Eightcap Review: Learn More About Eightcap.Com

Trading online requires finding a reliable company. We explore the broker thoroughly in our full Eightcap review so you have all the information you need to make an investment decision.

Don’t forget to read our reviews of LegacyFX, Admiral Markets, and Blackwell Global. With us, you won’t stress about finding a reputable broker.

Who Is Eightcap Broker?

Since 2009, it has served as a broker company from its headquarters in The Rialto, South Tower, Level 35/525 Collins St, Melbourne VIC 3000 Australia, and it now has four more locations throughout the world:

- Cyprus 4, Petrou Tsirou Street 2nd Floor Limassol

- Bahamas – 208 Church Street, Sandyport Marina Nassau

- Bulgaria – 22 Sgrad San Stefano Str. Oborishte Distr., Fl. 6, Office 6 Sofia-grad 1504 Sofia

- United Kingdom – 40 Gracechurch Street EC3V 0BTE, London

For offering traders great services, platforms, tools, and various instruments, Eightcap has been named the greatest CFD Broker Australia 2022 by International Business Magazine. Other honors for their services include the Global Business Review’s Most Innovative Affiliate Program, AtoZ Markets’ Best Crypto Broker, and the International Business Magazine’s Annual Review Award.

| Eightcap | |

| Legal name: | Eightcap Global Limited ex CAPITAL SOLUTIONS LTD |

| Regulation: | Regulated by FCA (UK), CySEC (Cyprus), ASIC (Australia), SCB (The Bahamas) |

| Registered in: | The Rialto, South Tower, Level 35/525 Collins St, Melbourne VIC 3000 Australia |

| Established: | 2009 |

| Website: | www.eightcap.com |

| Financial Authorities Warnings: | None |

| Contacts: | Phone: +61 3 8592 2375

Email: [email protected] 24/5 Live Chat Support |

| If a withdrawal is possible: | Yes |

| Fees: | Spreads (minimum of 0.0 pips to 1.0 pips)

Commission ($7.00 per standard lot) Swap Rates |

| If Active on Social Media: | Yes |

| Investor Protection: | No |

Eightcap Security and Regulation

It doesn’t matter what advantages a broker offers or how enticing he may seem if he isn’t regulated. You are not protected, nor are your assets, if there are no regulations. Eightcap is subject to regulation by the respected local authorities in each of the mandatory legal systems where the broker conducts business through its four main entities:

- FCA (Financial Conduct Authority) UK, with the registered company number 12448314 and license number 921296

- CySEC (Cyprus Securities and Exchange Commission), license number 246/14

- ASIC (Australian Securities & Investments Commissions), license number 391441

- SCB (Securities Commission of the Bahamas – Offshore), license number 40377

Being regulated by several authorities offers security when trading. It’s one of many things to take into account before selecting a forex company to trade with.

Eightcap Broker Profile

According to all the information we have so far gathered for this Eightcap review, the broker is secure and regulated. Although it was governed by the offshore regulating firm SCB, it was also governed by top-tier regulatory organizations like ASIC. Additionally, the fact that it is regulated by numerous regulatory bodies offers some kind of investment safety.

| Trading platforms: | MetaTrader 4, MetaTrader 5, TradingView |

| Account types: | Standard, Raw |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:500 |

| Minimum Deposit: | $100 |

| Commissions/bonuses: | $7.00 per Round Lot/Partnership program for a passive income |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | MetaTrader Guides, Fundamentals, and Trading Strategies |

Eightcap Leverage

The Bahamas branch of Eightcap offers a maximum leverage of 1:500. For active traders, the leverage ratio can be beneficial because it increases their trading flexibility, which has an impact on profitability.

Due to regulations, the maximum leverage for Australia is set at 1:30. Negative balance protection from Eightcap is necessary for leveraged trading since it makes sure that investors cannot lose more money than they initially invested.

Eightcap Spreads

Spreads change depending on the type of account you select. You can trade Forex, Indices, and Crypto CFDs starting at 0.0 pips on the Eightcap Raw account. Share CFDs start at $0.02 per share, per side, whereas commodities start at $0.1.

In general, EightCap provides competitive spreads of 0.0 pips – 1.0 pips, depending on the account type you choose. Keep in mind that while selecting a broker, spreads are only one thing to consider. Regulation, trading platforms, client service, and general trading conditions are further crucial variables.

Eightcap Minimum Deposit

Eighcap requires a minimum deposit amount of $100, which is good for beginners that don’t want to deposit a lot of money straight away. This approach promotes diversity and ensures that traders of all skill levels may take advantage of the opportunities and services that Eightcap offers.

Individuals can start trading with a manageable amount thanks to this reasonable starting point. With an Eightcap funded account, traders can access the financial markets and execute trades using the deposited funds.

