BDSwiss Review: A Comprehensive Analysis of the Broker’s Features and Services

When selecting a broker, numerous factors need to be taken into account. Regulations, financial security, a low minimum deposit, and transparency are just a few. Because of this, it’s crucial to read our BDSwiss review and discover more.

Be sure to stay up to date on news regarding ActivTrades, CMC Markets, and Degiro.

Who Is BDSWISS Broker?

BDSwiss forex firm launched in 2012 as an online binary options broker. BDSwiss had to alter its work because the European Union outlawed this sort of trading in 2018, therefore the company now deals in CFDs and FX.

| Broker name | |

| Legal name: | BDS Ltd/BDS Markets |

| Regulation: | Regulated by FSA and FSC |

| Registered in: | 6 Ioanni Stylianou, 2nd Floor, Flat/Office 202, 2003, Nicosia |

| Established: | 2012 |

| Website: | global.bdswiss.com |

| Financial Authorities Warnings: | FCA, BCSC, BaFin |

| Contacts: | Email: [email protected]

Phone: +49 3021446991 |

| If a withdrawal is possible: | Highly unlikely |

| Fees: | $30 Inactivity fee, Overnight fees |

| If Active on Social Media: | Yes |

| Investor Protection: | Negative Balance Protection Policy |

Regulation info

The Financial Services Authority (FSA) license number SD047 oversees BDS Ltd. Registered address: Suite 3 of Jivan’s Complex in Global Village, Mont Fleuri, Mahe, Seychelles. The number of registration is 8424660-1.

The FSC licensed and regulated BDS Markets as an investment dealer on June 12, 2016 (License No. C116016172).

BDSwiss Holding Ltd is regulated by CySec in 2013, with the registered address 6 Ioanni Stylianou, 2nd Floor, Flat/Office 202, 2003, Nicosia.

Regulated status does not, unfortunately, guarantee a broker’s dependability. Our thorough investigation enabled us to learn about the warnings filed against BDSwiss.

The FCA has mandated that BDSwiss Holding Plc stop all regulated and marketing activities in the UK and take all practical measures to prevent other BDSwiss Group members from doing the same. It also demands that the business cancel all open positions and return all client money.

BDS Ltd., BDS Markets, BDSwiss GmBH, BDSwiss Holdings Ltd., and BDSwiss LLC (collectively, “BDSwiss”) were warned by the Canadian BC Securities Commission (BCSC) in 2021 that they are not authorized to do trading activity in British Columbia.

BaFin also issued a warning against BDS Markets, stating that they lack the necessary authorization from the KWG to carry on banking operations or offer financial services in Germany.

A broker is not automatically good just because he is regulated. BDSwiss is the ideal illustration of a bad broker that succeeds. We have to assume that the broker was bad to invest with prior to the many government warnings.

BDSWISS Broker Profile

Information concerning the background and their BDSwiss trading services were also offered by our investigation.

