XM Broker Review: Learn More About XM Broker

XM broker is a legitimate broker with an offshore license that began serving clients in 2009. So far they have 1.5 million users and provide 24/5 customer care in over 30 languages. This broker provides clients with a very low barrier of entry due to their minimum deposit being only $5.

This, coupled with the wealth of research/educational materials provided directly by them, makes XM a great broker for beginners.

We strongly encourage you to read this detailed review of authorized brokers such as IQ Option, Rockfort Markets, and TIO Markets.

XM Broker Overview

XM broker was founded in 2009, with a headquarters in Cyprus and offices in the UK and Australia. They are regulated and licensed by a number of regulatory bodies:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investment Commission (ASIC)

- International Financial Services Center (IFSC).

- The Financial Conduct Authority (FCA)

- Dubai Financial Services Authority (DFSA)

Oversight from three different tiers of one regulatory body allows the XM broker the opportunity of serving clients all over the world. This broker really does what it can to ease a new client into the world of investing.

Between the educational resources that they provide and the research tools available on their website, even a complete novice could find their way about the first few trades.

If someone does happen to be that new to the trading world, the XM broker provides a free demo account where the client can see if this broker and their trading platform are a right fit for them, or just get some practice getting used to MetaTrader4 and MT5.

Potential clients should also be aware that XM does not charge a deposit or withdrawal fee. They do, however, charge a small inactivity fee. This means that all the trading costs that the client pays are already summed up in the spread.

This broker provides its clients with healthy trading conditions, from a low barrier of entry with a low minimum deposit, to industry-standard tools with a high level of customizability.

| Headquarters | Cyprus |

| Regulation | CySEC, ASIC, IFSC, FCA, DFSA |

| Platforms | MetaTrader 4-5, Web-Based trader |

| Instruments | Stocks, Forex, Commodities, Cryptocurrencies |

| EUR/USD Spread | 1.6 pips |

| Demo Account | Yes |

| Minimum deposit | $5 |

| Base currencies | Various Currencies |

| Education | Provides ample education for clients |

| Customer Support | 24/5 customer support |

XM Broker Reliability – Regulation and Security

This broker is licensed by a number of regulatory bodies making it possible for them to legitimately provide their services globally. The following are the regulatory bodies that license and oversee XM:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investment Commission (ASIC)

- International Financial Services Center (IFSC).

- The Financial Conduct Authority (FCA)

- Dubai Financial Services Authority (DFSA)

This means that traders in the jurisdiction of tier-one agencies can rest easy knowing that they enjoy all of the protection and the rights that these agencies ensure for traders. This primarily applies to traders based in the UK (FCA), Australia (ASIC), and EU traders (CySEC).

If you are trading from one of these regions, this means that the XM broker is legitimate and your funds are safe. It is also worth mentioning that this broker has won a number of awards in the 13 years that they have been active, further adding to its legitimacy and security.

XM Broker Trading Accounts Offered

This broker provides users with a few different account types allowing them to find the right fit for themselves. The XM minimum deposit ranges from $5 all the way up to a minimum of $10 000.

Micro Account

- Base currencies: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size: 1 Lot = 1,000

- Spreads as low as 1 pip

- Maximum leverage is dependent on the jurisdiction that you are based in however the brokers website states “1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +)”

- $0 commissions

- Minimum trade volume 0.1 lots MT4/5

- Hedging is allowed

Standard Account

- Base currencies: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size: 1 Lot = 1,000

- Spreads as low as 1 pip

- Maximum leverage is dependent on the jurisdiction that you are based in however the brokers website states “1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +)”

- $0 commissions

- Minimum trade volume 0.1 lots

- Hedging is allowed

Ultra Low Account

- Base currencies EUR, USD, GBP, AUD, ZAR, SGD

- Contract size Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000

- Maximum leverage is dependent on the jurisdiction that you are based in however the brokers website states “1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +)”

- Spread on all majors as low as 0.6 pips

- $0 commissions

- Minimum trade volume 0.1 lots

- Hedging is NOT allowed

XM Broker Trading Instruments Available

This broker makes a variety of trading instruments available to its users:

- Stocks

- Metals

- Forex

- Commodities

- Cryptocurrencies

XM Broker Trading Platforms Available

The XM broker makes use of industry-standard trading platforms like MetaTrader4 and MetaTrader5. This allows users a high degree of customization of the interface of the trading software, setting the trader up for success.

Web Trading

Traders can enjoy the full functionality of the MT4 and MT5 trading platforms even through their web browsers, without downloading the full software. All of the options available to desktop users are still made available via WebTrader.

Desktop Trading Platform

Desktop users of the MT4 and MT5 software get to use a comprehensive and exhaustive industry standard platform which, through its fully customizable setup, helps its users make the best decisions possible for their trades.

