CDO Markets Review: Regulated Broker With Critical Issues

CDO Markets broker is one of those with regulation but practically without any protection. In addition to that, the company is registered offshore in Vanuatu.

Nevertheless, we can’t say they are not ingenuine broker. But there are definitely some perks of trading with them. Read this CDO Markets review carefully to find out what to watch out for.

What Do We Know About CDO Markets?

With its first registration in 2018, the company had more than enough time to build its reputation. Considering their reviews someone might say they succeeded.

However, some experienced traders would know what are the downsides of trading with an offshore broker. But if they will continue doing so, we are about to reveal in this CDO Markets broker review.

| Reliable Broker Must Have | ||

| Legal name: | CDO Markets Limited | Transparently displayed in the disclaimer or legal documents |

| Regulation: | VFSC | Within your legal jurisdiction – local regulator |

| Registered in: | Vanuatu | Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2018 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | Cdomarkets.com | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | BAPPEBTI | None |

| Contacts: | Phone: +44 20 3598 8995

e-mail: [email protected] Online form Live chat |

Phone, email, social media, web form |

| If a withdrawal is possible: | Yes | Yes |

| Fees: | Hidden fees | Transparent fees – list of spread and commissions |

| If Active on Social Media: | Yes – Instagram, Twitter, Facebook, LinkedIn, Youtube, Reddit | Often present on social media |

| Investor Protection: | No | Compensation fund |

Regulation info

CDO Markets regulation comes from a domestic institution – VFSC. The company should have initial capital of $50.000 but also keep deposits in segregated bank accounts. Which they don’t reveal anywhere.

But to trade anywhere outside of Vanuatu, the company should have at least one Tier 1 license, issued from institutions like FCA, BaFin or FCA.

CDO Markets Profile

In general, CDO Markets trading conditions are quite attractive. Primarily because of trusted third-party software like Meta Trader. Also, there is a vast of tradeable instruments available.

Yet, the company is breaching many regulatory limitations, such as leverage and bonuses. While both are restricted in many countries, they still offer it.

| Trading platforms: | MT4, CDO Trader |

| Account types: | STP, ECN, VIP |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:500 |

| Minimum Deposit: | $100 |

| Commissions/bonuses: | $4 commission on FX and $6 on CFD / Bonuses are available |

| Mobile app: | Available |

| Desktop app: | Yes |

| Autotrading: | Yes |

| Demo account: | Available |

| Education or Extra tools: | Profit, margin and pivot point calculator / Basic educational articles |

CDO Markets Clients Reviews: What clients can tell us?

Generally speaking, traders are quite satisfied with CDO Markets features. Yet, there are only 11 reviews on the reliable Trustpilot platform. Their traders mainly come from:

- US

- Turkiye

- Philippines

- India

- UAE

But to get the bigger picture about this broker we will need to wait furthermore. But for now, we can only rely on facts provided by the broker. But if you still don’t know which broker is the most reliable for you, book your consultation with our experts today.

https://www.trustpilot.com/review/cdomarkets.com

CDO Markets’ Trading Products

The trading instruments provided are quite solid. However, nothing that you can’t get with a Tier 1 licensed broker at much better conditions.

Whether you are a pro or a newbie you can find yourself suitable choices here. Starting with FX pairs, commodities, spot CFDs, cryptos and shares.

To find different tradeable options and some other security measures you have to read our CPT Markets, Alpha FX and Xtrend Speed reviews.

CDO Markets Bonuses And Promotions

Another key point is the CDO Markets deposit bonus. In some jurisdictions, these bonuses are highly restricted. Primarily in Europe and Australia. The main reason for that is the malicious clause that often comes with it.

Also, there are many different ways how brokers find ways to provide you with a bonus. In this case, the company has a referral program.

Silver Bonus

Silver bonus is most attractive for beginners. Simply because it requires a low investment of $100. Also, you are rewarded with $50 bonus funds. Yet to withdraw the bonus you need to trade 5 lots.

