Viverno Review: Who Is the Owner of This Broker?

With headquarters in the capital of Cyprus, this broker is one of those that should comply with EU regulations and laws. Thus, their owner is not in good relations with those. Under the flag of BDSwiss Holding Ltd, this broker has operated since 2022.

However, the BDSwiss trading company has multiple entities worldwide. Will Viverno broker follow the old path or do something new we are about to see?

Who Is Viverno Broker?

Let’s see first how are Viverno and BDSwiss connected. The company owner has multiple brands in the EU and offshore. However, Viverno company is a freshly registered brand that uses licensing of BDSwiss in Cyprus.

Considering the BDSwiss ban in the UK by FCA, there is much to consider. On top of that, German BaFin is running an investigation into BDSwiss offshore entity. However, for Viverno company there are no signs yet of any ingenuine activities.

| Viverno | |

| Legal name: | BDSwiss Holding Ltd |

| Regulation: | Regulated / Offshore broker |

| Registered in: | Cyprus |

| Established: | 2022 |

| Website: | Viverno.com |

| Financial Authorities Warnings: | N/A |

| Contacts: | E-mail: [email protected]

Phone: +44 2086381223, +33 184671827, +39 0230579080, +30 2111211876 Online form Live chat |

| If a withdrawal is possible: | Potentially |

| Fees: | 10 EUR withdrawal fee for amounts lower than 100 EUR

10 EUR/month inactivity fee after 12 months Undisclosed swap fees and currency conversion fees |

| If Active on Social Media: | No |

| Investor Protection: | No |

Viverno Regulation and Security

As the key factor in the trading world, we need to confirm that Viverno company is licensed. But only with Cypriot CySEC. It’s not known as FCA, BaFin or ASIC. Important to note is that Viverno broker is not in any of Tier 1 regulatory registers. But also that they don’t provide any investor protection measures.

Generally speaking, CySEC-regulated brokers are members of the compensation scheme. But Viverno broker is not yet. This broker is yet to prove itself. Its parent company doesn’t have a good relationship with authorities like FCA and BaFin. Therefore, you should be careful in choosing your broker. Check it out yourself.

Important to realize is that the company doesn’t have negative balance protection and guaranteed stop-loss. Even though the leverage is low according to regulations, it can get you into a negative balance.

Viverno Broker Profile

Since this is a new brand of an already existing broker, there are many missing features. Such as mobile and desktop apps, but also a demo account. Instead of reliable and trusted third-party Meta Trader or cTrader, they only provide proprietary web traders.

In addition to that, the company doesn’t have any advanced trading features. For example, Expert Advisors or Copy trading. On the positive side, there is Trading Central where traders can follow the latest trends, get market updates and learn more.

Important to note is that the company doesn’t offer any risk-free trading options. Such as demo accounts or at least micro-accounts. Which leaves no space for traders to test their services.

| Trading platforms: | Proprietary web trader |

| Account types: | Classic, VIP, Raw |

| Financial Instruments On Offer: |

|

| Maximum leverage: | Up to 1:30 |

| Minimum Deposit: | $100 |

| Commissions/bonuses: | Up to $5 on pairs, up to $2 on indices & 0.15% on shares |

| Mobile app: | No |

| Desktop app: | No |

| Autotrading: | No |

| Demo account: | No |

| Education or Extra tools: | Trading central |

Is Viverno Broker Safe?

If you will take regulation as the only metric, then yes. However, many past flaws would make you possibly think otherwise. Especially reviews. Without segregated bank accounts for clients’ deposits, the broker can use those funds freely.

Generally speaking, Tier 1 regulated brokers provide compensation funds. Even CySEC members get up to 20.000 EUR. Thus, with Viverno broker that’s not the case.

If you are looking for a new broker it’s worth checking our Libertex and DeltaStock reviews. Whether you like them or not you can find more information and possibly new things to look for.

Viverno Traders Reviews – Sharing Experiences

For now, there are no reviews of this broker. Mainly because they are new to the business. However, their last company didn’t have such a great story. Out of almost 17 hundred BDSwiss reviews, many reported some issues. We can only hope that Viverno strategy won’t be the same.

Many of them reported problems with customer services and closed accounts. But most importantly, traders were facing withdrawal issues. Considering the dark past, you should just be careful where you are investing. But if you are looking for a flawless and more secure broker, our expert team is available for consultation.

How Does Viverno Platform Reach Clients and Who Are They?

The company doesn’t run any social media accounts. On top of that, they don’t promote any affiliate or referral programs. Therefore, the only solution is a marketing campaign.