Eightcap Account Types

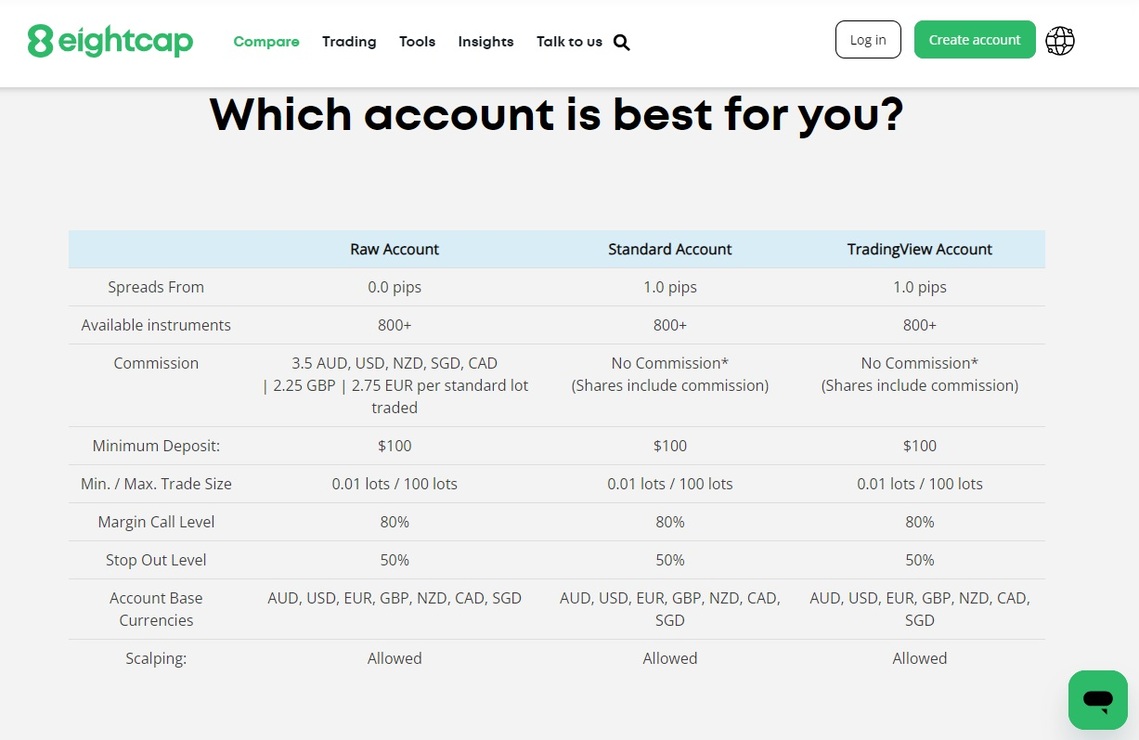

There are three types of accounts available:

- Standard Account

- Raw Account

- TradingView Account

The Raw account is ideal for more seasoned traders or those who primarily trade currency CFDs. With a minimum trade size of 0.01 (depending on the instrument), you can trade with spreads as low as 0.0 pips.

With the TradingView account, you will gain access to an advanced charting tool, automated trading using their own Pine-Script programming language, daily trade suggestions, webinars, customized indicators, and cheap spreads.

The Standard account is for you if you are a beginner or are still learning the ropes in trading. It offers the convenience of commission-free trading with spreads of as little as 1.0 pips. Depending on the instrument, a 0.01 minimum trade size is required.

The Standard and Raw accounts can use the Eightcap MT4 and Eightcap MT5, two of the best trading platforms, whereas the TradingView account uses the Eightcap TradingView platform. All three accounts have a minimum deposit requirement of $100.

Eightcap Commission

Online brokers like Eightcap have found that a lower total cost structure produces a more competitive trading environment. The commission-free trap, where trading fees are typically higher than commission-based options, is one that many retail traders fall into.

Depending on what account type you choose and what you trade with, spreads and commissions are trading on the Raw account for $7.00 commissions for $8.00 for each lot. Different trading conditions are available with the Standard account with no commission.

Eightcap Traders Reviews – Sharing Experiences

Before selecting a broker, research is crucial, but it’s common knowledge that few people do it. Because of this, many are content to read evaluations on TrustPilot before deciding whether or not to invest. Reviews matter a lot but they are not the only factor to consider when getting into the trading business.

With a total of 1368 reviews and a remarkable overall score of 4.3, Eightcap has received favorable feedback on Trustpilot. This suggests that clients who have used their trading services have a high level of satisfaction. The compliments represent the quality of their products and their customers’ faith.

While 80% of the ratings are from pleased investors, the negative reviews mainly focus on slippage, software issues, and spread manipulation. Tell us about your recent trading experiences.

How Eightcap Platform Reach Clients and Who Are They?

