SolidusX Review – Facts About This Scam Broker

SolidusX Review, The company that owns and operates SolidusX is based in St. Vincent and the Grenadines. The website they operate is well-made and of very high quality. Due to the fact that they are based in a non-regulated offshore nation, they do not have a trading license.

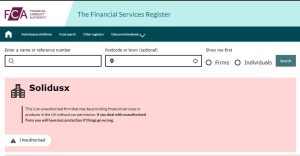

The UK’s main financial regulator, the FCA has issued the following warning about the SolidusX scam, as well as their parent company.

Read our SolidusX Review to find out more about how scam sites like this swindle their marks.

Additionally, we strongly advise you to avoid the fraudulent brokers XTrade Brokers, SkyFx Trader, and Tradiso.

| Broker Status: | Scam broker |

| Regulated by: | Unregulated |

| Operating Status: | Online |

| Scammers Websites: | SolidusX.Com |

| Blacklisted as a Scam by: | FCA |

| Broker Owner: | Digital Genius Group Ltd. |

| Headquarters Country: | St. Vincent and the Grenadines |

| Foundation Year: | 2021. |

| Online Trading Platforms: | Proprietary platform |

| Mobile Trading: | iOS, Android |

| CoinRise Minimum Deposit: | N/A |

| Deposit Bonus: | Available |

| Crypto Asset Trading: | BTC, USDT, XRP |

| CFD Trading Option: | Available |

| Available Trading Instruments: | Cryptocurrencies, Forex Pairs, Commodities, Indices, Shares |

| Maximum Leverage: | 1:200 |

| Islamic Account: | Not supported |

| Free Demo Account: | No, live trading only |

| Accepts US clients: | US Clients not accepted |

Compliance and Fund Safety at SolidusX

SolidusX is operated by Digital Genius Group Ltd, a legally registered company in St. Vincent and Grenadines, registration number 26130. This is where the legality of the whole operation ends. You see, SVG and their main financial regulator, FSA have stopped regulating broker companies.

Of course, there are many legitimate broker companies that are registered in SVG, which is a tax haven offshore nation. These legitimate brokers, unlike SolidusX, have obtained their trading license elsewhere in order to provide a good quality service.

SolidusX does not have any trading licenses to speak of, and by extension, is not authorized to provide broker services.

European Union has some of the most strict regulatory frameworks when it comes to online brokers. Let’s have a look at what safety standards the German regulatory body, known as BaFIN, requires from their brokers:

- At least 730,000€ of starting capital

- Client insurance fund of 20,000€

- The maximum allowed leverage is 1:30

- Negative balance protection

- Segregated bank accounts

- Bonuses are forbidden

- Financial transparency in accordance to EU MiFID

SolidusX does not adhere to many of these safety standards. Their leverage is quite high, set at 1:200 which unnecessarily exposes their clients to the market.

We have, of course, checked the company registry of a few prominent regulators to confirm our claim that SolidusX is not a legitimate company. The databases of German BaFIN, Russian CBR, and South African FSCA returned no results. The UK’s main regulator, FCA has issued a scam warning about this company being a fraud.

Trading Software Overview

For a company that claims to be on the bleeding edge of technology, it’s funny how the only trading platform they offer is a proprietary Web Trader. As far as Web Traders go, SolidusX does have very good software. It supports a good variety of trading instruments, and an interactive chart that has one-click trading enabled.

The web trader is widespread, but its limited functionality and security make it an unfavorable option. Authorized broker companies use the Web Trader only as a backup option. Current industry-standard software is MT4 and MT5. These programs allow great versatility, and excellent market execution speeds, and have the tools that allow trading automation.

Account Types Available at SolidusX

The account types at SolidusX will be upgraded to include more perks when the deposited amount breaches a certain threshold. This is a stark contrast to what legitimate brokers offer on their platforms. Regulated brokers will offer accounts based on different billing methods, and charge a premium on advanced market execution technologies.

At least these accounts don’t have the names of different precious metals, they are named after ancient Roman army ranks. It’s not clear which currency the minimum deposits are calculated in, there is only the number of “units” required. No demo accounts are available.

These are the accounts SolidusX offers:

- Tyro – 500+

- Optio – 2,500+

- Primus – 25,000+

- Centurion – 100,000+

- Legatus – 250,000+

Methods of Deposit and Withdrawal

SolidusX continues its shady practices when it comes to payments. The web platform will only accept cryptocurrency payments. Bank Wire and Bank Card payments are also said to be accepted, but only through a SolidusX representative.

This is a usual scamming strategy – the frauds use cryptocurrency because the transactions are untraceable and anonymous. This anonymity also allows the swindlers to hide their profits from the authorities, and avoid taxes.

SolidusX states that they process their withdrawals in less than 24 hours. They do not mention withdrawal methods or any withdrawal fees. The only thing that is out of the ordinary when you compare it to the regulated brokers, is that the withdrawal policy on the website is not defined well enough.

How the Fraud Has Carried Out

SolidusX hides its true intentions under the guise of a high-quality service provider. Their website is done by a professional, and they have a well-developed trading platform. The only method of depositing funds to SolidusX is through crypto transfers.

Scammers like SolidusX will use their trading platform to change real-world market data. They do this in order to coax more deposits from their victims, as we can see with their tiered account types. When the victim tries to withdraw funds, SolidusX will either ignore the request or charge hidden fees that undermine the profitability of the trades.

SolidusX Summary

SolidusX is a known scam entity. None of their claims of legitimacy are true. The UK’s FCA has issued a warning about this fraudulent entity.

The scammers use promises of high profits via their trading platform, but the only means of depositing funds are through Crypto Transfers. Don’t be fooled by these swindlers, and try some of our recommended brokers instead.

FAQs About SolidusX Broker

Is SolidusX a Regulated Broker?

No, SolidusX is not regulated or authorized to trade.

Is My Money Safe at SolidusX?

No, SolidusX is a scam, and the UK’s FCA has issued a warning about the site.

What Is The Minimum Deposit at SolidusX?

The minimum deposit as SolidusX is $500.