What is FXTM All About? Learn More About This Broker

FXTM Global, or Forextime, is an online financial trading company with a seat in Limassol, Cyprus. It has been in business for over ten years.

Lasting so long in this challenging industry speaks for itself, confirming company legitimacy. Forextime has a global footprint in emerging and frontier markets and licenses from Cyprus, South Africa, the UK, and Mauritius.

Undoubtedly, making it an innocuous choice for investors looking for a trustworthy brokerage. From the moment of accessing the FXTM legitimate-looking webpage, it becomes apparent that it is not just an anonymous forex provider.

Customers can easily find all relevant information about the company. A transparent business inspires trust, prompting customers to trade on FXTM internet-based trading platforms.

Nevertheless, it would be best if you knew of risks arising from unlicensed forex trading. Regardless if it is about an authorized/unauthorized broker, your invested money is always at stake. Hence, be careful about easy earnings and stay away from the unlicensed brokerage.

We urge you to take the time to read this detailed analysis of authorized brokers such as FP Markets, Pepperstone, and Plus500.

Pros and Cons of FXTM

When assessing FXTM trading, the number of advantages surpasses the disadvantages. The most noticeable ins and outs are outlined in the table below.

| Pros | Cons |

| Reliable provider regulated by several financial authorities | Limited offerings of tradable assets |

| Expeditious customer support | Non-trading & withdrawal fees |

| Fast and easy account opening | High CFD fees |

| Lots of educational materials | |

| Low deposit requirements | |

| Excellent web and mobile trading platforms | |

| Low trading & forex fees | |

| High leverage |

FXTM Quick Overview

| Headquarters | Cyprus |

| Regulated | CySEC, FCA, FSC Mauritius, FSCA |

| Year Established | 2011 |

| Education Type | ECN/STP, Market Maker |

| Minimum Deposit | $10 |

| Trading Platform (s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

| Signals | Yes |

| US Clients Accepted? | No |

| Islamic Account | Yes |

| Segregated Account | Yes |

| Managed Accounts | Yes |

| Support Hours | 24/5 |

| Customer Support | Email, Messages |

| Demo Account | Yes |

Regulation and Security of FXTM: Are They Regulated Brokers?

In terms of regulation, FXTM broker is safe since it is regulated in several jurisdictions, including a top-tier monetary authority, the British FCA (Financial Conduct Authority).

Tier two financial market regulators are CySEC (Cyprus Securities and Exchange Commission), FSC (Financial Services Commission of the Republic of Mauritius), and FSCA (Financial Sector Conduct Authority of South Africa).

Unlike a non-registered foreign organization, FXTM’s licenses are easily verifiable (summarized in the table below), indicating that your equity is protected with this trading firm.

Speaking of protection, FXTM offers segregated accounts to its customers, safeguarding clients’ funds by segregating them in first-class banks. In this case, a bank covers a debt if the broker busts. So, your money is entirely safe with FXTM.

| Country | Financial market regulator | License number |

| Mauritius | Financial Services Commission | C113012295 |

| United Kingdom | Financial Conduct Authority | 777911 |

| Cyprus | Cyprus Securities and Exchange Commission | 185/12 |

| South Africa | Financial Sector Conduct Authority | 46614 |

What is the Available Account at FTXM?

