CMC Markets Review: Is CMCMarkets.Com a Reliable Broker?

As the company is registered primarily in the UK and Germany, there are no doubts about security. But also, the company is spread all across the world. They are spreading since 1989 extremely fast.

On top of that, the company doesn’t miss any important features. But primarily high-security standards are necessary nowadays for reliable trading. Still, there are potential downsides as with any other broker. Keep reading this CMC Markets review to find out all the key facts.

Who Is CMC Markets Broker?

Besides mentioned offices in the UK and Germany, the company is present in other countries. Such as Canada, Australia, Austria, China and many more. With different countries comes different regulation.

However, the countries where CMC Markets are present have strict requirements. But also, funds protection features. This is something that makes this broker stand out in the crowd. On top of that, with advanced trading tools and multiple trading options, it’s easy to satisfy everyone’s needs.

If you are still exploring your choices you might as well read our unbiased OctaFX and FBS Broker reviews. More information can only be helpful.

| CMC Markets | |

| Legal name: | CMC Markets UK plc |

| Regulation: | Regulated |

| Registered in: | UK, Germany |

| Established: | 1989 |

| Website: | Cmcmarkets.com |

| Financial Authorities Warnings: | N/A |

| Contacts: | Phone: +44 (0)20 7170 8200

e-mail: [email protected] |

| If a withdrawal is possible: | Yes |

| Fees: | Inactivity fee, overnight swap, funding fee |

| If Active on Social Media: | Yes – Facebook, Twitter, Youtube, LinkedIn |

| Investor Protection: | Yes – GSLO, CASS, Compensation scheme |

Is CMC Markets Legit? Regulation and Security

Like any other trading company in the UK, the CMC Markets platform is regulated. Not by some offshore institution, but by one and only FCA. On top of that, the company holds all other necessary Tier 1 licenses. Starting with BaFin, ASIC, IIROC and many more.

Therefore, all their traders have the necessary protection from this broker. Some of the active fund’s protection measures are:

- Guaranteed stop-loss

- Compensation funds scheme

- Segregated bank accounts for deposits

- Negative balance protection

However, insolvency insurance is not provided for all traders. Still, everyone has a different experience with a broker. Practically it all comes down to your personal preferences and experience with a specific broker.

https://register.fca.org.uk/s/firm?id=001b000000MfH7rAAF

CMC Markets Broker Profile

With many different assets available and advanced trading technology CMC Markets broker became popular quickly. Generally speaking, their low FX fees and no withdrawal fees easily attracted traders. But ones that are looking for stock trading will have to pay a bit more than the average.

Other trading conditions are mainly guided by the regulation. That values as well for CMC Pro accounts. In general, traders that prefer higher volume trades and have knowledge and experience can require different conditions.

CMC Markets Leverage

CMC Markets leverage is quite an important topic. While traders in the EU are getting 1:30, New Zealand traders can get up to 1:500. Important to realize is that as much it gives you potential chances to earn more, chances for losing more are the same.

Therefore, leverage is to play with only when you have a certain experience. Thus, even experienced traders prefer lower leverage to control better their trades.

CMC Markets Spreads

Considering spreads starting already at 0.7 pips we can say that those are quite attractive. CMC Markets spreads are way below the industry average of 1.5 pips.

Therefore, the costs of trading with this broker become significantly lower. Especially on FX pairs. Thus, there is a %1 charge for the difference between the two currency rates.

CMC Markets Account Types

CMC Markets account types are not those standardized traders are used to seeing. There is CFD trading and Corporate trading. Besides those, you don’t have any different general conditions. Except for PRO traders, you have to pass the eligibility test.

Before you even invest any money, you can try a risk-free demo account. Since there is no minimum deposit requirement you can start with a lower amount and trade micro.

CMC Markets Trading Platform

CMC Markets traders have two different choices. One is MT4’s industry-leading and most reliable app overall. With advanced features like EAs, multiple technical indicators and charting tools, it’s the most used app. On the other hand, there is Next Generation software. This software allows traders to do spread betting which is tax-free. However, only available in the UK and Ireland.

As mentioned earlier, traders have guaranteed stop-loss. So, there are no worries if the trades will be closed on time or not. Important to realize is that both software comes with dedicated mobile apps. This makes it even more suitable for all traders to trade on the go.

| Trading platforms: | MT4, Next Generation |

| Account types: | CFD, Corporate |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:500 |

| Minimum Deposit: | $0 |

| Commissions/bonuses: | Average $7 commission / No bonuses available |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Webinars, Guides, Library, Market news |

CMC Markets Traders Reviews – Sharing Experiences

For a company that exists since 1989, CMC Markets reviews are quite impressive. Still, you can always find some traders not satisfied with something. Generally speaking, only 10% of reviews on Trustpilot contained some potential issues.

Allegedly, some traders were reporting frozen accounts, trades closed earlier unexpectedly locked accounts. Before you take any further steps into investing you might as well check those. But if you need any guidance or advice you can contact our professional team and clarify all uncertainties.

https://www.trustpilot.com/review/www.cmcmarkets.com

How CMC Markets Find Customers?

The company that exists for 30 years definitely built an advantageous marketing strategy. One of the options that legitimate brokers are using is social media. But LinkedIn the most.

