Admiral Markets Review – Is AdmiralMarkets.Com a Legit Firm?

The Admiral Markets broker company commenced operations in 2001. The broker’s activities are registered and licensed by the Australian Securities and Investments Commission (ASIC). They now operate in more than 40 countries with a cash cycle of up to USD 40 billion.

On top of that, Admiral Markets broker holds a lifetime license issued by the Federal Financial Markets Service and is a well-regulated Financial Conduct Authority (FCA).

The general aim of Admiral Market is to bring access to functional software and quality offering to the traders’ community through transparent pricing and execution.

In this Admiral Markets broker review, we will cover all the basic information you need about this company and as well, why you should start your investment with them.

Please read this detailed review of authorized brokers like JP Markets, TIO Markets, and Oanda.

Admiral Markets Pros and Cons

After taking a look at their website, we saw that Admiral Markets charges low forex CFD fees. On top of that, deposits and withdrawals are fast and mostly free, and multiple options are available including credit and debit cards and electronic wallets. Account opening is also fast and user-friendly.

But on the downside, the broker has a limited product portfolio as it mostly offers CFDs, although real stocks and ETFs are also available for some clients. Customer support is not available 24/7, and there is also an inactivity fee.

Pros of working with Admiral Markets:

- Low forex CFD fees

- Free and fast deposit and withdrawal options

- Straightforward account opening

Cons of working with Admiral Markets:

- Inactivity fee

- Customer support is not available 24/7

Although there are some pros and cons, after looking up Admiral Market’s trading review, the clients overall are very satisfied working with them.

| Headquarters | 37th Floor, One Canada Square, Canary Wharf, London, United Kingdom. |

| Regulation | ASIC, FCA, CySEC, EFSA, IIROC, JSC |

| Instruments | Forex, CFD, Crypto, and Stocks |

| Platforms | Web, Mobile, and Desktop |

| EUR/USD Spread | Yes |

| Minimum Deposit | 25$ |

| Base Currencies | EUR, USD, AED, and JOD |

| Demo Account | Yes |

| Education | Yes |

| Customer Support | Yes |

Is Admiral Markets Safe? License and Safety of Funds

Admiral Markets are heavily regulated by multiple of the world’s most reputable authorities including FCA in the UK and CyCES in Cyprus and also EFSA in Estonia and ASIC in Australia, IIROC in Canada.

So, in other words, Admiral Markets is a fully regulated and licensed broker that offers financial services online. Admiral Markets operate via different legal entities.

This matters because the amount of investor protection, you are eligible for differs from entity to entity. They also provide negative balance protection. If the balance on your account goes negative, you will be protected.

As we have mentioned above, Admiral Markets was established in 2001. The longer the track record a broker has, the more proof we have that it has successfully survived previous financial crises.

The Admiral Market’s parent company, the Admirals Group is listed on the stock exchange, which is a big plus for safety, as Admiral Markets releases financial statements regularly and transparently. These are all great signs for the Admiral Market’s safety.

And after checking the Admiral Markets forex review, they don’t have any complaints made against the broker. This is always a good sign and it means you are dealing with a regulated brokerage. That’s why it’s always advisable to read the review before investing your money anywhere.

Accounts Types Offered

There are a few flexible accounts offered by Admiral Markets allowing you to select a trading account suitable for your trading needs. They are offering a choice between two types of platforms divided into Admiral Markets Account and Admiral MT5 Account.

Trading accounts for MetaTrader5:

- Trade.MT5

- Invest.MT5

- Zero.MT5

Trading accounts for MetaTrader4:

- Trade.MT4

- Zero.MT4

It doesn’t matter if you are an experienced trader or a beginner, you can still sign up for the Admiral Markets account that is featured through the MT4 platform and the costs built into the spreads.

MT4 accounts are defined as Trade.MT4 and Zero.MT4. Accounts depend on fee structure either with all costs in the spread or with interbank quotes and commission per lot as a broker fee.

MT5 accounts are also defined as Trade.MT5 and Zero.MT5 with a similar structure, plus there is a separate account type for investors. Invest.MT5 is allowing to invest in Stocks and ETFs and a minimum deposit requirement of only 1$.

Overall, there is something for everyone, either a beginner or experienced trader. Also when it comes to the Admiral Markets login into the accounts, it’s a very easy process, and you are protected by two-step authentication.

Trading Platforms Overview

For the Admiral Market software and technical performance, let us start with the servers. They are physically located next to all major liquidity providers and provide truly good execution and the lowest latency.

The software Admiral Markets uses is reliable, convenient, and a mainstay on popular trading platforms MetaTrader4 and MetaTrader5. Both platforms deliver STP execution and are eligible to use EAs with no restrictions, which is a great opportunity along with various useful tools.

That alone can tell you that the company is serious and offers good trading software and all the necessary help. The MetaTrader web trading platform has great customizability. It is easy to change the size and the position of the tabs.

The Broker \ also has a clear portfolio and fee reports available on MetaTrader 4 web trading platform. You can easily see your profit-loss balance and the commissions you paid.

These reports can be found under the ‘History’ tab. On top of that, you can boost your MetaTrader trading experience with StereoTrader or the MetaTrader Supreme Edition.

StereoTrader is a trading panel extension that you can connect to your MT platform, while the Supreme Edition enables you to use a wider range of research tools than the basic platform.

Trading Instruments Offered

When it comes to the instruments offered, Admiral Markets also diverse their offering by opportunities to trade metal and currencies, as well CFDs trading on indices, energies, bonds, stocks, and CFDs on Cryptocurrencies such as Bitcoin, Litecoin, Ethereum as well freshly introduced Monero, Dash and Zcash.

This means that you have plenty of things you can choose from to make your profits. We have also found that Admiral Markets is constantly enlarging its trading instrument range, which is definitely great, with more adding of Cryptocurrencies, Ethereum trading, and other currencies too.

