eFinno Review: Evaluating the Benefits and Drawbacks

This eFinno review will give you an in-depth look at this broker’s regulation, security, trading platform, pros and cons, and more. Join us as we examine this review in detail.

You can also check our FxView, MultiBank Group, and Skilling reviews for more insight about other brokers.

Who Is eFinno? All About eFinno.com

Streams Financial Services Ltd (eFinno) is a Cyprus-based broker that offers a variety of financial products, including CFDs, forex, and stocks.

The company was founded in 2019 and is registered at 284 Makarios Avenue, 4th Floor, 3105, Limassol, Cyprus with the number HE 387124.

| eFinno | Reliable Broker Must Have | |

| Legal name: | Streams Financial Services LTD | Transparently displayed in the disclaimer or legal documents |

| Regulation: | CySEC | Within your legal jurisdiction – local regulator |

| Registered at: | 284 Makarios Avenue, 4th Floor, 3105, Limassol, Cyprus | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2019 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | www.efinno.com | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | None | None |

| Contacts: | Social Networks: twitter.com/efinno_eu, www.facebook.com/eFinno, www.youtube.com/channel/UCsf1sLzbdi2vdW9jLsOFRFg, www.instagram.com/efinno_official

Phone: +357 25 055782 Email: [email protected] |

Phone, email, social media, web form |

| Is a withdrawal is possible: | Yes | Yes |

| Fees: | Spreads from 0.1 – 2.9 pips | Transparent fees – list of spread and commissions |

| If Active on Social Media: | Yes | Often present on social media |

| Investor Protection: | Funds separation, Negative balance protection, Financial compensation (ICF) | Compensation fund |

Regulation info

The Cyprus Securities and Exchange Commission (CySEC) oversees eFinno, license number 376/19. CySEC makes sure that eFinno abides by the rules established by the commission, including the license criteria, continuing oversight, and investor protection protocols. eFinno operates within the parameters of accepted financial standards according to CySEC oversight, ensuring openness and defending investors’ interests.

Most of their clients are based in France, and there are some from the US and Israel. However, neither the Israel Securities Authority (ISA) nor the U.S. Securities and Exchange Commission (SEC) provides any regulatory authority over eFinno. This indicates that residents of these nations could not be covered by the financial laws of their respective governments.

eFinno Broker Profile

We collected the most important info about eFinno CFD broker, as always.

| Trading platforms: | eFinno Multi and eFinno Mobile App |

| Account types: | Silver, Gold, Platinum, Diamond |

| Financial Instruments On Offer: |

|

| Maximum leverage: | up to 300:1 |

| Minimum Deposit: | $500 – $50, 000 |

| Commissions/bonuses: | N/A |

| Mobile app: | Yes |

| Desktop app: | Web-based |

| Autotrading: | No |

| Demo account: | No |

| Education or Extra tools: | Trading Signals, Economic Calendar, and Financial Web TV |