| Trading platforms: | MT4 and MT5 |

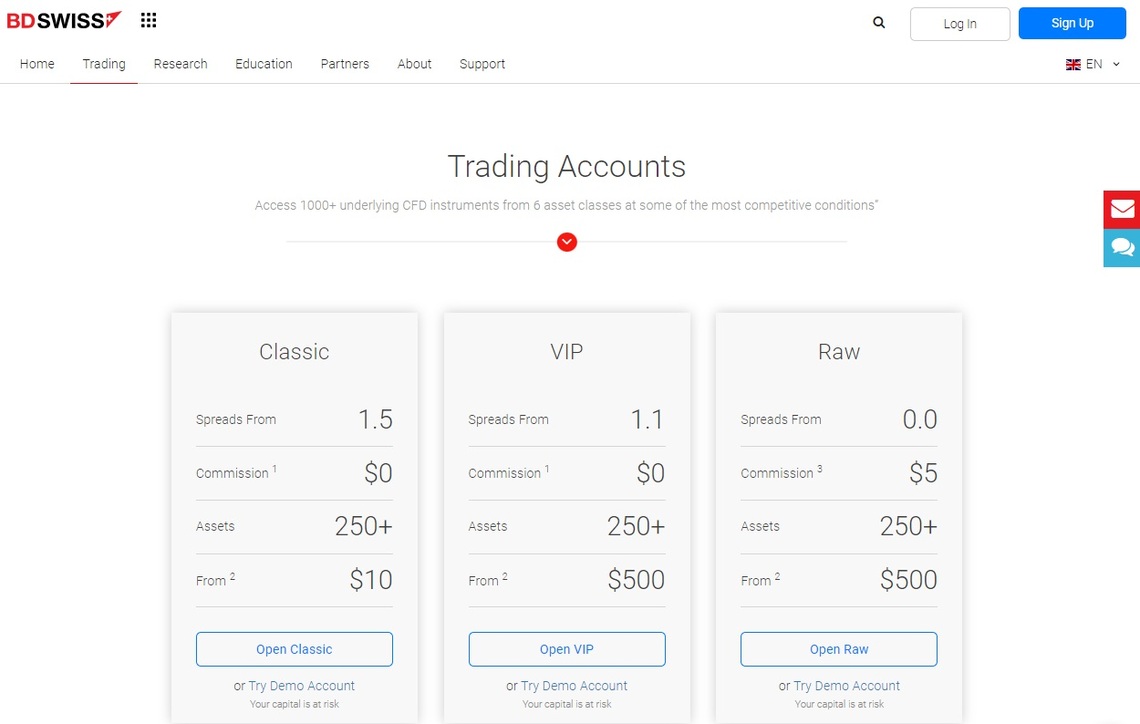

| Account types: | Classic, Raw, and VIP account types |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:1000 |

| Minimum Deposit: | 100 EUR/GBP/USD |

| Commissions/bonuses: | 0.01%/FTD bonuses for non-EU clients |

| Mobile app: | Yes |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Yes |

| Education or Extra tools: | Trading Academy, Forex eBooks, Educational Videos, Seminars |

Is BDSWISS Safe?

We may assert that BDSwiss is secure for nations where they are subject to regulation. BDSwiss provides a secure trading platform, has a low minimum deposit requirement, and has improved after warnings were made against them. They are no longer taking in UK clients after the warning FCA issued.

Traders Reviews of BDSWISS Broker-Sharing Experiences

90% of the 2,084 reviews on Trustpilot are favorable. The remaining 10% of negative ones emphasize various withdrawal-related problems. One investor even claims that BDSwiss withheld his $22,000 even after he provided all necessary information.

Overall, the reviews are positive. Ultimately, developing client trust is what will drive future business to you. If you are searching for a broker with positive experiences, contact us today.

How BDSWISS Trading Platform Reach Clients and Who Are They?

After warnings were issued, it was revealed that BDSwiss primarily used marketing and social media to draw in new investors. Our research indicates that BDSwiss mostly operates from:

- Morocco

- Italy

- Germany

- South Africa

- France

BDSWISS App Review

The app has simple navigation and good buy/sell functionality. Additionally, it provides sorting and charting tools with a search bar, options for categorizing assets by category, a favorites page, and many other factors. It’s available as an online trader and a mobile app.

