Blackwell Global Review: Is BlackwellGlobal.com Reliable?

Our Blackwell Global review focuses on all the essential offers and trading circumstances this broker provides. The first thing to note is that Blackwell Global is an international brokerage company established in 2010 in the UK.

The firm has been regulated by several financial entities, among which is a top-tier regulator – FCA (UK). However, Blackwell Global also owns two other licenses from SFC (Hong Kong) and SCB (Bahamas).

Respectful of the legal framework and regulatory criteria, Blackwell Global is a regulated broker, safe for investments.

We urge you to take the time to read this detailed analysis of authorized brokers such as CommSec, Invast Global, and Robinhood.

Blackwell Global Pros and Cons

Blackwell Global brings the best trading platform of modern trading -MetaTrader 5. With fast execution speed and the latest features and options, traders can remain competent in all global markets. Trading costs are average. The ECN account offers spreads from 0.7 pips on EUR/USD while it goes up to 1.8 pips for other accounts.

Deposits and withdrawals and fast, safe, and without fees and additional charges. Several account types offer different investment possibilities, but trading is limited. Tradable assets are CFDs on Forex, CFDs on commodities, and CFDs on indices.

Educational material is not overly impressive either. In that sense, beginners at online trading could have a hard time without more detailed instructions and guides.

| Minimum Deposit: | $0 |

| Minimum Trade: | 0.01 lots |

| Maximum Leverage: | 1:200 |

| Spreads: | From 0.7 pips |

| Underlying Assets: | CFDs on Forex, CFDs on commodities, and CFDs on indices |

| Base Currencies: | SD, EUR, GBP, HKD, SGD, AUD |

| Demo Account | Available |

| Mobile App: | Available |

| MetaTrader 4: | No |

| Other trading platforms: | MetaTrader 5 |

| Social Trading: | Not available |

Is Blackwell Global Regulated? Security and Regulation

Without a doubt, FCA is a tier 1 regulatory institution of the United Kingdom. This licensing organization is overseeing over 50 000 businesses on UK soil. To keep the brokerage business legal and successful, rules ensure highest safety protocols apply.

FCA-regulated broker firms have to comply with a number of rules. Since keeping the investments safe is the priority, brokers form contracts with leading banks. These arrangements guarantee the safety of traders’ capital through segregated bank accounts.

The UK regulator in charge also forces every brokerage house to limit the leverage to 1:30 and enable negative balance protection to lower the risks of loss. The final standard of safety is compensational funds the broker plans for clients in case the firm goes bankrupt.

Additional rules apply and it’s all for the purpose of ensuring transparency of transactions and the highest safety standards for clients.

Additionally, to be able to provide services and products in other areas, Blackwell Global has acquired licenses from SFC and SCB.

What are Available Accounts at Blackwell Global?

