SohoMarkets Review: SohoMarkets.eu Is a Trustworthy Brokerage

Soho Markets broker is under the ownership of Vstar & SohoMarkets LTD and they have been operating since 2022 with registration and licensing in Cyprus.

The broker offers the industry standard and veteran trading platform MetaTrader4 and they are offering the possibility for clients to invest in forex, commodities, stocks, shares, and cryptocurrencies.

Besides being a regulated brokerage by the Tier 2 regulator, they have been in business for only a year and that’s why we wanted to make this Soho Markets review so we can give you all the needed details about them.

| Broker Status: | Regulated broker |

| Owner: | Vstar & Soho Markets Ltd |

| Websites: | SohoMarkets.Eu |

| Regulated by: | CySEC |

| Headquarters Country: | Cyprus |

| Operating Status: | Active |

| Foundation Year: | 2022 |

| Trading Instruments: | Forex, commodities. indices shares, cryptocurrencies |

| Trading Platforms: | MT4 |

| Mobile Trading: | Yes |

| Minimum Deposit: | $200 |

| Deposit Bonus: | N/A |

| Maximum Leverage: | 1:30 |

| Islamic Account: | No |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

SohoMarkets Regulation and Security of Fund

SohoMarkets has a Cyprus Securities and Exchange Commission (CySEC) license since January 2022. That puts them in the group of highly trusted brokers. Of course, we also wanted to check other Tier 1 regulators to see if they are maybe in other registers as well.

Unfortunately, they are not regulated by any other regulator which is quite a shame, since the company is young and they really offer good trading conditions and good services.

Ultimately, the CySEC regulation is a great start simply because it allows them to grow and as well expand their services further down the road.

Also, all the brokers under CySEC are required to hold €730 000 as proof of minimum capital at all times. Another major CySEC requirement is the demand for all users’ money to be held in segregated bank accounts away from the brokers one.

And last but not least, we have the Investor Compensation Fund that covers all users of CySEC brokers by up to €20 000 in the event of a sudden broker insolvency.

All in all, the Soho Markets broker has a good license and they are following the rules set by CySEC. Additionally, if you want to work with other good and reliable brokers, we suggest you try out XTB Broker as they have a solid license and good trading conditions.

SohoMarkets Available Account Types

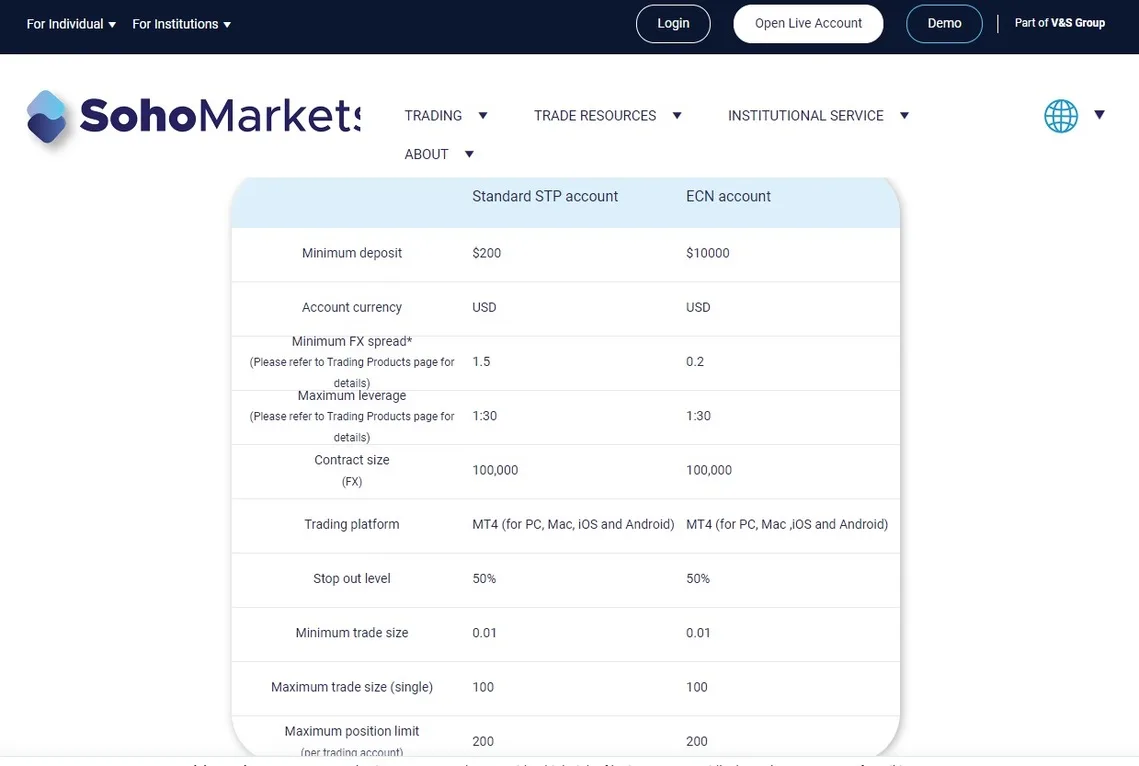

We have to be honest when we say that we are a bit disappointed with the choice of trading accounts offered by Soho Markets. Mainly because they only offer two options, but we hope they will diversify it a little bit in the future.

