Plus500 Review – Who is Behind Plus500 Broker?

Plus500 is an online CFD broker that was founded in 2008 in Israel. Now, this broker provides its services to clients globally, as they are licensed and regulated in multiple countries.

Several of the regulatory bodies providing oversight for the Plus500 broker are considered tier-one regulators.

Another good sign in favor of Plus500 is the fact that they are listed on the London Stock Exchange, further proving its legitimacy.

Finally, the broker publicly releases all of their financials, providing clients with an astounding level of transparency.

It is worth keeping in mind that a broker that intends to scam its clients tends to make their information very difficult to find but with one glance at the “About Us” section on the website of Plus500 clients are greeted with a link that shows all of the necessary information about this broker, such as where and by who they are licensed, their address and other crucial pieces of information.

Please take the time to read this thorough analysis of authorized brokers such as XM Broker, Robinhood, and Oanda.

Plus500 Pros and Cons

Every broker, no matter how legitimate, has a list of pros and cons attached to them based on the choices that they make as an entity.

Sometimes it comes down to the trading platform that they provide, other times it’s something as fundamental as who they are licensed by.

All of the information about Plus500 that you could need in terms of pros and cons can be found in the table below.

| Pros | Cons |

| Regulated by several tier-one agencies (FCA, ASIC, CySEC) | Difficult to find educational tools |

| Offers negative account balance protection | High Forex CFD fees |

| Offers commission-free trading for all accounts | Low customizability of proprietary trade platform |

| Intuitive to use platform | |

| Quality customer support is provided 24/7 | |

| No deposit/ withdrawal fees |

Plus500 Quick Overview

This broker is legitimate and has tier-one regulations as well as suitable trading conditions. In the table below readers can find a quick overview of the Plus500 broker:

| Broker Name | Plus500 |

| Establishment Date | 2008 |

| Website | Plus500.Com |

| Address | Cyprus: 169-171 Arch. Makarios III Avenue, Cedars Oasis Tower, Floor 1, 3027, Limassol, Cyprus.UK: Plus500UK Ltd, 8 Angel Court, Copthall Avenue, London EC2R 7HJ |

| Minimum Deposit | 100 GBP |

| Maximum Leverage | 1:30 |

| Regulation | CySEC, ASIC, FCA, MAS, FSA Seychelles |

| Trading Platforms | Plus500 Trader for PC, Mac, Web, Android, & iOS |

Is Plus500 Safe for Traders? – Regulation and Securities

A quick review of Plus500’s website will lead clients to the About Us section where, if they click on the company information link, they will be led to a document featuring all of the important information about the company.

If clients are wary about following external links, simply scrolling to the bottom of the page, they can see that Plus500 is regulated by five regulators, several of which belong in the tier one category like FCA and ASIC.

- UK– Financial Conduct Authority (FCA)

- Cyprus– Cyprus Securities and Exchange Commission (CySEC)

- Australia– Australian Securities and Investment Commission (ASIC)

- Singapore– Monetary Authority of Singapore (MAS)

- South Africa– Financial Sector Conduct Authority of South Africa (FSCA)

When choosing a broker, traders must be aware of the regulatory bodies that license the brokers they are looking at because it is these agencies that protect the traders’ rights and interests.

All in all, considering the regulatory bodies at play, Plus500 is safe to invest with. Clients should just make sure that they are under the jurisdiction of a tier-one regulatory body.

Plus500 Account Types

This broker offers two basic accounts, “Retail Account” and “Professional Account,” as well as two special use accounts under the names “Islamic Account” and “Premium Account”. Below you will find a breakdown of the different account types on offer from Plus500:

Retail Account:

- Fees – This account type has no deposit or withdrawal fees. There is, however, an inactivity fee of 10 pounds if you do not log in during a period of 90 days. Swap fees also apply for holding a position overnight

- Leverage – The maximum leverage this account type allows is 1:30

- Minimum deposit – The minimum deposit for this account type is 100 GBP

- Spreads start from 0.6 pips

This is the default account type that clients receive when signing up with Plus500. It is possible for clients to upgrade to the “Professional Account,” however, they have to meet the standards listed under the “Professional Account” below.

Professional Account:

- Fees – This account type has no deposit or withdrawal fees. There is an inactivity fee of 10 pounds if you do not log in for a period of 90 days. Swap fees also apply for holding a position overnight

- Minimum deposit – Instead of a minimum deposit, this account type requires clients to have a portfolio that holds 500 000 euros or more.

- Clients are also required to have 1-year experience in the financial sector in order to be eligible for this account type

- Spreads start from 0.6 pips

Islamic Account:

- This account type is in compliance with Sharia law and does not affect the leverage of Retail or Professional accounts. However, the overnight funding fees are waived

Premium Account:

- If a user becomes eligible for a “Premium Account,” they will be notified by email and they can choose to reject or accept the offer of upgrading

- This account type comes with an account manager and priority support

Plus500 Overall Fees

This broker uses a system for fees that charge users based on swaps, trades, and inactivity. Below is a breakdown of the different types of fees charged by the broker.

