidity and execution optimization and sponsored cross-connected VPS.

Trading Software Overview

Specially optimized for advanced trading and more demanding customers, cTrader at Varianse has superb performance. Professional traders will be happy to hear about ultra-low latency execution, advanced charting, and hundreds of copy trade strategies.

The State-of-the-art interface allows insight into market changes and instant access to 200+ instruments including forex, indices, metals, commodities, and US equities. Available as cTrader desktop, cTrader mobile, and cTrader Web, the seamless software works on any platform and whenever the investor needs it.

What better way there is to use the power and dynamism of the forex markets than via the most popular trading software on a global scale? As you’ve probably already guessed, we’re talking about MT4. There’s little left to say about this platform that not every trader knows.

Analyze price dynamics, build your own strategy, and achieve your trading goals with the help of EAs, one-click trading, custom indicators incorporating 9 time periods, and all that on your desktop or your mobile device.

Deposit and Withdrawal Methods at VARIANSE

Clients’ funds being deposited on ring-fenced segregated client trust accounts at Barclays speaks volumes of security and safekeeping.

To fund your trading account simply login to the Client Portal and choose one of the several highly trusted and safe methods:

- Bank transfers

- Credit cards

- Electronic wallets

Please take note that only bank wire transfers are free. Other payment methods require you to pay fees (2.9% for MasterCard and Visa, and 3.9% for Skrill). After making a deposit, the funds will appear in your live trading account on the same day.

Same as deposits, all withdrawal requests are processed within the same day they were received. It does, however, take up to 3 business days for the funds to get to your account.

Education Available

For a broker of this caliber, Varianse actually disappoints as far as educational potential goes. The knowledge is solely resented in the form of articles. Although the text is quite informative and covers a range of subjects, not everyone prefers to study this way.

Other traders might find video tutorials easier to follow. Committed investors on the other hand appreciate live exchanging of ideas. It’s obvious that Varianse greatly lacks live lessons, webinars, and discussions with experts to support traders in improving their knowledge.

Customer Service

Varianse has several channels open 24/5 for clients to contact customer support. The broker takes tending to their client’s needs seriously and doesn’t leave anything to the case. The level of satisfaction with general service greatly depends on the efficiency of the customer service. Varianse provides the following methods of getting in touch:

- Emails – [email protected] and [email protected]

- Phone numbers – +230 5297 0989 and +44 (0) 203 475 2285

- Live chat – available on the site, but automated – you have to insert your question and email to which you will receive the response.

The help & FAQ page could be an additional source of alternatives for problem-solving. We advise you to first check this page before contacting the support service. Chances are, your problem was already described and solved before, so you don’t have to go through the entire process of communicating it all over again.

VARIANSE Overall Summary

Owner of several online trading certificates, Varianse is a reliable and genuine global brokerage conglomerate. The comprehensive and easily-navigated website offers all the relevant info you might seek.

From getting to know the company and its leading team to the last trading parameter, Varianse offers everything on a plate. They have to since they’re obligated by the regulatory framework they follow.

Although there are some negative points, our brutal honesty binds us to bring them up too. For instance, the educational programs are poorly designed and only rely on articles. Following that, customer service isn’t available 24/7 but only during business days.

Some depositing fees also apply when funding your account through cards and electronic wallets. However, there’s no withdrawal fee, inactivity fee, or other commissions.

Trading is an enjoyable experience with Varianse thanks to the top-notch performance of their trading platforms – cTrader and MT4. For more information, you are free to open a Demo account and explore to your heart’s content.

FAQs About VARIANSE Broker

Which Method Can I Use to Withdraw Funds at VARIANSE?

Withdrawing funds from Varianse works through bank wire transfers, cards, and digital wallets.

Do VARIANSE have Negative Balance Protection?

FCA license forces Varianse to provide negative balance protection, but this is only certain for UK customers. Non-UK traders fall under other regulations.

Which Platforms Does VARIANSE Offer?

Varianse offers two premium trading platforms: cTrader and MetaTrader 4 in web, desktop, and mobile versions.

Is VARIANSE Regulated?

Yes, this broker has acquired several regulations, from FSC, FCA, and LFSA.

Does VARIANSE Offer Demo Account?

Trading with virtual funds during a trial period is possible. After that, you have to invest at least $500 to start a live trading account.