The accounts they have are the following ones:

- Standard STP – $200

- ECN account – $10,000

The minimum deposit is a bit too high for our taste as there are many other good brokers that will let you start with as little as $5. Other than that, these accounts come with different spreads. Standard account traders can get a spread from 1.2 pips, while for the ECN traders, they can get from 0.2 pips.

We also like that this broker is really following the rules and set the leverage at 1:30 which just proves they are in the guidelines of ESMA.

The only major problem we faced with these accounts is that Soho Markets doesn’t actually offer a Demo account. Once we tried to open it, we got a notification that we first need to deposit the funds in order to use it.

This is a first for us and we truly hope they will fix that as that is not how Demo accounts should work.

SohoMarkets Trading Instrument

As for the trading instruments, SohoMarkets has really good coverage. Traders can choose from:

- Currency pairs (Forex) – USD/AUD, NZD/HKD, GBP/NOK

- Commodities – natural gas, crude oil, silver

- Indices – AU200, FTSE 100, S&P 500

- Shares – American Airlines, Master Card, Facebook

- Cryptocurrencies – BTC, XRM, ADA

Deposits and Withdrawals

We give credit where it is due and Soho Markets gets that credit for a huge diversity of the deposit methods. Those methods include the following ones:

- Visa or Mastercard credit or debit card

- Wire transfers

- Skrill

- Neteller

- PayPal

The only bad side when it comes to the funding methods is the fees the broker charges. For any transaction below $2 000 into your account, the broker will charge you an additional 2%. Moreover, it is charged non-regarding the funding method.

It would be very sad if the broker doesn’t change that as it will create a lot of problems with their potential clients down the road as they could easily opt for a Tier 1 regulator who doesn’t have any fees.

SohoMarkets Trading Platform

You saw that in our intro, we have stated that the Soho Markets broker offers a veteran and industry standard by now trading platform MetaTarder4. And that is completely true and we have to give them huge credit for actually doing their homework and choosing the best platform out there.

MetaTrader4 allows traders to use advanced charting options and indicators and on top of that clients can also watch multiple charts and have fast executions.

Additionally, the Expert Advisor bots allow for back testing, trading signals, one click trading, and hundreds upon hundreds of other small and big options and features.

MT4 can also be used on the desktop, as a web trader or you can even download it as an app on your phone or laptop. Overall, the platform is amazing and you should definitely try out the Soho Markets broker.

Customer Support

In regards to customer support, this broker can be reached by a few different ways. On their website they provided this phone number +357 25323 1 and this email address [email protected]. Besides that, you can also choose to contact them through the form on their website.

And when it comes to the quality of their support, we can say that the majority of the reviews are positive with people praising their fast responsive time. And on top of everything, there is an online chat feature that can help you get answers to many questions you may have in no time.

Education Available

Once you access the SoHoMarkets website, you will be able to see many educational materials under the Trade Resources tab. This extensive library includes:

- Market analysis

- Financial calendar

- Forex trading academy

- Trading calculator

- Webinars

It’s obvious that brokers like this one or even Plus500 put a lot of time and effort into making sure your trading is smooth and easy with the right literature.

While there are many brokers that will provide you with even more, you should focus on quality over quantity and really take your time in studying the financial markets and how exactly they work. By taking the time to educate yourself you will be able to make better decisions regarding your trading.

The resources we mentioned cater to traders of all levels of expertise interested in having a good understanding of the topic.

SohoMarkets Overall Summary

We made this SohoMarkets review, so you can get an insight into how a reliable trustworthy broker operates. While sometimes it can be hard to differentiate if something is legit or a scam, brokers that are this transparent are easy to be seen as being a good option for trading.

The broker is based in Cyprus and does follow regulations set by Tier 1 regulator CySEC, which makes this broker a good option for both new or already experienced traders.

The minimum deposit is on a higher side and is set at $200, but in terms of leverage, it follows guidelines set by CySEC and does not exceed 1:30. Their quitting-edge trading environment is supported by MT4 trading platform and features competitive average spreads as well as mobile trading.

FAQs About SohoMarkets Broker

Can I have a Demo and Live Account Working at the Same Time?

In theory, with some brokers you can, but as SohoMarkets clients have some difficulties with accessing the demo account, this is currently not possible.

What Trading Platform Does SohoMarkets Offer?

SohoMarkets offers a MetaTrader 4 which you can download for either your PC, laptop or your phone.

What Is The Minimum Deposit at SohoMarkets?

The minimum deposit that SohoMarkets has is $200, which is a bit more than what regulated brokers usually ask for.