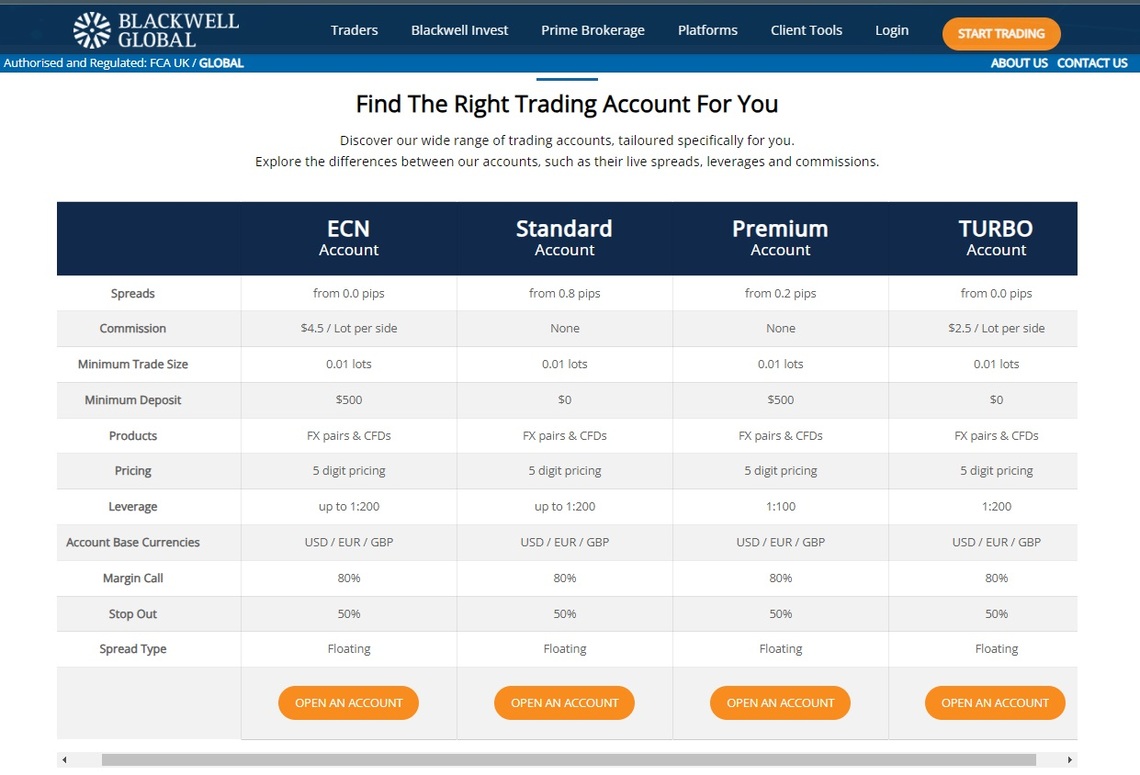

Tailored for every type of trader, investors can choose between several custom account types at Blackwell Global. The accounts differ in terms of spreads, commission, leverage and deposit:

- ECN Account – spreads from 0.0 pips, a commission of $4.5, min deposit of $500, leverage up to 1:200

- Standard Account – spreads from 0.8 pips, commission $0, leverage up to 1:200, min deposit $0

- Premium Account – spreads from 0.2 pips, min deposit $500, commission $0, leverage up to 1:100

- TurboAccount – spreads from 0.0 pips, commission $2.5, min deposit $0, leverage up to 1:200

Some common characteristics are present in all accounts. Products available for trading are FX pairs and CFDs. Several base currencies are the same for all accounts (USD, EUR, GBP). All spreads are floating.

Trading Instrument Available

Several asset groups are available for trading on Live or Demo accounts. The total number of trading instruments seems somewhat limited in comparison to other brokers of this level. Here are the available categories of instruments:

- CFDs on over 50 currency pairs with zero fees and tight spreads (EUR/USD, EUR/CHF, USD/CAD, USD/JPY, AUD/USD)

- CFDs on 10+ indices with $0 commission and 1:200 leverage (DE40, UK100, US100, US30, US500)

- CFDs on commodities with 1:200 leverage and low costs (oil and precious metals)

Trading Platforms Overview

Blackwell Global provides superior trading experience and a chance of achieving profitable trading results through the exceptional MetaTrader 5. Although a successor to the most popular world’s trading software – MT4, this terminal belongs to the next generation of trading software solutions.

Apart from offering the unique features cemented on the standard distribution of MT4, MetaTrader 5 has innovative and completely original features on the market. There is more than one benefit of trading on this superior terminal:

- Flexible trading – the dedicated app allows traders to access the market on the go

- Real-time charting – chart updates in real-time for the newest market data

- Live pricing – constantly updated prices for real-time trading

- Hedging – a good strategy to reduce the risks by hedging the trades

- EAs – automated trading robots (Expert Advisors)

Blackwell Global Funding Methods

Years of service and regulations are a warranty of Blackwell Global treating all investments in a safe and secure manner. All deposits and withdrawals are almost instant and fee-free, with no deposit requirements for Standard and Turbo accounts. Investments on ECN or Premium accounts have to start with at least $500.

Payment methods available for funding live trading accounts are:

- Credit & Debit cards (Visa and MasterCard in USD, EUR, and GBP with instant processing time)

- Bank Transfer ( USD, EUR, GBP, HKD, SGD, AUD with processing time between 1 and 5 business days)

- Skrill (USD, EUR, GBP with instant funding)

- Neteller (USD, EUR, GBP, HKD, SGD, AUD approximate processing time is immediate)

Although Blackwell Global does not charge deposit processing, be aware that fees may incur depending on your bank. The broker does not accept responsibilities for fees unaffiliated with their side.