eFinno Account Types

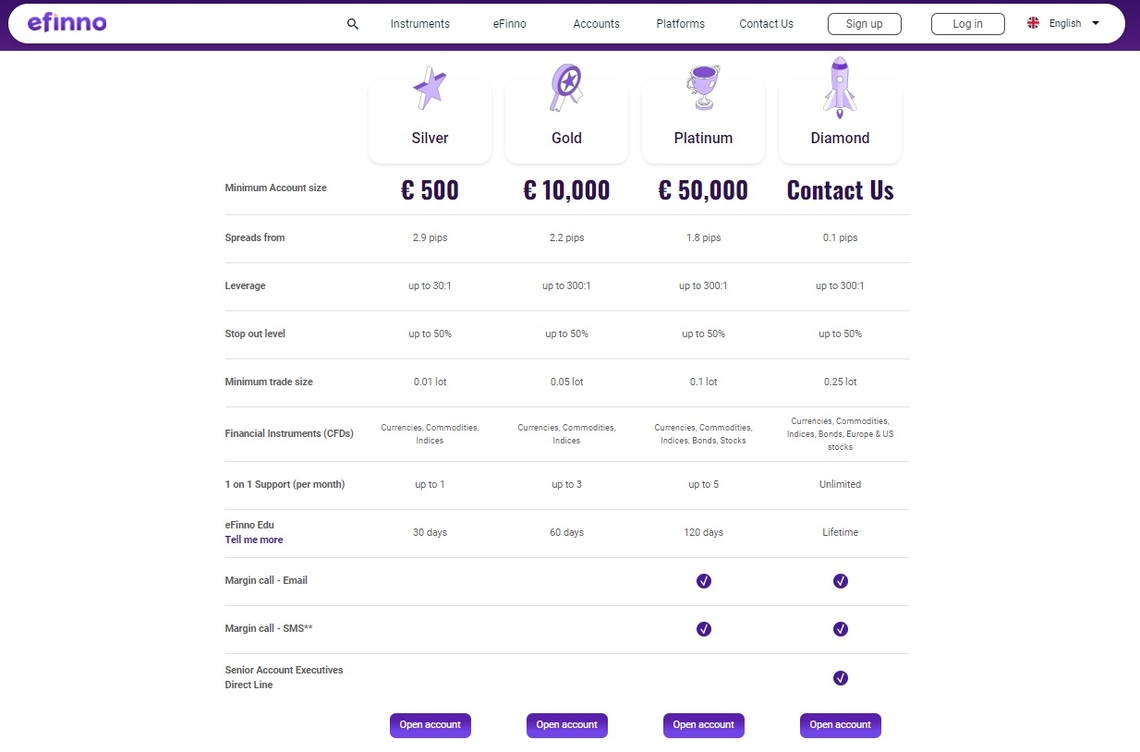

There are Silver, Gold, Platinum, and Diamond account types. Moving up the account level after transferring and depositing the required amount, you unlock new benefits and things. eFinno minimum deposit depends on the account type you choose.

- eFinno Silver – With a $500 minimum deposit, you may open an account with spreads starting at 2.9 pip, leverage up to 30:1, a minimum transaction size of 0.01 per lot, monthly one-on-one support, and 30 days of eFinno Education. It is possible to trade indexes, commodities, and currencies.

- eFinno Gold – With this account type, the spreads are improved, starting at 2.2 pip, with up to 300:1 leverage, a minimum transaction size of 0.05 lot, one-on-one support up to three times per month, and 60 days of eFinno Edu. Additionally, you can trade indexes, commodities, and currencies. $10,000 is the required minimum deposit.

- eFinno Platinum – With the eFinno platinum account, you may trade with spreads starting at 1.8 pip, 300:1 leverage, 0.1 lot minimum transaction size, 1 on 1 support up to 5 times per month, and 120 days of eFinno Edu for a minimum investment of $50,000. You can trade currencies, commodities, indices, bonds, and stocks.

- eFinno Diamond – The minimum deposit for their best-offered account type is not stated, however, you are recommended to contact eFinno for additional details. Commodities, indices, currencies, bonds, and equities from Europe and the US are all available for trading. The minimum trade size per lot is 0.25 and you have unlimited access to eFinno Edu. The spreads start at 0.1 pip. Additionally, you receive the senior account executive’s direct line.

All account types have a stop-out level of up to 50%. eFinno bonus is not provided with any of the account types.

After creating an account at the eFinno login page, you get access to eFinno mobile app and web-based platform. With the eFinno app, you can trade on the go, while their web-based platform offers you to trade from any device.

Is eFinno Safe To Trade With?

We were surprised that the eFinno demo account doesn’t exist. Providing a demo account is essential since no one should open an account and begin trading without first using the platform and checking the broker’s advantages.

Additionally, they are operating out of Israel, France, and the US where they are not subject to regulation. However, not all of eFinno’s flaws are evident. They provide a respectable trading platform, competitive spreads, account kinds with increasing perks as you level up, and some fee transparency.

Overall, we may claim that eFinno is a secure broker—for Cypriots, at least. If you’re looking for brokers in the US, France, Israel, or anywhere else in the world, eFinno might not be the best choice.

