Accuindex Review: An In-Depth Analysis of the Features and Services Offered

Since the company is registered in three countries there is a lot of confusion. With headquarters in Cyprus and official registration in 2017, the company is trying to build up its reputation.

But if the broker already has 25% of negative reviews, that should be a warning sign. Let’s take a closer look at this Accuindex review of what key services this broker offers.

Overview of Accuindex Broker

The official owner of the brand is Accuindex EU Limited. This entity is registered in Cyprus. Also, there are two other entities. In this case, Accuindex Limited (Mauritius) and Accuindex LTD (St. Vincent and Grenadines).

With this in mind, you need to know what offer you can get from both sides. Especially knowing that one has stricter regulations than the other.

If you would like to know more about safety in the trading world, read our YellowStoneFX, EagleFX and ViaMarketsGo reviews.

| Accuindex | Reliable Broker Must Have | |

| Legal name: | Accuindex Group | Transparently displayed in the disclaimer or legal documents |

| Regulation: | CySEC, FSC Mauritius | Within your legal jurisdiction – local regulator |

| Registered in: | Cyprus | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2017 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | Accuindex.eu, accuindex.com | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | N/A | None |

| Contacts: | Phone: +357 25 262216

E-mail: [email protected] Online form |

Phone, email, social media, web form |

| If a withdrawal is possible: | Potential issues | Yes |

| Fees: | Hidden fees | Transparent fees – list of spread and commissions |

| If Active on Social Media: | Yes- Facebook, Instagram, Twitter, Youtube, LinkedIn | Often present on social media |

| Investor Protection: | Negative balance protection & segregated accounts | Compensation fund |

Regulation info

If you are looking for a reliable broker you always tend towards Tier 1 regulations. Such as FCA, BaFin, ASIC or CFTC. In this case, the Accuindex broker doesn’t have any of those. Instead, they opted for CySEC regulation for the European brand. But also, there is an FSC Mauritius license for an offshore entity.

Considering the different conditions between entities, you have to make sure you are trading with the right one.

Accuindex Profile

In general, it all depends on where you are coming from. Still, there are a few facts that you need to take into consideration. According to ESMA rules, you are not allowed to get leverage higher than 1:30 if you are from the EEA zone. Unless you are a pro trader.

In case you get higher leverage, you know that you are trading with an offshore entity. Overall, offshore entities have weak protection and a lower trust rate.

| Trading platforms: | MT5, MT4 |

| Account types: | Standard, ECN |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:30 / 1:400 |

| Minimum Deposit: | $250 / $100 |

| Commissions/bonuses: | $5 for standard round lot / 20% bonus for an offshore entity |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Accu Academy |

Is Accuindex Legit and Safe?

With numerous negative reviews, it’s hard to believe in that. Even though they have reliable and trusted European entities, there are also offshore ones.

One is registered in Mauritius with low-tier regulations and the other is completely without regulations in SVG. Since the main countries of their activity are UAE and Saudi Arabia, it’s easy to confirm they don’t have any of the required licenses there. Neither from DFSA or CMA.