Research and Education Offered

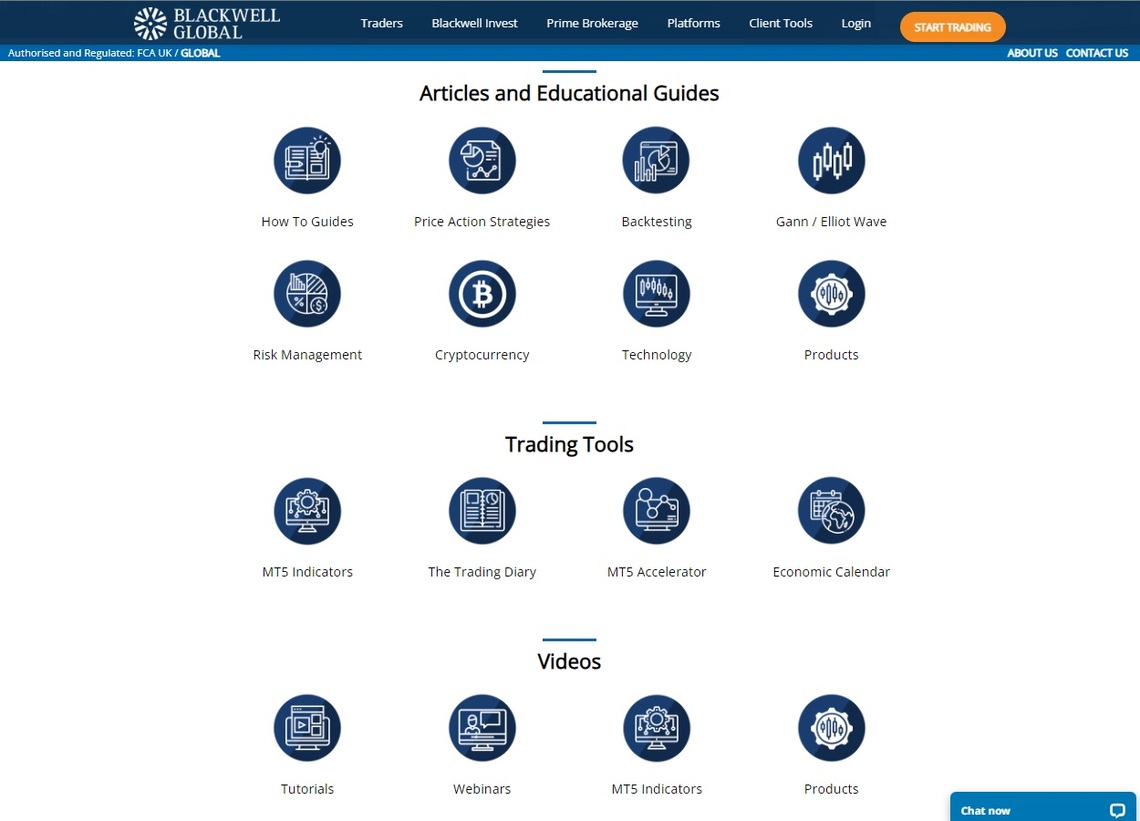

Blackwell Global offers free learning material to help you develop your trading skills faster and more efficiently. For that purpose, several educational resources exist:

- Articles and Educational Guides

- Trading Tools

- Videos

Textual articles cover some important steps of starting your trading journey. For example, there are How To guides to teach you how to analyze and backtest a trading strategy and how to reverse engineer trading strategies. Other written lessons help you get more familiar with risk management, crypto, technology, and products.

The Trading Tools section explains in detail all the advanced features and add-ons that come with MT5 and how to use them to your advantage. Here you can read about MT5 Indicators, the Trading Diary, MT5 Accelerator, and Economic Calendar.

Video tutorials cover the aforementioned subjects. Traders have the possibility of accessing Webinars for free or re-watching them in the form of recorded video clips.

Customer Service

Getting in touch with customer service at Blackwell is relatively fast and efficient. The website offers several ways of contacting the staff responsible for handling the investors’ inquiries for help. A dedicated team of experts responds in a timely fashion and is at your service for any kind of issue. Communicating with the support department is possible via

- Live chat – direct messages on the site for instantaneous responses

- Callback – a call from support arranged for a particular time

- Email at [email protected]

- Online fill-in form for requesting help in solving issues

Overall Summary

Investing in Blackwell Global is a good idea if you’re a trader looking for good pricing and fast executions. We do recommend you to reconsider choosing this broker if you’re not an experienced trader. Limited educational resources and 24/5 customer support might not be entirely up to the task in the eyes of a beginner.

However, professional traders can enjoy profitable trading conditions, top-notch trading platforms, and well-designed trading accounts.

As a regulated broker, Blackwell Global is safe for investments. FCA makes sure of this by constant supervision of brokerage activity so that no illegal action is performed. Clients at Blackwell Global can trade safely, knowing their funds are kept in segregated accounts and that all transactions are legal.

FAQs About Blackwell Global Broker

Is the Blackwell Global a Reliable Broker?

Yes, Blackwell Global is a reliable and trustworthy international brokerage house with several licenses.

How Long Does a Blackwell Global Withdrawal Take?

Depending on the funding methods, withdrawals can be either instant or take only several days to process if done via bank wire transfer.

What Account Types are Available at Blackwell Global?

Several accounts with different spreads and commissions are available: ECN, Standard, Turbo, and Premium accounts. Other account options are Demo and Islamic accounts.

What Trading Platform Does Blackwell Global Use?

Blackwell Global uses the most advanced and popular trading platform of today – Metatrader 5.

Does Blackwell Global Offer a Mobile Application?

Yes, a dedicated MT5 mobile platform is available for trading on the go.