Reputable brokers don’t need to fabricate reviews or bother their potential clients all the time. Engaging in social media activity is one way to draw investors and more recommendations. Given their reputation, those businesses frequently receive referrals. By offering the leading trading platforms, MT4 and MT5, Eightcap Web Trader attracts investors and upholds safety.

These nations make up some of Eightcap’s clients:

- Thailand

- United States

- United Kingdom

Contact us right away if you want to locate a trustworthy broker and learn how to trade.

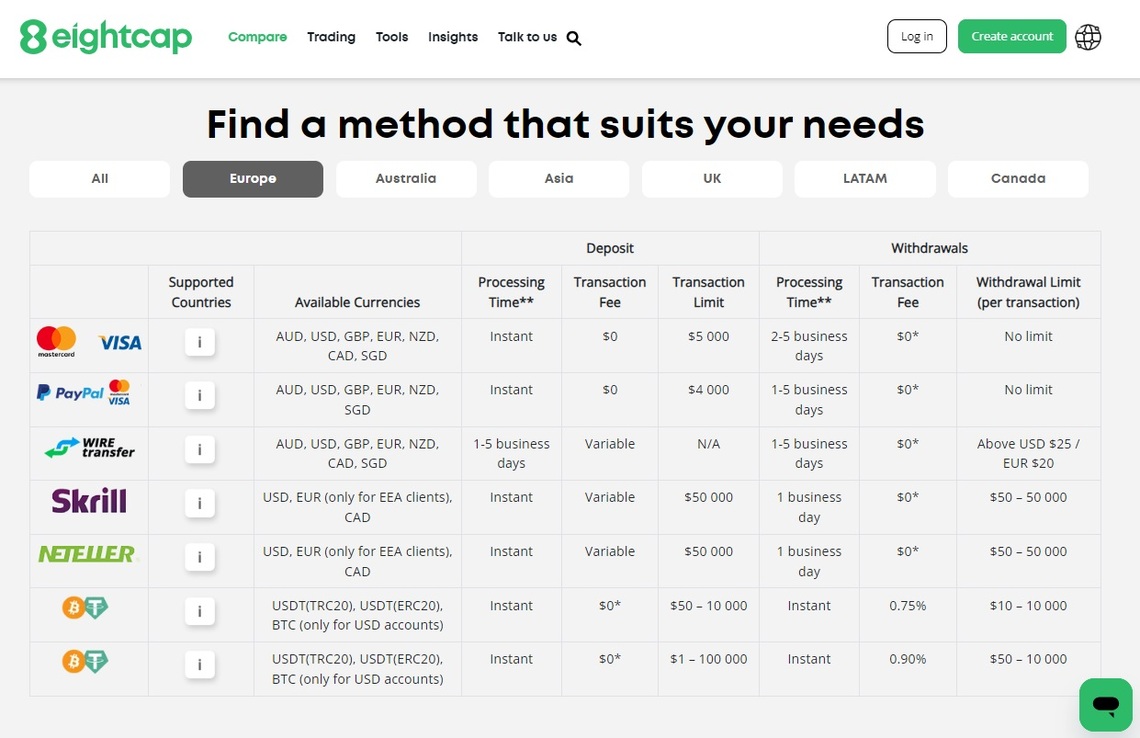

Eightcap Funding Methods

Eightcap provides a wide range of funding options. The most widely used credit and debit cards, bank wire transfers, and popular online payment platforms like Skrill. Other than what your bank may charge, there are no fees imposed by Eightcap.

That applies to both deposit and withdrawal options. A withdrawal is possible when completing the withdrawal form at Eightcap’s website.

Our Safe Trading experts’ opinion of Eightcap broker

Eightcap is known for delivering high-quality trading services. Their dependability is aided by their regulatory standing, competitive spreads, user-friendly platforms, outstanding client feedback, and multiple won awards. Investors can have faith that Eightcap will provide a reliable and safe trading environment.

If you are looking for a reputable broker to trade with, contact us today for a free consultation.

FAQ Section

Is Eightcap Regulated?

The examination we did for this Eightcap review has established that Eightcap's regulation is valid. ASIC (Australia) is among the most important and reliable regulators, followed by FCA (UK), CySEC (Cyprus), and the offshore regulator SCB (The Bahamas).

How To Make Money In Trading?

Create a trading plan, control risk, make use of analysis, test your techniques on a practice account, and adjust them as necessary. However, there are dangers involved in trading and no assurance of success. Contact us to schedule a free consultation if you're looking for a trustworthy broker.

How To Choose a Broker?

Regulation, trading platforms, asset selection, spreads and fees, deposit and withdrawal methods, educational resources, demo account, and reputation should all be taken into consideration when selecting a forex company. Call us right away for a free, no-obligation consultation.