FNPMarkets Review – Facts About This Scam Broker

FNPMarkets Review, Every little detail about FNPMarkets advertised is a lie. Every single one. From the pool of piranhas that scammers form, FNPMarkets is one that is scarily anonymous. Yet, they lurk in the shallow Forex waters ready to lock the newest victims in their deadly jaws.

Terms and Conditions attempting to assure clients of safe trading mention practicing MiFID trading laws and regulations. However, MiFID would never allow an incognito broker to offer their questionable services to EEA traders. We’ll explore this in-depth in this FNPMarkets review.

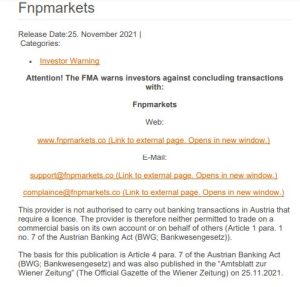

If you try and preview their website, you’ll find it already non-functional. The warnings alerting the public of the FNPMarket’s fraudulent intentions are:

-

FMA:

-

Finanstilsynet:

What is more, we strongly advise you not to invest in Citadelex, 70Trades, and Liquidspro fraudulent brokers.

| Broker Status: | Inactive forex scam |

| Regulated by: | Not regulated |

| Operating Status: | Unoperational |

| Scammers Websites: | FNPMarkets.Co |

| Blacklisted as a Scam by | FMA, Finanstilsynet |

| Broker Owner: | N/A |

| Headquarters Country: | EU (allegedly) |

| Foundation Year: | 2021 |

| Online Trading Platforms: | Webtrader |

| Mobile Trading: | N/A |

| FNPMarkets Minimum Deposit: | $250 |

| Deposit Bonus: | 10%-15% first deposit bonus |

| Inactivity fee: | 10% monthly after not trading for 6 months |

| Crypto Asset Trading: | Yes (BTC, ETH, LTC) |

| CFD Trading Option: | Yes (commodities, stocks, indices) |

| Available Trading Instruments: | Currency pairs, crypto, stocks, indices, commodities |

| Maximum Leverage: | 1:500 |

| Islamic Account: | No |

| Free Demo Account: | No |

| Accepts US clients: | N/A |

Compliance and Fund Safety at FNPMarkets

FNPMarkets makes one bold claim about their regulation and legal status. This is supposedly a valid brokerage site that engages in online trading and money transfers under the MiFID directive. Set up by ESMA, an independent EU regulator, this compilation of laws is what every legit broker has to use to guide their conduct.

Hypothetically speaking, even if FNPMarkets operated from an EU member country, they would need a jurisdictional regulator’s permit. Since they list none on their website, we searched through a couple of registers, including AMF, BaFin, CySEC, CONSOB, CNMV, and FINMA. None of these leading EU regulators have issued a trading certificate for a broker known as FNPMarkets.

The only way to obtain a brokerage license is by first investing a remarkable amount of 730 000 EUR. FNPMarket’s cheap web presentation doesn’t look like it should represent a business worth that amount of cash.

Secondly, every broker has to provide segregated bank accounts for the safe keeping of clients’ funds. In EEA, the leverage ratio is set to 1:30, while FNPMarkets offers leverage of up to 1:500. And although they claim so, FNPMarkets isn’t eligible to provide negative balance protection and compensation funds. Being an illegal entity, they do not have access to the Financial Ombudsman, which protects the traders in case of dispute or the company going bankrupt.

Various other conditions stand as well. For example, not a single EU broker is allowed to offer bonuses. Because of being often misused in the past, they have been banned in the EU. FNPMarkets still offers several types of bonuses.

Trading Software Overview

Webtrader offered at FNPMarkets cannot even remotely compare to the excellence of MT4, cTrader, and MT5, for example. Don’t expect the possibilities like algo trading and advanced indicators. And we won’t even discuss the trading conditions.

Several classes of financial instruments are available for trading with spreads starting from 3 pips, which is just absurd. The leverage ratio is 1:200, and in case you deposit more, you can unlock 1:500. Without anyone’s help, FNPMarkets basically exposes their own deal as a scam, considering this leverage is not available in EEA.

Account Types Available at FNPMarkets

Based on how FNPMarkets categorizes its customers, they’ve made three account types available:

- Bronze – €250, for beginner traders

- Gold – €2,500, for intermediate traders

- Black – €25,000, for experts

Supposedly, with a more expensive account type come better trading conditions. Strangely enough, the account features given on the site do not match the ones we saw in the trading terminal. Just another reason to take this inconsistency as scam evidence.

Methods of Deposit and Withdrawal

Because of how unreliable and buggy the website turned out to be, we couldn’t verify the payment methods. Although FNPMarkets allegedly provides secure payments through bank wire transfers and credit cards, they’re still only internet fraud. You can’t just trust such a shallow claim to have any value when it comes to safety.

Revealing anything in direct correlation with how they conduct their business doesn’t complement their anonymity. However, FNPMarkets warns about withdrawal fees that go up to $50 for wire transfers.

Plus the 10% of the amount if you haven’t executed more than 200 trades. There’s the dreadful trading volume requirement too, which we will discuss in the following section of the review.

How the Fraud was Carried Out

FNPMarkets is a proven scammer and several reliable warnings are solid proof of that. Since they display some of the most common swindler behaviors, let us evaluate them now.

Especially effective for luring customers are the bonuses. Imagine walking right into a steel trap because you didn’t watch your step. The same is with risky investments. If you fail to recognize the warning signs, your investment is in grave danger.

Bonuses that FNPMarkets offers are quite attractive. The first deposit bonus adds 15% of the total investment to your cash pool. There’s also a referral bonus, but FNPMarkets doesn’t reveal how it exactly works.

These bonuses unmistakably always come with special conditions like trading volume requirements. FNPMarkets demands you to make 25 times more profit than the deposit and bonus combined in order to allow you any refunds!

FNPMarkets Summary

As the publications by regulators have warned us, FNPMarkets doesn’t have the necessary authorizations to carry out banking transactions. Neither are they permitted to offer online investment services or trade on behalf of individual investors. It is simply so because they require a license that they do not own.

We discussed it at the beginning of this review – FNPMarkets has no means of becoming a regulated broker.

It takes a significant amount of money and effort to even apply for a license. All the reasons we listed in our FNPMarkets review are major red flags you should look for when deciding who to entrust your funds with.

FAQs About FNPMarkets Broker

Is FNPMarkets a Regulated Broker?

This broker is in possession of no legal license or trading certificate. Public alerts by several regulators warn traders about FNPMarket's malicious intentions.

Is My Money Safe at FNPMarkets?

No kind of capital is safe with a fraudulent broker. Without a proper license FNPMarkets is another internet scam.

What Is The Minimum Deposit at FNPMarkets?

The minimum amount you have to invest to become a customer is $250.