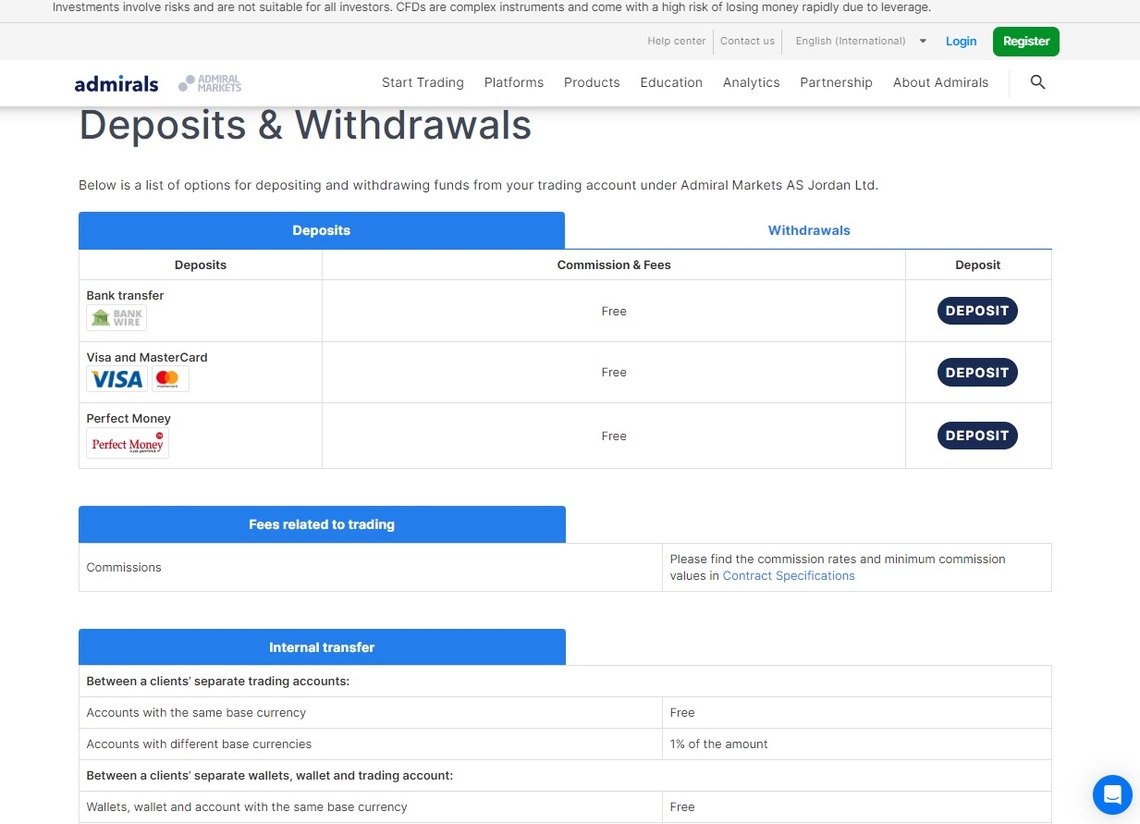

Deposits and Withdrawals Methods

At Admiral Markets, you are able to fund your accounts through the most convenient methods:

- Visa or Master debit or credit

- Wire transfer

- Klarna

- iBank

- BankLink

- Przelewy

- Skrill

- Neteller

If you are interested to start with Admiral Markets, their minimum required deposit is 25$. When it comes to the fees, they haven’t mentioned any charges for deposit.

However additional methods of e-wallet payments like Skrill and Neteller will add on a 0.9% fee for the deposit transaction or 1% for withdrawal respectively. So it is all depending on the method you use and the entity you trade with.

When it comes to the withdrawal, there aren’t any issues or complaints regarding it. The only thing you should be aware of is that the broker offers two bank wire withdrawals per month free of charge, while further requests may incur fees for your transfers.

Customer Support

There are a couple of ways how you can contact Admiral Markets:

- Live chat

- Phone

The broker has a quick live chat to which an agent is connected almost immediately. We got detailed help and relevant answers.

Phone support was helpful and we received detailed answers also. The agent also offered to send us information via email.

Email support is very helpful. We received useful and to-the-point answers to our inquiries, although in some cases we had to wait for a full day for a reply.

Overall, it’s a good experience with customer support and they are there to help you with whatever you need.

Admiral Markets Overall Summary

In this broker review, we came to the conclusion that it’s a great CFD broker. It is regulated by several financial authorities globally, including the UK’s FCA and Australia’s ASIC.

On the plus side, Admiral Markets CFD trading fees are low, while forex fees aren’t high either.

We also liked that the deposit and withdrawal process is fast and mostly free. The account opening process is seamless, hassle-free, and quick.

Admiral Markets also brings an opportunity to trade with deep liquidity conditions from top-tier providers through the high speed of order executions and a quite low deposit to start along with its attractive pricing strategy.

FAQs About Admiral Markets Broker

What Account Types Does Admiral Markets Offer?

They offer the following accounts: Trade.MT5, Invest.MT5, ZeroMT5, Trade.MT4 and also Zero.MT4.

Does Admiral Markets Offer Demo Account?

Absolutely yes. Besides an option to open a live account, you can use the demo one.

What Are The Deposit Methods and Fees at Admiral Markets?

You can deposit via your debit or credit card, wire transfer, or e-wallet. Fess goes from 0.05 to 3.0 USD.

What Is the Minimum Deposit at Admiral Markets?

They have stated on their website the minimum required deposit is 25$.

Do Admiral Markets Have a Mobile Trading Application?

They absolutely do. They have a mobile app, web trader, and desktop trader.