Traders that are visiting their page are mainly from Europe. Simply because they still have a BDSwiss platform for other countries. Anyway, those traders mainly come from:

- France 33,5%

- Italy 12,9%

- Poland 11,9%

- Other 21,6%

Deposit and Withdrawal

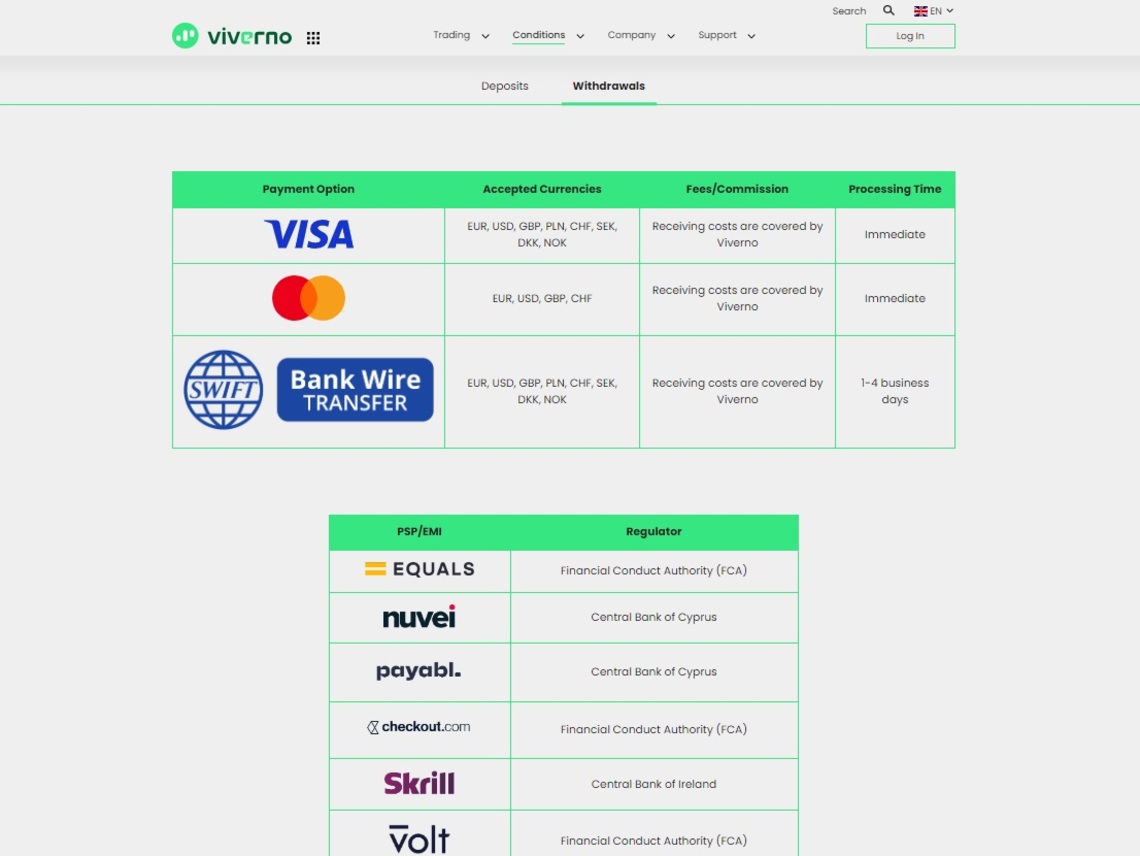

The good thing about the broker is that funding methods are completely transparent. The company covers all deposit and withdrawal receiving fees. There are two options for funding:

- Debit and Credit cards

- Wire transfers

Card transfers are processed immediately, whether for deposit or withdrawal. On the other hand, wire transfers can take up to 4 business days. The company also lists several PSP providers that they are using. Many of those are UK regulated, but there are also few regulated in Cyprus. Important to know is that for card transfers traders can get a chargeback within the first 540 days.

Our Safe Trading experts’ opinion of Viverno broker

Many traders get confused when they see a new brokerage. Indeed, you never know which direction they will go. In fact, Viverno broker is a licensed broker and they should comply with all European laws and regulations. From this perspective, we can’t know for sure if they will.

But to avoid any paranoia because of their previous brand, you should stick to Tier 1 licensed brokers. To know more about those and even get a list fitted for your needs, you can get in touch with us. Free of charge and without obligation you can get advice from our professional expert team about any trading company. Don’t hesitate and contact us today!

FAQ Section

Is Viverno Trustworthy?

Considering the license and transparency, yes. However, Viverno broker offers proprietary trading software. Also, they don’t have such a great pedigree. Stay cautious.

How To Start Trading Safely?

Safe trading is mainly obtained through Tier 1 regulated brokers. To find the best broker that can match all your requirements, get in touch with our experts today!

How Can You Help Me Choose the Best Forex or Crypto Broker?

Our team can filter brokers based on your needs and find you the most suitable and secure options. Most importantly, that’s completely free and without any obligatory requirements.