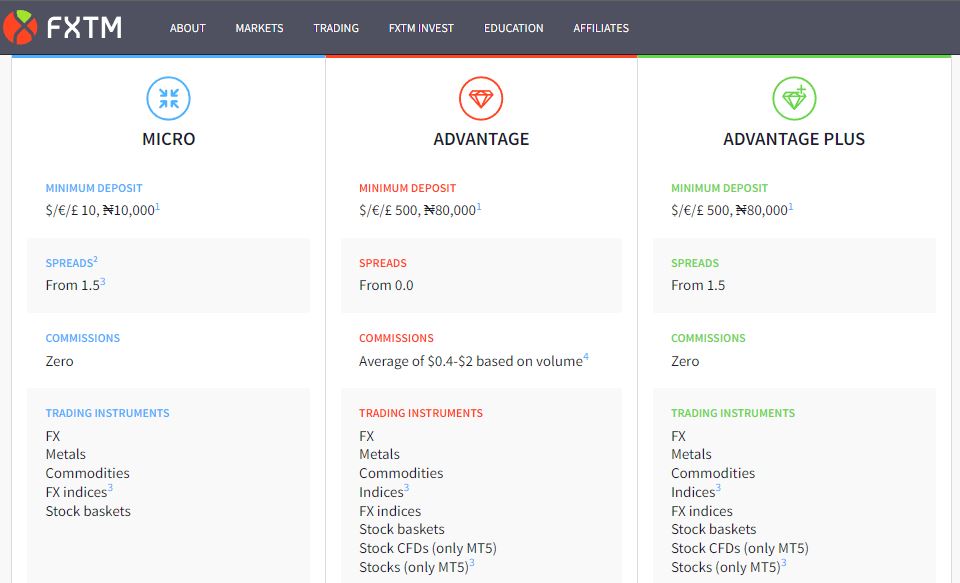

As for trading on FTXM, three accounts are on offer, catering to every trading experience level.

- Micro Account: minimum opening balance $10 or currency equivalent/no commission

- Advantage Account: minimum opening balance $500/no commission

- Advantage Plus Account: minimum opening balance $500/commission-based

A micro account requires one of the lowest deposits in the industry, allowing you to test this multi-asset broker without serious risk; you can always count on live customer support to help you with your trading experience.

In light of this, an unscrupulous broker charges three times more for basic accounts and doesn’t offer assistance.

On the negative side, FXTM charges inactivity fees. Although these fees are relatively low ($5 per month after six months of non-trading), customers should plan and organize their trading to avoid unnecessary penalties.

Demo Account

A demo account is enabled at FXTM and comes without a time limit. Users can experience actual trading, develop and assess trading strategies, and get hands-on experience with trading platforms.

Demo account holders can practice on MT4 and MT5 platforms with an option of selecting balance and leverage. Additionally, dedicated help is always available on demand.

Pro Account

The Pro account is designed for professional traders and offshore investment funds. It has no limitations on trading strategies, deposits, or open positions; the lowest deal is 0.01 lots per trade, while the maximum is 250 lots per trade.

For opening such an account, a customer must make a $25,000 down payment or currency equivalent. Pro account benefits are embodied in zero spreads, meaning there is no difference in pips between the bidding and asking price.

Trading Platforms at FXTM – Overview of Trading Platforms

Broker enables clients to trade on modern web trading platforms, MetaTrader4 (MT4) and MetaTrader5 (MT5). FXTM trader a proprietary mobile trading app created by FXTM is also available for smartphone users.

FXTM surpasses competitors by offering an upgraded version of the MT4 browser-based platform with live updates and comments from the FXTM tutors. The user-friendly interface of the FXTM trader app makes trading easier for every user.

FXTM customers can access proven trading instruments, including FX, stocks, commodities, indices, and share baskets. Yet, it misses ETFs, mutual funds, bonds, options, and futures, which are all provided by competitors. Hence, this is something an FXTM team should consider improving in the future.

Research and Education Provided at FTXM

Novice traders will find the FXTM education section very helpful since many training tools are available, ranging from a demo account, trading platform tutorial, and educational articles and videos to a forex dictionary with the definition of trading terminology.

Besides, the FXTM team publishes news daily on important industry topics and events, producing revealing and valuable insights into business trends.

Website users will find free trading tools practical, such as live rates, economic calendar, market analysis, trading signals, and pip calculator, enabling them to manage risks and understand markets.

Customer Support Available at FTXM

Concerning customer service, FXTM renders second-to-none client service comprising 24/5 multilingual customer support via online live chat, phone, emails, and messenger apps.

FXTM has regional centers in Indonesia, Malaysia, Thailand, China, Africa, and Europe, affirming it as a genuine global brokerage.

