Adar Capital Review: Who Is Behind AdarCapital.Pro?

Insofar as it relates to forex trading, it is flooded with scam brokers that either operate unauthorized or counterfeit licenses. When it comes to the latter, in today’s article, we are dealing with the Adar Capital broker—a clone company of a legitimate brokerage firm.

Along with being a proven fraudster, Adar Capital provides disadvantageous services that are clearly made to fit its anonymous identity and felonious intent.

It is part of Sonorous Group LLC, based in Saint Vincent and the Grenadines, a jurisdiction that doesn’t regulate its forex brokers. So, please continue reading the Adal Capital review to find out who is behind AdarCapital.pro.

In addition, we strongly suggest that you avoid trading with dishonest brokers such as Cerus Markets, UXTrades, and GTS Financial.

| Leverage | 1:500 |

| Regulation | No |

| Headquarters | SVG |

| Minimum Deposit | 250 EUR |

| Review Rating | 1/5 |

| Broker Type | Forex provider |

| Platforms | Web trader |

| Spread | 0.13 pips |

Is Adar Capital Legit? Regulation and Financial Stability

In terms of regulations, all brokers regardless of their jurisdictions must be authorized by a respective financial market regulator to operate legally. That is not only to meet legal requirements but also to ensure the funds’ security.

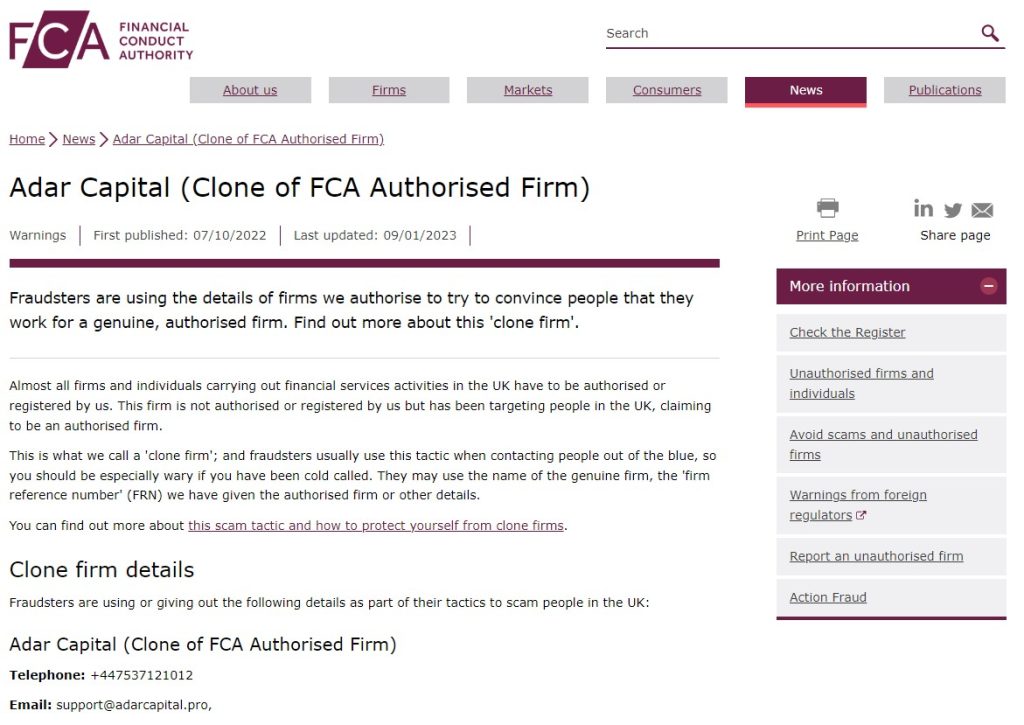

Speaking of Adar Capital, not just that it is an unlicensed brokerage firm but fraudulently impersonates an FCA-licensed company (Sky Blue Wealth Management Ltd) which the British watchdog warns.

If you wonder why a company would want to counterfeit specifically an FCA license, it is because FCA (Financial Conduct Authority) stands for one of the most respected financial agencies, closely cooperating with the HM Treasury. It covers traders with up to 85,000 GBP compensation in the event of brokers’ insolvency.