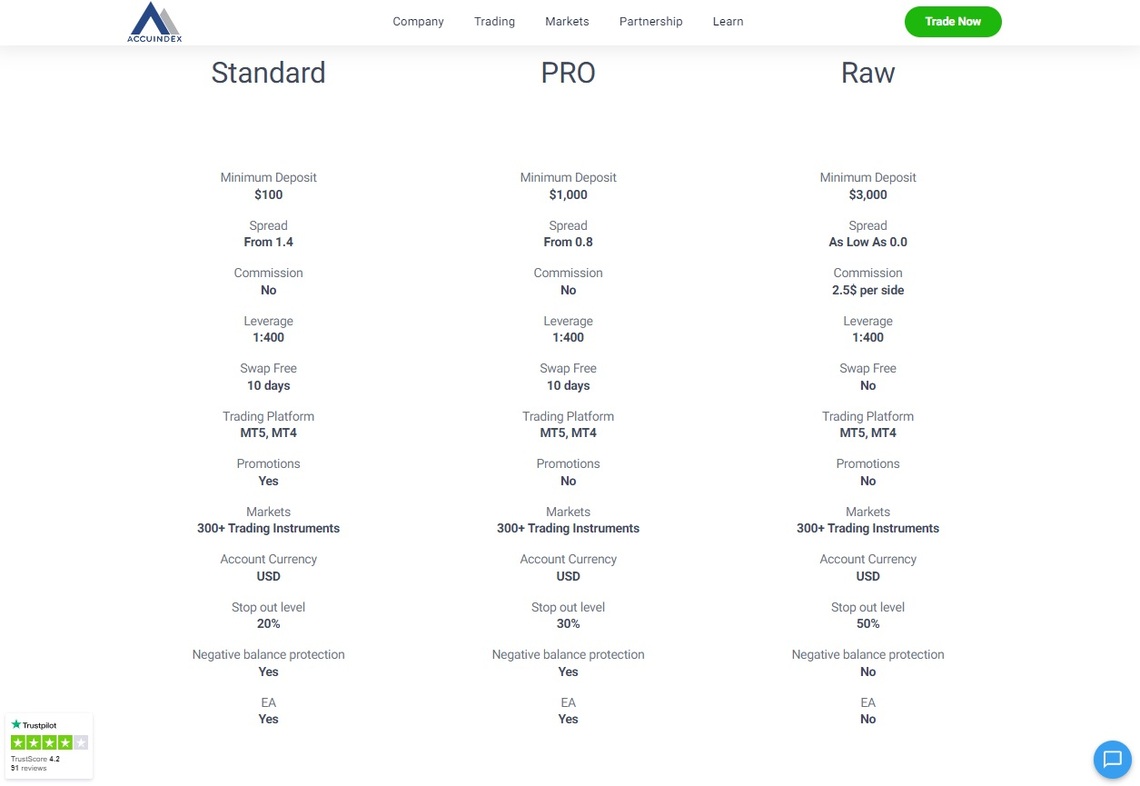

Account Types

Account types and their offer differs from entity to entity. With a European entity, the minimum deposit starts at $250 while for an offshore entity takes only $100.

Important to realize is that you can get bonus funds with the offshore entity. Of course, with a shady bonus clause.

Accuindex Demo Account

On the positive side, wherever you are trading you can get a demo account first. It’s a great choice for anyone who wants to test out the broker.

Yet, there is no micro-account available with this broker. In general, micro accounts are a great opportunity to trade with real money but minimized risks.

Accuindex Clients’ Reviews: Insights from Traders

The warning flag raises once you check Accuindex reviews. Unfortunately, there are many traders reporting issues with their accounts. Starting with unexpected account locks and withdrawal issues. In case you are trading with a Tier 1 licensed broker you would be able to report that to the regulator.

However, with brokers that have multiple regulations you have to make sure what regulation monitors company activities. In case you are looking for a trusted broker, get in touch with our expert team to get in-detail guides.

Accuindex Investment Products

Another key point is that Accuindex doesn’t offer crypto assets. However, they accept crypto payments. Which is quite strange.

Nevertheless, traders can choose between Forex, Commodities, Indices and Shares. In general, there is more than enough room to find suitable options for everyone.

Accuindex Customer Service

Customer services with Accuindex are available 5 days per week, 24 hours. Since they are offering a live chatbot, the best option is to contact them directly.

You can do that via phone, e-mail or online contact form. However, some traders reported unprofessional customer support experience. So, just in case you need them, be patient.

Overview of Trading Platforms

Accuindex company offers industry-leading software. With the European brand, you can get only the MT5 platform. On the other side, traders with accounts offshore can get MT4 and MT5.

Most importantly, both software comes with dedicated mobile apps. Whether you use iOS or Android you don’t lose any functionalities. Thus, with RAW offshore account you can’t use EAs.

Accuindex Leverage

As can be seen from the company presentation there are different options. With Accuindex EU, you get leverage according to regulation. The maximum is 1:30.

On the contrary, with an offshore entity you get up to 1:400. Also, with an RAW account you lose negative balance protection. Practically, the more money you deposit the less protection you have.

Accuindex Trading Hours

Practically, for equity markets the company follows worldwide trading hours. On the other hand, you can trade other instruments 24 hours a day.

Thus, only on weekdays. As mentioned earlier, the company doesn’t offer 24/7 crypto trading.

Deposits and Withdrawal Methods

Important to realize is that with a European entity, an Accuindex login is required to get info about deposit and withdrawal options.