Trading Fees

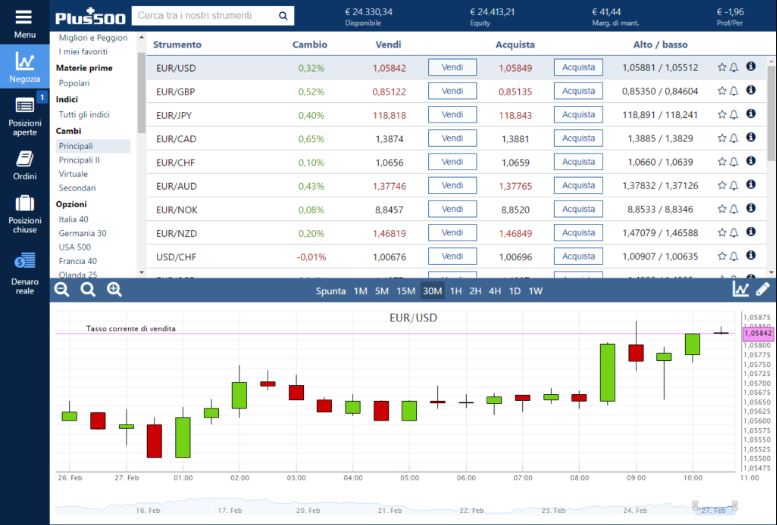

The trading fees charged by this broker are centered around the spread of currency pairs that clients can trade.

Spreads

The fees that are charged by this broker are spread fees on trades. This is the difference between the ask and bid prices in financial instruments. Spreads with this broker start from 0.6 pips. Below is a breakdown of different spreads:

- EUR/USD 0.8 pips

- EUR/GBP 1.5 pips

- GBP/USD 1.3 pips

Commission Fees

Plus500 charges 0 commission fees across all of the above-mentioned account types, meaning clients can trade while enjoying no commission payments for trades.

Swap Fees

This broker charges a swap fee that is automatically deducted from the client’s account for holding a position overnight. The broker waived the fee for the “Islamic Account” type.

Currency Conversion Fees

The currency conversion fee is also automatically added to the profit or loss of an open position.

Non-Trading Fees

Here’s a list of non-trading fees Plus500 charges.

Deposit and Withdrawal Fees:

This broker does not charge its clients any deposit or withdrawal fees. Clients can enjoy withdrawing and depositing funds without fear of being overrun with pending fees due to these actions.

Account Inactivity Charges:

Plus500 does charge an inactivity fee of 10 GBP for every month the client does not log into their account after a period of 90 days. This fee, however, does not apply if the client does not have funds in their account.

Plus500 Deposits & Withdrawals

Clients of this broker can deposit and withdraw their funds via the following safe methods:

- Credit Card (Visa, MasterCard)

- Apple Pay

- PayPal

- Trustly

- Skrill

- Wire Transfer

What is Plus500 Minimum Deposit?

The minimum deposit required by this broker to open the base account is 100 pounds. Clients also have the option of depositing their funds via wire transfer although this does increase the minimum amount to 500 pounds.

What is Plus500 Minimum Withdrawal?

The withdrawal system is a little more complicated as different withdrawal methods have different minimums that clients are able to withdraw:

- Credit card, bank transfer, and Skrill – minimum withdrawal of 80 pounds

- PayPal and Apple Pay – minimum withdrawal of 40 pounds

- Trustly – has the highest minimum withdrawal of 100 pounds

Plus500 Trading Platforms Available

The trading platform provided owned by Plus500 Ltd., the parent company of the Plus500 broker entities. This proprietary platform does not integrate with the industry standard MetaTrader.

This is a drawback as the MetaTrader4 and MT5 platforms offer clients a high degree of customization that just is not present with the proprietary trading platform.

The platform provided has an accompanying WebTrader and mobile apps for Android and IOS, however, all three are lacking in the industry standard options and tools afforded by MT4-5.

Available Customer Support at Plus500

The reviews of the Plus500 broker are overwhelmingly positive and never fail to mention the high quality of customer support that this broker provides. Clients of Plus500 can reach the customer support agents through the following channels:

- Live Chat- a customer support agent answered our question in under a minute.

- Email- the wait time for an answer was approximately 30 minutes.

- Phone support- This broker does not provide phone support, however, they do have a company WhatsApp number that has similar functionality to that of the live chat option

It is clear that this broker puts effort into making sure that their customer support agents are available to their clients and answer their questions in a reasonable timeframe. A minor improvement could be made to their customer care system by adding telephone support.

Plus500 Research and Education

This broker provides a wealth of educational material for their clients in the forms of:

- Demo account

- Educational videos

- Economic calendar

- Ebook

The demo account alone will be extremely useful for clients. Even those who are seasoned traders could benefit from trying out the free demo account as this broker uses a proprietary trading platform that might not fit your needs as a trader.

The educational videos could prove to be a useful refresher to experienced traders, and a great introduction to those new to this world.

The economic calendar is an interesting way for clients to keep up to date with all of the crucial events that could affect their currency pairs of choice.

Finally, the ebook is a useful guide for those who are just entering the investment world.

Plus500 Summary

Overall, is Plus500 a good broker? The answer is mainly yes. There are a few drawbacks, like the proprietary trading platform and the high forex CFD fees, but overall there are plenty of positives that make up for these.

Broker is a licensed and regulated tier-one regulatory body and in full compliance with the rules set by these agencies. The Broker does not take deposit or withdrawal fees.

This broker also provides a wealth of educational tools for their clients even though it is not exactly easy to find the quality that makes up for it.

Finally, this broker also has fantastic customer service that could only be improved slightly by adding a telephone option other than WhatsApp messaging. In conclusion, Plus500 is a quality broker with some room for improvement.

FAQs About Plus500 Broker

How to Open Your Account at Plus500?

Opening a Plus500 account takes about a day with the processing time, and can be done fully online.

What are Plus500 Fees?

The type of fees clients pay is dependent on the account type they select, the broker does not charge deposit or withdrawal fees.

What Is The Minimum Deposit at Plus500?

If your deposit is via Credit Card, PayPal, Skrill, Trustly, or Apple Pay, the minimum is 100 pounds. If the deposit is via wire transfer the minimum deposit is 500 pounds.