ACY Securities Review – Regulated Australian Broker With Tax Haven Branches

ACY Securities is an Australian brokerage brand with fairly attractive trading conditions. These include adjustable leverage, tight spreads and the utilization of MetaTrader platforms. While the brand is properly regulated in their jurisdiction, the offshore registration and license for the wider clientele is somewhat worrying. What that means for non-AU clients is just one of the key elements we’re discussing in the following ACY Securities review.

Who is ACY Securities?

The Australian brokerage firm operating under this name is owned by ACY Securities Pty Ltd, properly licensed by ASIC. The other firm, ACY Capital Australia LLC, is actually registered in the SVG and licensed by VFSC (Vanuatu) as an alternative for the non-AU clients.

So while the Australian customers may enjoy the highest security standards in a controlled trading environment, the same cannot be said about international clients. Nonetheless, the company belongs to an old brokerage conglomerate, which we cannot help but praise for the years of practice behind them.

| Broker name | Reliable Broker Must Have | |

| Legal name: | ACY Securities | Transparently displayed in the disclaimer or legal documents |

| Regulation: | ASIC, VFSC | Within your legal jurisdiction – local regulator |

| Registered in: | SVG | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 1998-09-24 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | https://acy.com/ | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | None | None |

| Contacts: | Phone, Email, Live Chat, Online Form, Physical Office | Phone, email, social media, web form |

| If withdrawal is possible: | Yes | Yes |

| Fees: | Transparent Fees | Transparent fees – list of spread and commissions |

| If Active on Social Media: | Actively present on social media (FB, ING, YT, Twitter, TikTok, etc) | Often present on social media |

| Investor Protection: | Compensation fund | Compensation fund |

Regulations – ASIC and VFSC

As the broker openly discusses it on their website, ACY Securities Pty Ltd (‘ACY AU’) is licensed and regulated by the Australian Securities and Investments Commission. Some of the major terms that AU brokers have to meet in order to obtain this Tier 1 license are starting capital of AU$1 000 000.

Otherwise, the firm is not eligible to even apply for this prestigious license. Following that, each ASIC regulated broker has to provide segregated bank accounts for safe-keeping of clients’ investments, as well as negative balance protection. Another crucial risk-managing rule is leverage limitation to 1:30.

On the other hand, non-Australian residents cannot expect the same treatment because they fall under the regulation of VFSC – an offshore regulator with loose requirements. Leverage isn’t limited and security measures aren’t even half as strict. FXCC is another broker operating under the same regulation.

ACY Securities Briefly

Although the ACY Securities education is not as thorough as we expected, it could be justified with the broker’s focus on serving professional traders. That is why MT4 and MT5 are made available, as the most sophisticated yet comprehensive software on the market. To trade with ACY Securities means accessing hundreds of financial instruments in the diverse range of options.

Let’s discuss each of these offers separately, so you can compare them with other AU brokers, such as CommSec.