FTXM Offers Bonuses and Promotions

Regarding bonuses and promotions, FXTM is compelling and competitive, offering a refer-a-friend promotion and giving you and your referral $50 each.

At the time of writing this article, FXTM provides a 30% welcome bonus for each trading deposit customers make until the end of the year.

One must complete a minimum of $100 down payment to qualify, and the good thing is that the number of deposits is unlimited during the campaign.

Additionally, you should meet the regulation requirements to partake and claim the prize. Note that bonuses are not allowed within the EU. Hence only customers located in other countries are eligible.

What is The Minimum Deposit at FXTM?

The best part of using FXTM for online trading is that the company offers one of the lowest minimum deposits and covers all involved costs. The minimal down payment required is $10 for the Micro account.

Although the initial balance for the advantage and advantage plus accounts are higher, $500 each, each comes with many worthwhile features.

Deposits and Withdrawals Methods

In respect of finance mechanisms, FXTM offers a wide range of deposit and withdrawal options. The former may vary from country to country.

Four currencies are available: EUR, GBP, USD, and NGN (the Nigerian Naira is only for Nigerians).

After depositing money, funds become available in your account within two hours, allowing you to start trading as soon as possible. It is also good that FXTM sets no deposit fees. Funding methods are credit/debit cards, bank transfers, and E-wallets.

The latter’s availability depends on your country of residence (check the table below). Additionally, the time frame for deposits differs; e.g., bank wire transfers can take several business days while credit/debit card transfers are instantaneous (up to two hours).

Make sure to deposit money from a bank account in your name; otherwise, it won’t be accepted.

| Deposit method | EU | UK | Non-EU |

| Neteller, Skrill | Yes | Yes | Yes |

| Bitcoin | Yes (through Skrill) | No | Yes |

| Crypto (BTC only) | No | No | Yes |

| Yandex. Money, Qiwi | No | No | Yes |

| VLOAD, WebMoney, Perfectmoney, Fasapay, TC Payment, GlobePay, Nganluong | No | No | Yes |

| Algerian / Afghani / African Local Solutions (D) / Bangladeshi / Egypt / Ghanan / Indian / Indonesian / Iraq / Latin American local transfer / Malaysian / Nigerian bank wire / Pakistani / Palestinian / South Arabian Peninsula / Sub-Saharan Africa and Dubai / Turkish Local Transfer | No | No | Yes |

| Online Banking Malaysia / Indonesia / Vietnam / Thailand | No | No | Yes |

The downside of Forextime is that the company charges when clients withdraw funds. However, fees are still considered low compared to others. Customers can take out money the same way as they deposit it, which complies with anti-money laundering laws.

Thus, withdrawal options are bank transfers, credit/debit cards, and electronic wallets, excluding Alfa-Click, Western Union Quick Pay, and Dotpay.

To prevent withdrawal issues, a client must understand the standard processing time for a withdrawal request, which is 24 working hours.

So, after one business day, your funds will be released from FXTM. Since FXTM is very pedantic in its work and adheres to a strict code of conduct to avoid scam allegations, the requested withdrawal can be delayed if proper documentation for verification is missing, ensuring the security of clients’ funds.

FXTM Summary

Is FXTM legit? Our FXTM trading review finds it is. It is a bona fide, reputable Cyprus-based broker.

There are countless reasons for selecting FXTM—you will appreciate FXTM’s transparency, outstanding customer support, a broad range of learning tools, and up-to-date trading platforms.

In conclusion, the company provides traders with all they need for trading with peace of mind.

FAQs About FXTM Broker

How Do I Open an FXTM Account?

Opening an account with FXTM is straightforward and quick since the entire process is digital, and you can start trading from your account in no more than two business days.

How Much Does FXTM Charge per Trade?

FXTM is known for low trade expenses. So, FXTM trading either doesn’t charge or levies lower fees than the competition.

Does FXTM Charge for Withdrawal?

Like its competitors, FXTM charges for withdrawal; on average, it is $3 for bank transfers and is correlated with the transfer size.