One Financial Markets Review: Pros, Cons, and Everything in Between

Nothing makes us happier than regulated brokers, and we wish they were all regulated, transparent, and simple to use. However, possibilities are not the same as wishes. Fortunately, this One Financial Markets review focuses on their advantages and disadvantages, a detailed analysis of the broker’s profile, traders’ perspectives, and more.

If One Financial Markets doesn’t meet your trading needs, you can find alternative options by reading our assessments of TradeMarkets and Oanda.

Who Is One Financial Markets? All About onefinancialmarkets com

Axi Financial Services (UK) Ltd., a business registered in England with company number 6050593, trades under the name One Financial Markets. Their registered office is located at 1 Finsbury Market, London, United Kingdom, EC2A 2BN.

| One Financial Markets | Reliable Broker Must Have | |

| Legal name: | Axi Financial Services (UK) Ltd | Transparently displayed in the disclaimer or legal documents |

| Regulation: | Regulated by FCA | Within your legal jurisdiction – local regulator |

| Registered at: | 1 Finsbury Market London EC2A 2BN, United Kingdom | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2007 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | www.onefinancialmarkets.com | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | None | None |

| Contacts: | Web Form

Tel: + 44 203 544 9646 Fax: + 44 203 857 2001 Whatsapp: +61 448088246 +971 44 222 888 |

Phone, email, social media, web form |

| Is a withdrawal possible: | Yes | Yes |

| Fees: |

|

Transparent fees – list of spread and commissions |

| If Active on Social Media: | Yes | Often present on social media |

| Investor Protection: | FSCS | Compensation fund |

One Financial Markets MT4 and MT5 Trading Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two well-liked and often-used trading platforms that One Financial Markets makes available to its customers. These platforms are made for online trading in a range of financial markets, including indices, cryptocurrencies, commodities, and foreign exchange.

Due to their intuitive user interfaces, sophisticated charting tools, and extensive developer community that contributes custom indicators and expert advisors, both MT4 and MT5 are well-valued among traders. They provide a thorough trading experience for numerous financial markets and are appropriate for traders of all skill levels, from amateurs to seasoned pros.

One Financial Markets Regulation Info

The Financial Conduct Authority (FCA) in the UK, the Financial Services Commission (FSC) in the British Virgin Islands, and the Financial Sector Conduct Authority (FSCA) in South Africa are just a few of the financial organizations that oversee the broker. For traders, this regulation contributes to a sense of security and trust.

It is crucial to remember that the broker is not authorized to conduct business in nations like the United Arab Emirates, Oman, Kuwait, Pakistan, or Bahrain. Each nation has its own set of rules and specifications for those who provide financial services.

Brokers typically need to receive particular licenses or approvals from the relevant regulatory authorities in these nations to operate there. For instance, in the United Arab Emirates, brokers are subject to licensing and regulation by the Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FSRA) or the Dubai Financial Services Authority (DFSA).

Brokers in Kuwait must receive approval from the Capital Markets Authority (CMA) and Pakistan has its own regulating body called the Securities and Exchange Commission of Pakistan (SECP).

One Financial Markets Broker Profile

With trading platforms including MetaTrader 4 and 5 and One Core Trader, One Financial Markets provides competitive pricing, small spreads, and quick execution times for a variety of financial products.

| Trading platforms: | MT4 and MT5 |

| Account types: | Standard, Professional |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:400 |

| Minimum Deposit: | $50 – $250 |

| Commissions/bonuses: | No commission on Standard accounts |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Trading Glossary, Trading Seminars, Economic Calendar |

One Financial Markets Demo Account

One Financial Markets provides a thorough demo account that enables traders to hone their trading abilities in a risk-free setting. With a big virtual sum of $10,000 at your disposal, you may practice trading without taking any risks by immersing yourself in genuine market conditions and testing different trading techniques. This demo account offers the ideal setting for developing your trading tactics and gaining confidence, whether you’re new to trading or looking to hone your skills.

You have the freedom to practice trading from anywhere, at any time, thanks to the demo account’s availability online and through their user-friendly mobile apps. One Financial Markets’ demo account offers traders a useful learning tool to improve their trading prowess before entering live markets. More information about the demo account can be found on the One Financial Markets login page.

Is One Financial Markets Safe To Trade With?

Because OneFinancialMarkets is governed by recognized agencies like the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in the British Virgin Islands, it is regarded as safe to trade with them. To promote transparency and customer protection, these regulatory organizations apply stringent rules. OneFinancialMarkets has also been in business since 2007, building a solid track record and reputation in the sector.

However, it’s crucial to remember that there are risks associated with trading on the financial markets, and neither a broker nor an investment can be guaranteed to be risk-free. It is always advisable to thoroughly assess your risk tolerance, do in-depth research, and get in touch with a professional for more information before opening an account or beginning any trading activities. You can contact us for help of any type, and the greatest thing is that there is no obligation.