Deposits and Withdrawal Methods

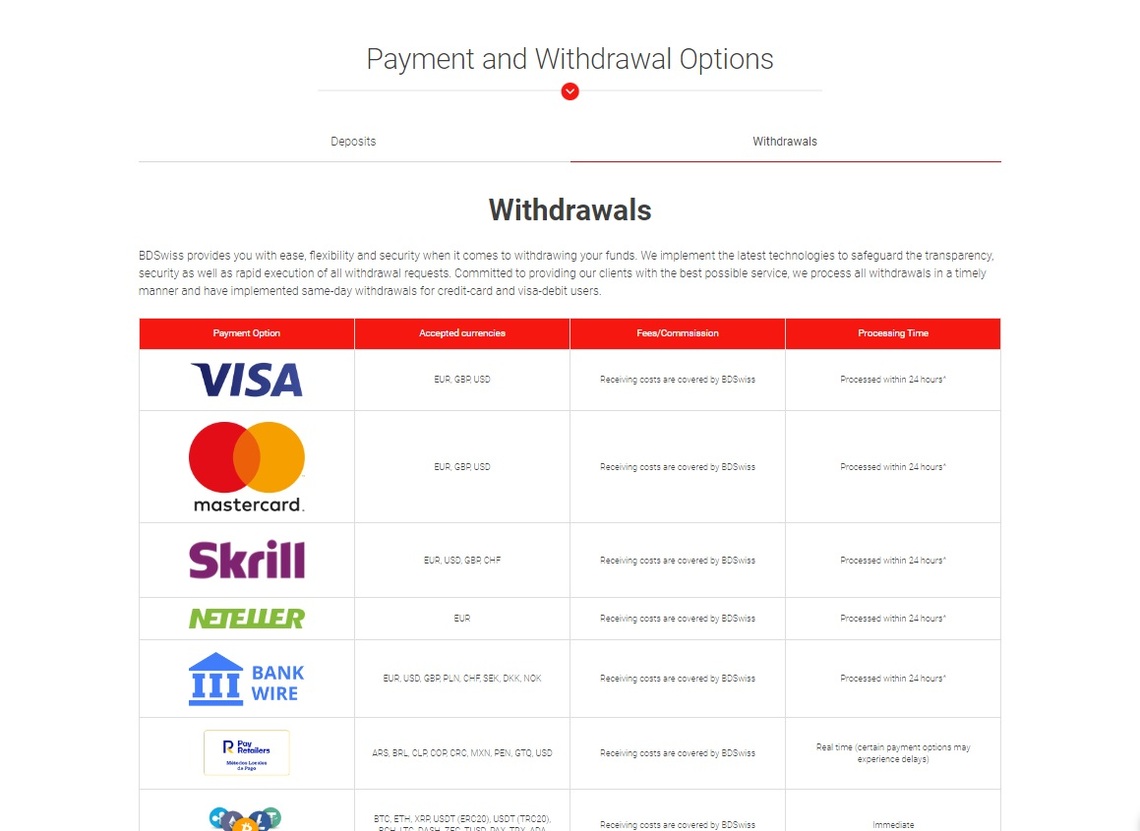

BDSwiss offers various payment options including Credit and Debit cards, Bank Wire, and popular online payment methods such as Skrill, Neteller, Payretailers, and many more.

Client withdrawals can only be executed if the necessary KYC documentation has been submitted by the client and their account has been completely validated in order to safeguard all parties from fraud.

BDSWISS Affiliate Program

Through BDSwiss’s affiliate network, you can monetize your traffic by directing customers to their websites and earning tempting commissions. On their website, the commission structure is described.

Compensating existing investors in addition to attracting new ones is an excellent strategy. Brokers that provide this kind of advertising are few and far between.

Pros and Cons BDSWISS Broker

| Pros | Cons |

|

|

Our Safe Trading experts’ opinion of BDSWISS Broker

Trading with unlicensed brokers can result in money losses, and a host of other potential outcomes. Overall, depending on the nation you are from, we may claim that trading with BDSwiss is safe.

BDSwiss provides transparent pricing, security and regulation, a secure trading platform, and a minimum deposit requirement that allows experienced and novice traders to test the platform on a demo account.

Although BDSwiss no longer operates in the UK, we could still see them functioning out of Germany, even after BaFin issued a warning. German citizens are encouraged to proceed with caution because that does raise red flags.

FAQ Section

If your account was created as a result of an affiliate campaign that required a greater or lesser first payment, the sum may vary, but typically it is $100.

Regulated brokers are the main source of safe trading. To find out which ones best suit your preferences for trade and the legal requirements in your nation, get in touch with our team.

We consider your trading requirements, preferences, and level of competence to provide the best recommendations. Importantly, our consultation carries no commitments. What is the minimum deposit on BDSwiss?

How To Start Trading Safely?

How Can You Help Me Choose the Best Forex or Crypto Broker?