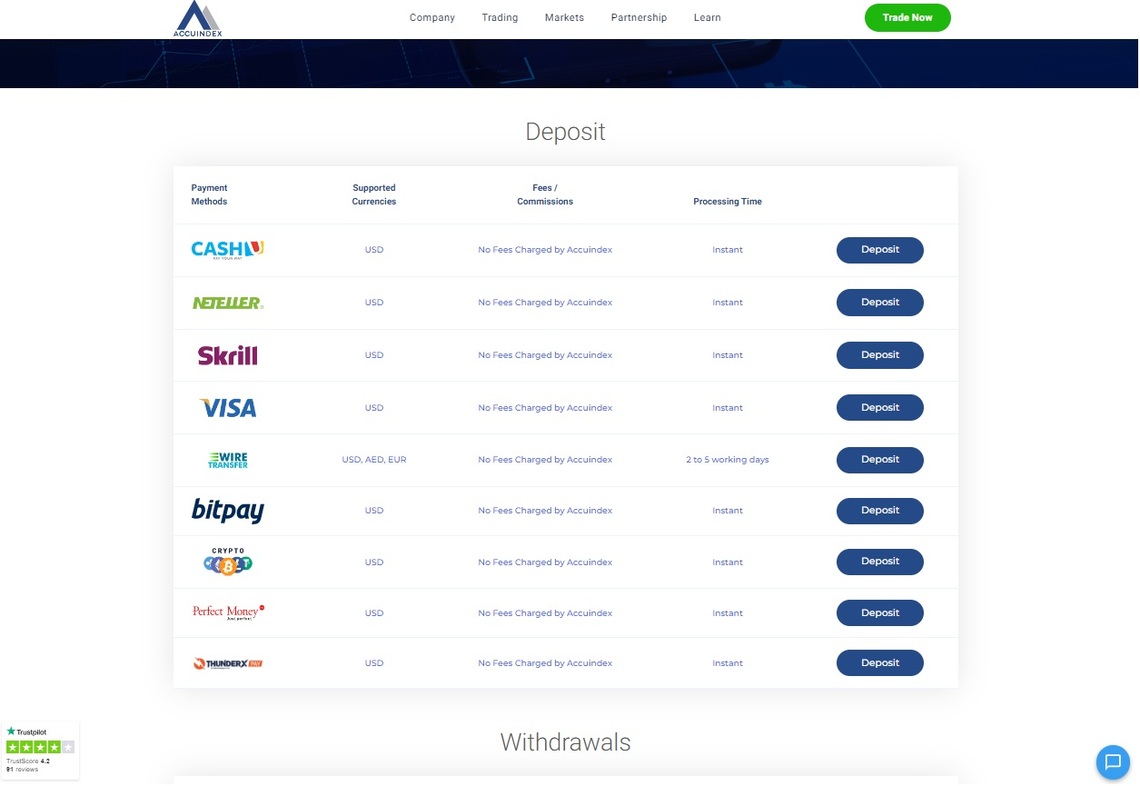

However, with an offshore website, we can find more information about funding options. Those are:

Debit and Credit Cards (Visa)

- Wire transfers

- E-payment options (Skrill, Neteller and many more)

- Crypto

For withdrawals, you can only use a few e-payment solutions and wire transfers. Many withdrawal options are processed on the same day. Yet, some reviews are pointing in the other direction.

Bonuses and Promotions

Since bonuses are banned in Europe since 2018, they can only provide that offshore. Indeed, that is the reality. Up to a 35% bonus is provided on your first deposit.

However, that bonus is non-withdrawable. Also, bonuses come with numerous clauses that you have to read through carefully. On top of that, there are multiple promotional options. Such as White-label and IB partnerships.

Pros and Cons of Accuindex

Generally speaking, the biggest downside is the unclarity between entities. If you are not protected by CySEC, there could be potential issues. That is pointed out by traders in Accuindex reviews.

On the positive side, the company provides trusted software and demo account. As for trading conditions, there is nothing spectacular. Nothing that you can’t get with any other Tier 1 licensed broker. Ultimately, the decision is yours if you will trust this broker or not.

Personal experience with Accuindex and expert opinion of the author

Overall, there is not much protection guaranteed. The broker nowhere mentions the compensation scheme that CySEC-regulated brokers generally have. But if you are trading with an offshore broker, none of the above is strictly required.

If you are still searching for a broker that is trusted and reliable, we can help you filter them out. Get in touch with our experts to find out more about where and what to look for. Don’t hesitate because it’s free of charge and without any obligations.

FAQ

Is Accuindex a good Forex broker?

Considering their European regulation, yes. But after checking Accuindex reviews you might rethink your decision of investing here.

What is the Accuindex minimum deposit?

Depending on the entity you are working with it’s required to deposit between $100 and $250 for basic account.

Is Accuindex safe?

If you compare it with FCA-licensed brokers, no. In general, you can enjoy some kind of rotection, but for experienced traders that’s not enough.