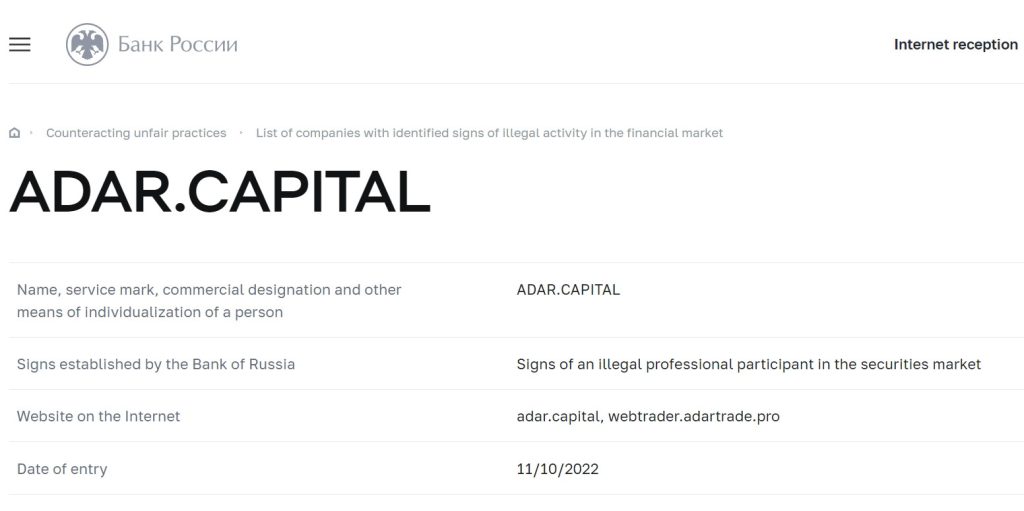

In addition, Italian CONSOB, Russian CBR, and Spanish CNM have also issued a warning against this broker scam. Therefore, it is not possible to expect nothing but deception from such a crooked company.

An Overview of the Adar Capital Trading System

As an exposed cyber fraud, Adar Capital can offer nowhere near enough of a professional trading platform. Its web trader comes with very basic features and can’t provide profitable and safe trading.

For that one, you need to choose MetaTrader 4, MetaTrader 5, cTrader, and Sirix. All of these powerful programs have advanced features such as expert advisors, copy trading, stop loss, and so on. They are widely used, user-friendly, and accessible from all devices.

Deposit and Withdrawal Methods

The minimum required deposit, it is 250 EUR, which is several times higher than what legitimate brokers require (i.e., 10 USD). Anyhow, payment methods are always an issue with an investment scam.

For deposits, fraudsters insist on anonymous and irreversible means of payment such as crypto wallets. As for payoffs, they levy hefty fees and are ambiguous about processing time.

Moreover, you can’t expect successful withdrawals with fraudulent broker companies like Adar Capital—which allegedly supports credit/debit cards and wire transfers and falsely guarantees instant payoffs.

How Do They Conduct Their Scam?

Concerning the Adar Capital scam, we have seen this frame so many times. It first pretends that it is a valid broker providing a safe and profitable trading environment, assuring that with groundless statements and fake documents.

When a financial swindler gets your attention, it tries to take advantage of your trust and entice you with lucrative investment opportunities. For instance, Adar Capital provides 1:500 leverage, which is a high ratio. In most countries, it is capped at 1:30.

Once a victim falls for its fraudulent project and makes a deposit, it won’t be able to make any real profits nor draw funds out.

That being said, if you are one of the victims of this or any other trading scam, you must act fast and inform the relevant authorities. With the help of cyber security experts, it is possible to get your money back. In light of this, you can contact our company.

Bear in mind that when a broker gets too many complaints against the broker, it disappears and reappears under a new name and/or domain. In the case of Adar Capital, adarcapital.com and adar.capital.pro domain names are already exposed, so it now uses adar.capital.

Adar Capital Summary

To wrap up the following Adar Capital broker review with the most important facts. Legitimate and safe brokerage services require licenses and regulations. Otherwise, brokers can be involved in fraudulent trading activities and get off scot-free.

As for Adar Capital, it is an unlicensed and untrustworthy broker exposed by two watchdogs FCA and CNMV. Aside from that, its service is based on falsehoods. Considering all of this, you don’t need more reasons for keeping away from this unscrupulous broker.

Lastly, just a word of advice, don’t trust fabricated positive Adar Capital reviews on the web, do your due diligence, and rely on honest reviews by professionals.

FAQs About Adar Capital Broker

What Are the Funding Methods for Adar Capital?

This bogus broker allegedly accepts credit and debit cards and bank wire transfers for deposits and withdrawals.

Is Adar Capital Regulated?

No, it isn’t; it is a clone company and an exposed scam by FCA, CONSOB, and CNMV.

How Long Does it Take to Withdraw from Adar Capital?

This shady brokerage firm guarantees instant withdrawals, which is not possible with this scammer