eFinno Review: Traders’ Thoughts and Opinions

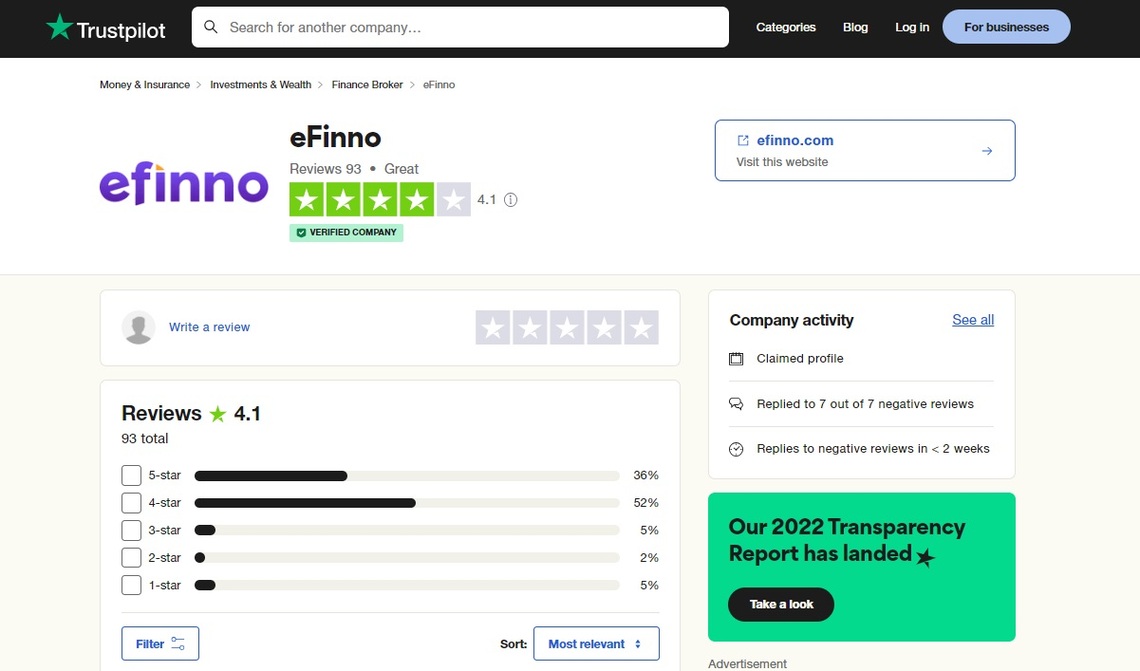

eFinno has 91 reviews in total, with 86% of them being favorable. Poor customer support, platform troubles, and even withdrawal issues were highlighted in 14% of the negative evaluations.

Trustpilot has given eFinno an overall rating of 4.1 stars, and there are enough reviews to allow you to see what other people have to say and come to your conclusion. Reviews are crucial so you may learn more about the broker before making an investment with them rather than just trading blindly with an unproven broker.

A Look at eFinno’s Traders They Serve

As always, we have done extensive research for this eFinno review to give you the most current knowledge about this broker. Although crucial, regulation is not everything, so picking a broker only based on that fact is not the best course of action. From our analysis, the broker’s traders come from:

- France

- United States

- Israel

It’s crucial to locate a broker who is licensed in your country. Without any obligation, get in touch with us immediately, and we’ll find a broker who perfectly suits your needs.

Deposits and Withdrawal Methods

Both deposits and withdrawals can be done through:

- Credit/Debit cards (Visa, MasterCard)

- Apple Pay

- Google Pay

Their trusted payment providers are Decta and Nuvei.

eFinno Trading Pros and Cons

| Pros | Cons |

|

|

Our Trading experts’ opinion of eFinno

The Cyprus Securities and Exchange Commission (CySEC) oversees eFinno’s regulation. Through this regulatory control, eFinno is made to follow the rules and regulations established by CySEC.

Low fees and reasonable spreads are provided by eFinno, which is advantageous for traders looking for cost-efficient trading circumstances. Additionally, the site charges little fees, enabling users to keep their trading expenses in check.

Additionally, the minimum deposit requirement is too big compared to other brokers. For their primary account type, they require $500, while for their Diamond account type, the deposit is not even specified. We can only assume it ranges from $100,000 – $200,000.

Overall, eFinno is safe to trade with for people living in Cyprus. Before engaging in trading operations with eFinno or any other broker, traders must evaluate their unique circumstances and regulatory preferences. Get in touch with us right away if you need trading guidance or suggestions for the top brokers available.

FAQ Section

CySEC, or the Cyprus Securities and Exchange Commission, oversees eFinno. CySEC is the regulatory body in charge of monitoring and controlling Cyprus's financial services industry.

eFinno offers a Silver, Gold, Platinum, and Diamond account type. With each you receive something new like lower spreads, trading options, and more.

The minimum balance required for eFinno is $500 for their Silver account, $10,000 for Gold, $50,000 for Platinum, and for their Diamond account type the minimum is not specified. Is eFinno Regulated?

What account types does eFinno offer?

What is the minimum balance for eFinno?