A Look at One Financial Markets’ Traders They Serve

One Financial Markets provides services to a wide variety of traders from different nations, including both individuals and institutions. Nations the broker draws clients from are:

- United Arab Emirates

- Oman

- Kuwait

- Pakistan

- Bahrain

OneFinancialMarkets is regulated by the FCA, which means UK residents are protected, but others are not, so traders are advised to act with caution. When trading, it’s crucial to use licensed brokers to protect the security of your money. For a free consultation if you are unsure about a broker or need trading advice, get in touch with us.

Deposits and Withdrawal Methods

Payment methods available at One Financial Markets include:

- Credit cards

- Bank wire

- Maestro

- Safe charge

- Solo

- Switch

- Laser

- Fasa pay and Union pay

- Neteller

- Skill

The fact that the withdrawal process is not fully detailed raised some questions, but it’s also possible that it’s simple and doesn’t require a lengthy explanation.

One Financial Markets Pros and Cons

| Pros | Cons |

|

|

Insights from Our Trading Experts

The Financial Conduct Authority (FCA) in the UK, the Financial Services Commission (FSC) in the British Virgin Islands, and the Financial Sector Conduct Authority (FSCA) in South Africa are just a few of the recognized financial regulators who oversee One Financial Markets. To guarantee that financial service providers operate fairly and openly, these regulatory agencies implement tough rules and regulations.

One Financial Markets has also been in business since 2007, which shows that it has a long history in the sector. They have provided services to a variety of clientele over the years and have built a solid reputation as a reliable brokerage organization.

Overall, OneFinancialMarkets is safe to trade with, however, other brokers are better. Enhance your trading experience or seek expert advice today – Contact us now for a no-obligation consultation and take your trading journey to the next level.

FAQ Section

Is One Financial Markets Legit?

Yes, One Financial Markets is a part of Axi Financial Services (UK) Ltd, a reputable brokerage company. By being regulated, transparent, and adhering to rules, the broker is deemed legit and safe to trade with.

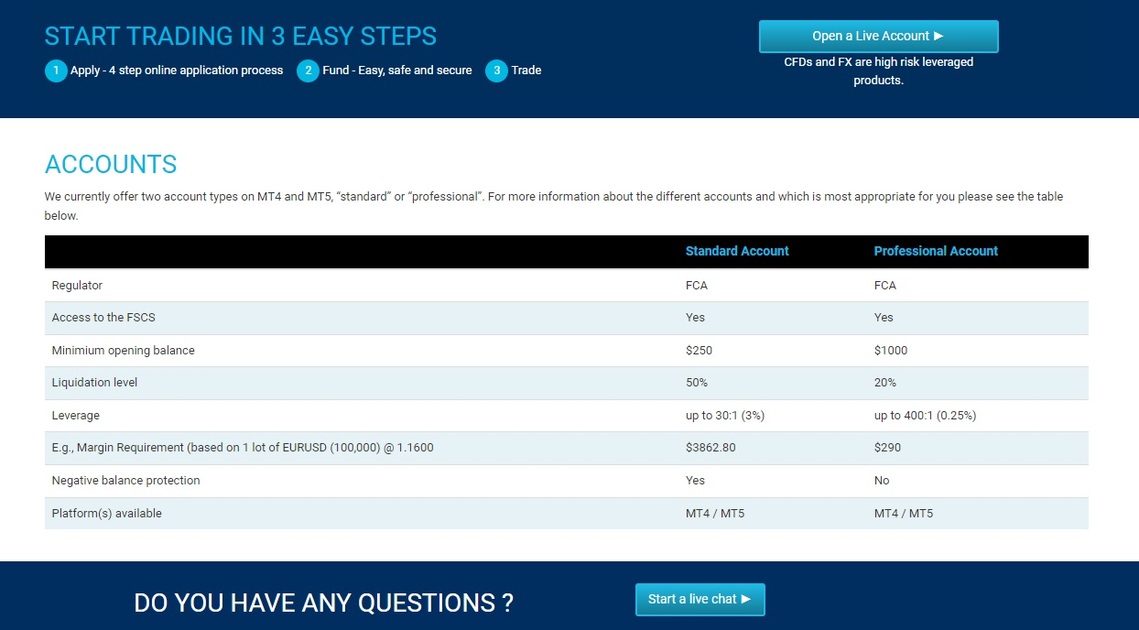

What Are The One Financial Markets Account Types?

One Financial Markets offers only 2 account types: Standard and Professional. Both account types are similar to one another, besides the fact that no commission is charged on the Standard account.

What Are The Account Features Of One Financial Markets?

One Financial Markets provides access to a variety of financial products, several trading platforms, competitive spreads, and regulatory oversight by respectable agencies, among other account features.