Diamond Bonus

The diamond bonus gets a bit more interesting. For all deposits up to $10.000, you can get a 50% bonus. In this case, the account stop-out is at $5.000.

Gold Bonus

This bonus is designed for brave traders. The ones that have a bit more money and freedom. For $1.000 you can get a $300 bonus. Thus, to withdraw those $300 you have to get 30 lots of trading volume.

Referral Program

The referral program is the easiest way to get new customers. At least in a legitimate business. Once you have satisfied customers they are happy to bring more. In this case, it’s in exchange for a reward bonus. Which again comes with a clause.

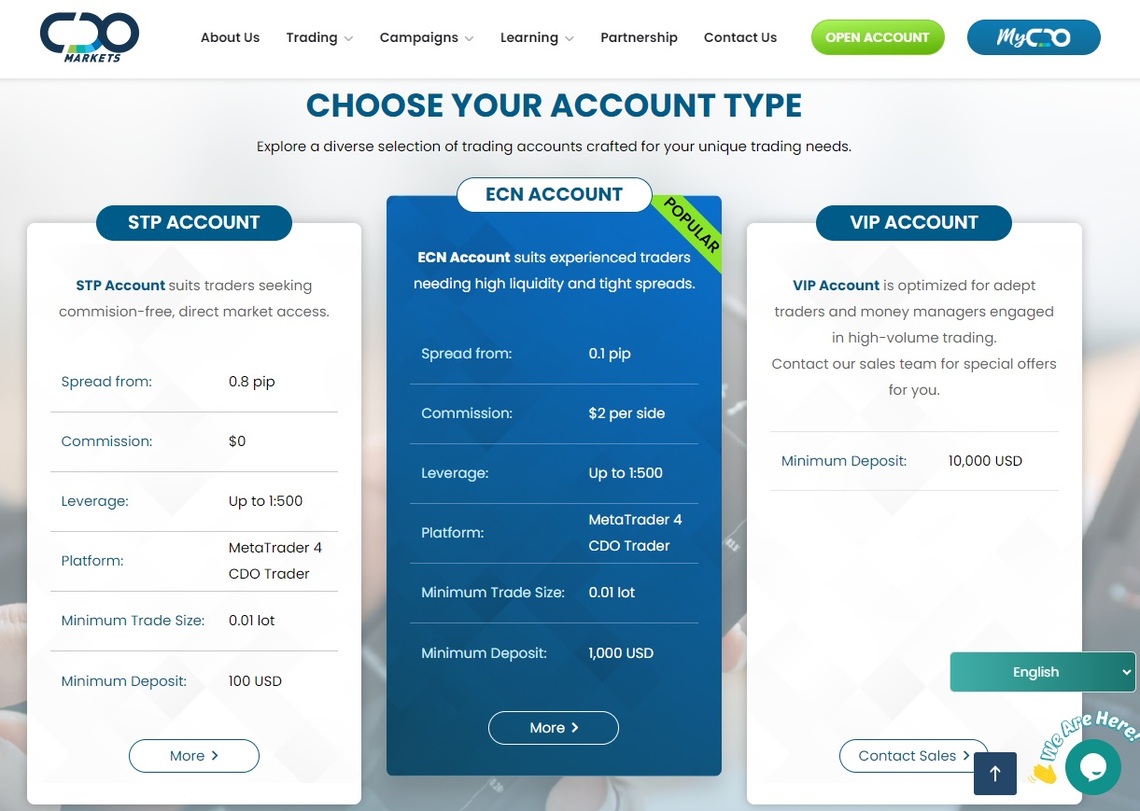

Account Types Available at CDO Markets

There are 3 account types with CDO Markets. Every account brings more options and better trading conditions. But also, they require a higher deposit.

STP Account

STP account starts already at a $100 minimum deposit. Leverage goes up to 1:500, while there is no commission. Also, the account is swap-free. As for the spreads, those start from 0.8 pips.