This raises the awareness and credibility of the company. However, it’s not rare that brokers create specific ads for important events like IPOs, new company releases and more. These quick money-making options always attract more traders. Speaking of traders, they’re mainly coming from:

- Australia

- United Kingdom

- United States

If you are looking for more information on how to protect yourself, feel free to contact us. We can help you understand the safety in the trading world and assist you in choosing the right broker.

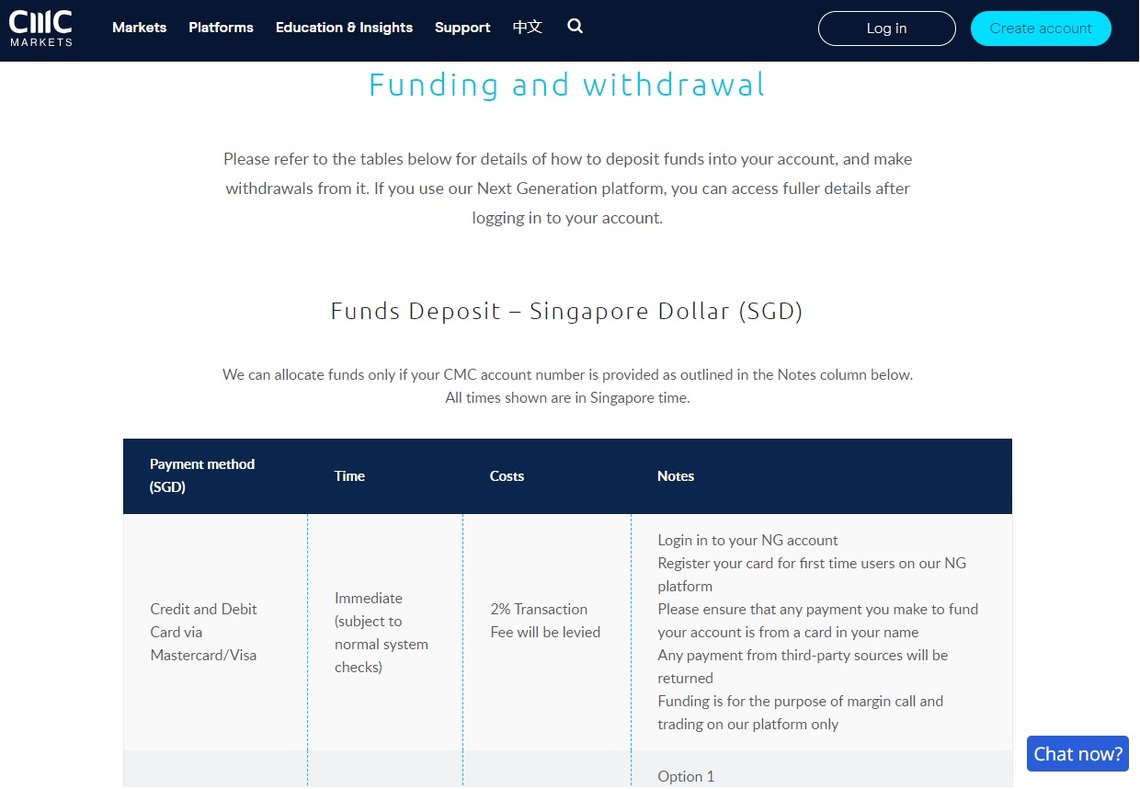

CMC Markets Deposit and Withdrawal Methods

CMC Markets funding options are quite narrow. Even though those are highly secured and transparent ones it’s expected something more. Anyway, traders can choose between:

- Debit and Credit cards

- Wire transfers

- PayPal

Expect wire transfers, funding is free of charge. But for a wire you are paying 15 GBP fee. Still, some of the methods may vary depending on your residence country.

CMC Markets Minimum Deposit

CMC Markets minimum deposit starts at $0. This is seen quite often among licensed brokers. Still, with lower amounts you have lower buying power.

Generally speaking, everyone gets the same trading conditions and equal chances for success. The size of success depends mostly on the amounts you are trading with.

CMC Markets Withdrawal Fees

Important to realize is that there are no CMC Markets withdrawal fees. This is quite important because traders are coming from different experiences. Since this broker is regulated they are not allowed to mislead traders.

Therefore, you won’t be charged anything more upon requesting a withdrawal. Thus, some traders were reporting some issues there and you should be aware of that.

Our Safe Trading Experts’ Final Words About CMC Markets broker

As can be seen, the CMC Markets broker has all the necessary licenses. Depending on the country you are coming from, conditions may vary. With different software options and multiple assets, they have quite an attractive offer. Also, there are many financial benefits and fund protection features. All in all, nothing to worry about except for those CMC Markets broker reviews.

Therefore it’s best to consult with professionals if you still haven’t decided which broker to choose. With our specialized team, you can go through your choices and even get some recommendations. Ultimately, the decision is yours and you don’t have any obligation towards us. Most importantly, it’s free of charge. Get in touch today!

FAQ Section

Is CMC Markets Trustworthy?

Yes. With many different regulations they provide a very strict and safe trading environment. Still, only your opinion matters after testing any broker.

How To Start Trading Safely?

Trading safely means choosing the perfect fit for you. That fit varies and depends on your residence country. Let us help you analyze your options thoroughly. Contact us today!

How Can You Help Me Choose the Best Forex or Crypto Broker?

The main thing is to define your preferences. Once you know what you are looking for we can get your list of trusted brokers. Contact us today to get yours!