The tools provided are also a great way for users to get to know the software via the XM broker’s free demo account.

Mobile Trading Platform

Mobile trading is done via the XM MT4 and XM MT5 apps which give users access to the same functionality that the WebTrader and desktop users get. Users can enjoy 3 chart types and over 30 technical indicators created to help guide their decisions.

XM Broker Deposits and Withdrawals

This broker provides a variety of ways that clients can withdraw or deposit funds into their accounts. The good thing about this is all methods used by XM are legitimate forms of payment and the method used to deposit lines up with the method used to withdraw funds.

This is important as many scam brokers push their clients to deposit funds in less safe ways, like cryptocurrency transfers. Clients of XM can withdraw or deposit their funds in one of the following ways:

- Credit Cards

- Bank Wire and Local Bank Transfer (available in some regions)

- E-Wallets including

- Neteller

- Skrill

- Western Union

The XM broker’s minimum deposit is only five dollars allowing for a very low barrier of entry that virtually anyone interested in trading can afford to get in on.

It is worth noting that, should an issue of any kind arise, it is possible to get your money back via chargeback but only under the circumstance that you have paid via credit card.

XM Broker Offers Bonuses and Promotions

Currently, clients can find the following promotions on the XM website:

The promotions that the broker is running are mostly focused on new client acquisitions. They propose interesting incentives to join the XM broker from getting $30 to start without a deposit to providing incentives to invite your friends.

The broker also has a loyalty program that they run for their long-time clients based around certain seasonal calendar events.

XM Broker Customer Service

The one item that always comes up when searching for XM Forex broker reviews is the quality of customer care that they provide. They provide 24-hour customer support 5 days a week in over 30 languages:

- English

- Russian

- Thai

- Chinese

- Portuguese

- And others

This means that no matter what issue you could face whilst trade with XM, someone is always there to help resolve it.

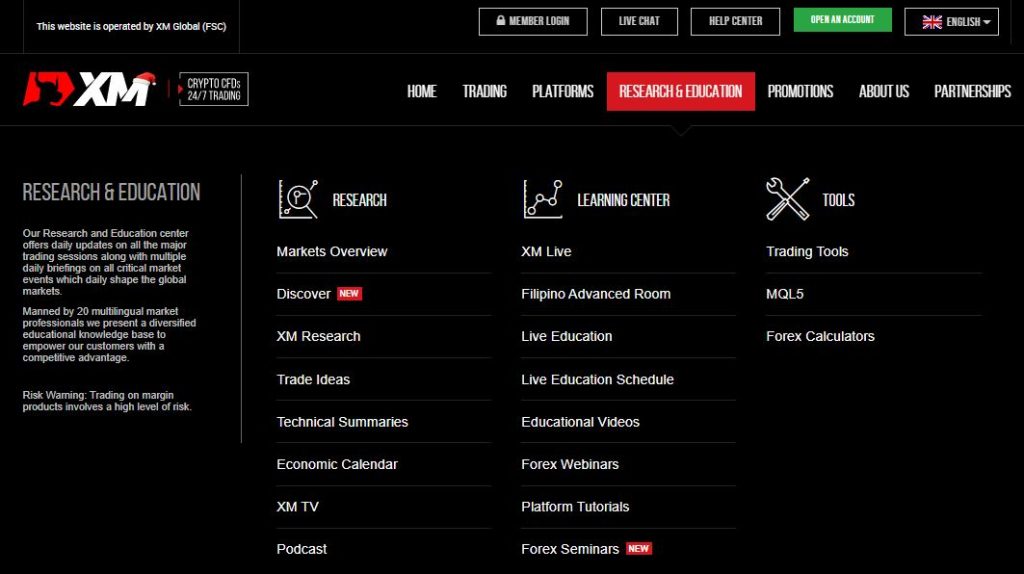

XM Broker Research and Education

One of the best things about this broker is that they take user education seriously. Users have access to the following forms of education:

- Forex webinars

- Regularly held seminars

- Live education offerings

- Educational videos

- Free demo account

Users should try to take advantage of all the educational opportunities provided by XM as it is a surefire way to become a better trader.

FAQs About XM Broker

Is XM Broker Good For Beginners?

XM provides a wealth of research and educational material, as well as a very low barrier of entry with a $5 minimum deposit.

Is XM Legit and Reliable Broker?

XM is a legitimate broker with an offshore entity. They are still regulated by 3 tier one commissions (FCA, ASIC, CySEC)

What Is The Minimum Deposit at XM Forex Broker?

The XM broker has a minimum deposit of $5 (this is however dependent on the account type you choose).