| Trading platforms: | MT4, MT5 |

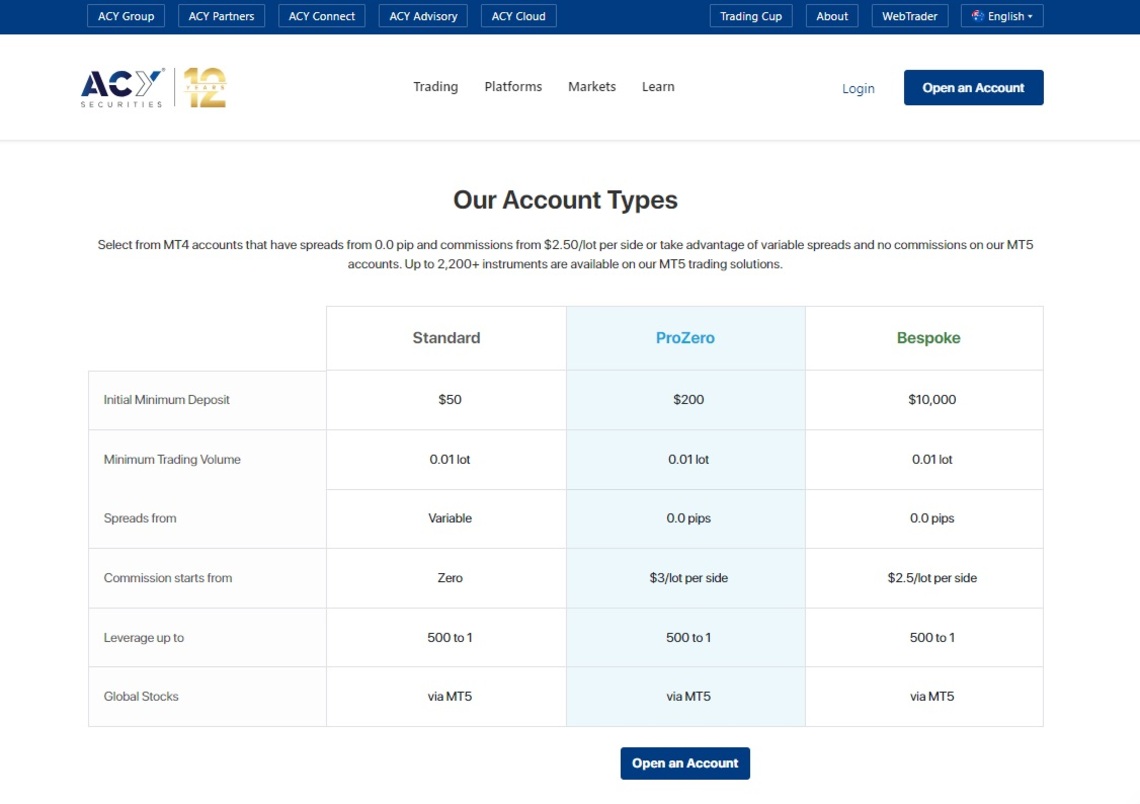

| Account types: | Standard – $50

ProZero – $200 Bespoke – $10,000 |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:500 |

| Minimum Deposit: | $20 |

| Commissions/bonuses: | Not available |

| Mobile app: | Available |

| Desktop app: | Available |

| Autotrading: | Available |

| Demo account: | Available |

| Education or Extra tools: | Audiobooks, Webinars, Courses |

ACY Securities – Safe or Not?

Despite the unquestionably attractive range of tradable instruments, tools, options, accounts and platforms, we have several doubts. These refer to the funds’ safety of the international clientele.

You see, in order to please the jurisdictional regulatory standards, AU traders have to be offered a modest leverage of up to 1:30. Non-domestic clients can access a far higher ratio of up to 1:500. This has its pros and cons, like increased profit in case of winning, but also excessive loss.

That isn’t the end of our concerns. The VFSC entity serving the less protected clients doesn’t properly secure the deposits, or is required to enable crucial AML measures. In essence, it is up to the broker to keep the good practice.

Opinions are Positive

The overall rating that ACY Securities has on TrustPilot is relatively high – 4.2 out of 5. This is what the clients have to say so far:

“So far so good with ACY Securities. I am a trader from the Philippines and attended their Webinar and Seminar in the office before. You can know that they can be trusted. On Trading – it is not perfect like other brokers are not as well, but no issues with deposits and withdrawals yet. Good to note that their Support is now better than before.”

“I have a free swap trading account with ACY for awhile now, i like it, very fast execution, low spreads, good help & support, personal account manager contact you no mater how small your account, i did a complete withdraw my funds with little profit no problem i later deposit more still trading with them, the only CONS for me is: up to 2 business days withdrawal, not a lot payment options, you can only have one active account (i did not contact the manager about it). I was little surprised when i saw this bad reviews here. will update my review here if something happened.”

Who Prefers ACY Securities and Why

As previously noted, the broker doesn’t fail when it comes to attractive leverage, tight spreads and popular trading instruments. These are just some of the major advantages of investing with this brokerage. It is, at the same time, what the traders are mostly attracted to and what the ACY Securities sales team mainly advertises to potential customers.

By that we don’t mean just the regular, Australian clientele. Many other traders also seem to prefer this broker over many others. Some of the countries where ACY Securities is visibly popular are:

- Australia

- Malaysia

- Egypt

- South Africa

- Philippines

Funding Methods and Payouts

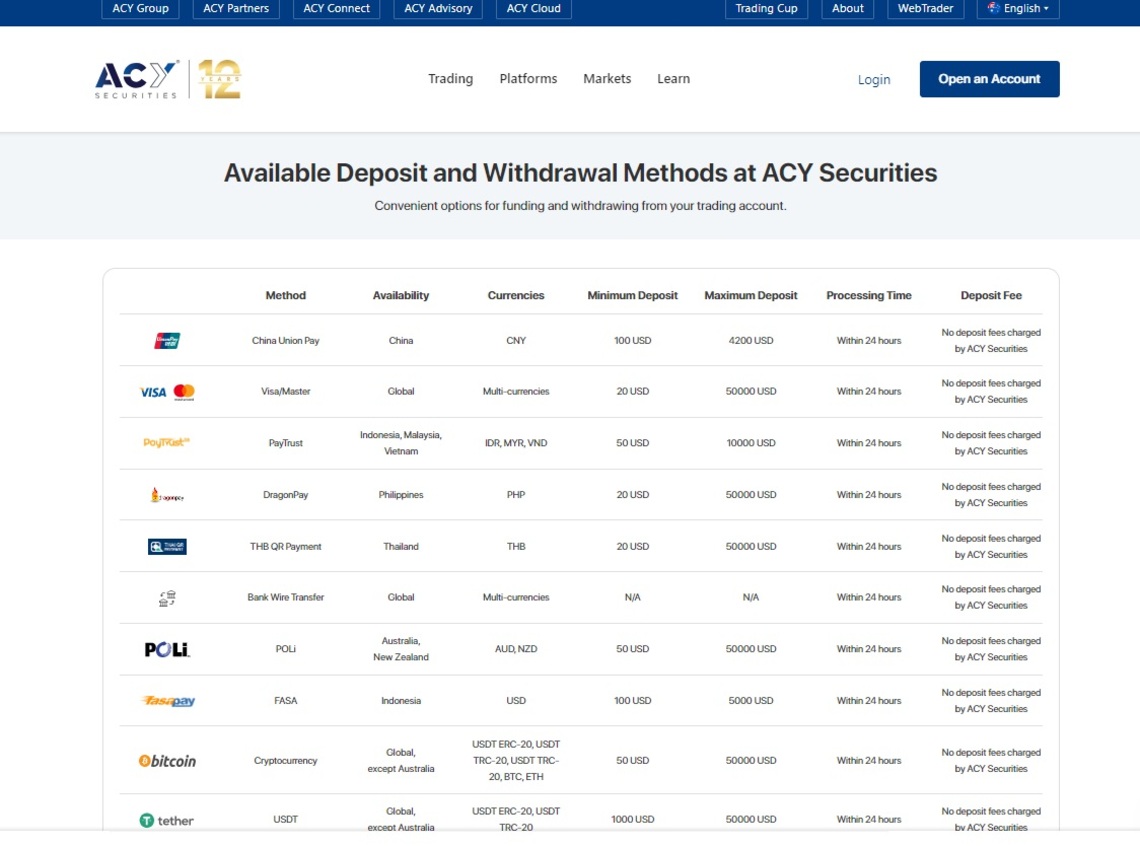

ACY Securities is quite transparent when it comes to discussing possible funding methods, as well as the fees pertaining to cashing out and processing time. Relating to that, here are some more popular transfer channels enabled:

- Bank Wire

- Crypto

- Credit Cards

- E-wallets (Skrill, Neteller, Poli)

While there’s no deposit fee, withdrawals are slightly different. There’s still three free withdrawals per month, after which each is charged with the minimum of $25 per transfer. The processing time doesn’t last more than 24 hours.

Why Caution is Advised

We can’t help but again warn traders to carefully choose what broker they wish to be their confidant when it comes to investing and price speculating.

Australian traders are adequately taken care of in terms of security, safety and transparency. The same cannot be said about all other, non-AU investors. Relax regulatory standards cannot guarantee the same safety. That’s why caution should be exercised.

Our Expert’s Advice

However seemingly attractive, ACY Securities is not a safe option for any other trader except AU-based ones. Unless you’re willing to risk and are a professional trader, we recommend seeking a safe alternative.

Beginning traders need to be especially cautious – you need a broker to rely on, with transparent conditions and highest safety measures. If you need additional info on any of the sites you’re interested in investing with, you can refer to us for free additional info or advice.

FAQ Section

Who Is ACY Securities?

ACY Securities is an Australian brokerage brand with offshore entities. Non-AU traders can refer to our free consultation team for more safer recommendations.

Is ACY Securities Regulated?

Yes, ACY Securities is regulated by the Australian ASIC and VFSC (Vanuatu).

What Are The Trading Instruments Of ACY Securities?

Most traded instruments at ACY Securities are Forex, Shares, Indices, Precious Metals, Commodities, and ETFs.