ECN Account

ECN account is a bit more conservative. With lower spreads starting from 0.1 pips, you can expect a commission. In this case, $4-$6 depending on the assets. But also there are swap fees. To get this account you have to put on aside $1.000.

VIP Account

OF course, the most attractive offer comes with the highest deposit requirement. For a $10.000 deposit, you get leverage 1:200, undisclosed spreads and commission. Thus, you get swap free account with scalping allowed.

Demo Account

On the positive side, before you invest any funds you can try their services through a CDO Markets demo account. Yet, that’s not a realistic picture. In cases like this, some traders prefer micro-accounts with Tier 1 licensed brokers.

Islamic Account

Islamic believers would be extremely satisfied with the offer. Simply because there is a swap-free CDO Markets Islamic account available for them. But if they are satisfied with services we are about to see.

Partnership Program Offered By CDO Markets

With CDO Markets, there are 4 partnership programs. Those are:

- Introduce broker

- WhiteLabel partner

- Bridge Solutions

- Money Manager

Generally, all of those are designed to expand the network and grow. The most interesting part is MAM and PAMM accounts.

CDO Markets Platforms and Trading Tools

As the most important aspect of trading comes the trading software. If the software is not reliable you don’t have anything else to think about. But let’s see what other tools you can get from this broker

CDO Trader

CDO Trader is the proprietary platform of this offshore broker. Even though the software has mobile and desktop apps, it can’t be compared to Meta Trader. The advantages that broker presents are one-click trading, market alarms and news.

MetaTrader 4

CDO Markets MT4 is a completely different story. With a strong reputation and multiple advanced features, it remains the No.1 spot in the industry. Also, the software is available for all iOS and Android devices.

Profit Calculator

The profit calculator is a website feature. It allows traders to quickly determine how much money they want to invest. But also what conditions to set up to reach certain goals.

Margin Calculator

On the other hand, there is a margin calculator. It quickly gives insight into information about money management. Traders can define quickly how much money they should have to open certain positions.

Pivot point calculator

The key point of investing is strategy. Once you set up your support and resistance levels it’s way easier to track asset prices. That’s why have a pivot point calculator to easily determine those points.

CDO Markets Educational Materials

Educational material with CDO markets is available in the article form. They have general information about the trading world. However, there are no live training, webinars or sessions available.

Deposit and Withdrawal Methods

Funding methods with CDO markets broker are quite unconventional. They claim to introduce soon card payments. But for now, you can use:

- Bank transfers

- FasaPay

- PerfectMoney

- USDT

- TRC-20

Yet, for withdrawals altogether with bonuses you have requirements that you have to meet.

Pros and Cons of CDO Markets Broker

In general, the positive thing is that the broker at least has some kind of regulations. Yet, there are no funds protection features. Also, there is MT4 trusted software available.

On the negative side, there is a shady withdrawal policy if you accept bonuses. Therefore, you should be careful in accepting any bonus funds.

Summary of CDO Markets Broker Review

Overall, the broker is trying hard to look transparent. Yet, they don’t have negative balance protection or segregated bank accounts for deposits.

But if you are still looking for a reliable broker you are at the right place. To find out everything you should know about the broker to define if they are legitimate or not, talk to our experts. Book your first free consultation right now.

FAQ Section

Which Platforms does CDO Markets offer?

CDO Markets traders can choose between third-party Meta Trader 4 and proprietary CDO trader.

Is CDO Markets a Regulated Broker?

Even though the company doesn’t offer funds protection measures they are regulated by VFSC.

How long does CDO Markets withdrawal take?

The company doesn’t have a full withdrawal policy, therefore processing time remains unknown with the CDO markets broker.

What is the Commission for CDO Markets?

If you are using an ECN account you can expect a $4 commission for FX pairs and a $6 commission on CFD trading.