Fortissio Review: A Thorough Examination of the Broker’s Profile

We did extensive research for this Fortissio review so you could find out all the broker has to offer. We’ll go over Fortissio’s broker profile, including benefits and drawbacks, payment options, fees, leverage, and more! Find out by reading on.

To avoid missing out on crucial details, read our reviews of CornerTrader, Cobra Trading, and TradeZero.

Who Is Fortissio? All About Fortissio.com

Under the name Fortissio, Vie Finance A.E.P.E.Y. S.A., a registered Greek investment firm, runs a branch in Germany under the name BaFin and is fully approved and recognized by the Hellenic Capital Market Commission.

| Fortissio | Reliable Broker Must Have | |

| Legal name: | Vie Finance A.E.P.E.Y. S.A | Transparently displayed in the disclaimer or legal documents |

| Regulation: | Regulated by the Hellenic Capital Market Commission (HCMC), BaFin | Within your legal jurisdiction – local regulator |

| Registered at: | 4, 28th October Street, Marousi, Greece

Sonnenallee 262, 12057, Berlin |

Your country or the country whose license applies in your legal jurisdiction |

| Established: | 2017 | The older the domain – the higher the possibility the company is trustworthy |

| Website: | www.fortissio.com | Domain should be from local or international zones, no .xyz etc. |

| Financial Authorities Warnings: | None | None |

| Contacts: | Company Information

Complaints Dealing Back Office Customer Service Phone +302112340925 |

Phone, email, social media, web form |

| Is a withdrawal possible: | Yes | Yes |

| Fees: |

|

Transparent fees – list of spread and commissions |

| If Active on Social Media: | No | Often present on social media |

| Investor Protection: | Segregated funds, Negative Balance Protection, ICF | Compensation fund |

Regulation Info

Greek financial rules are complied with by Fortissio under the supervision of the Hellenic Capital Market Commission (HCMC). The broker also manages a branch in Germany under the jurisdiction of the Federal Financial Supervisory Authority (BaFin). Because trading provides some level of investor safety and control, it needs to be regulated.

It is important to keep in mind that Fortissio may or may not provide authorization to operate in Sweden, Poland, or Spain. To operate legally in these countries, the broker would need to be under the control of the appropriate regulatory bodies.

Sweden’s governing authority is the Swedish Financial Supervisory Authority (Finansinspektionen). In Poland, it is referred to as the Polish Financial Supervision Authority (KNF), and in Spain, it is referred to as the National Securities Market Commission (CNMV).

Fortissio Broker Profile

Fortissio broker offers trading in FX spot, commodity spot, commodities, shares, index, crypto, ETFs, and synthetic derivatives. With multiple options to trade with, it also offers multiple account types with different benefits.

| Trading platforms: | Xcite |

| Account types: | Starter, Explorer, Champion, Elite, Luxury, VIP, Prestige, Superior, Infinity, Royal, and Expert |

| Financial Instruments On Offer: |

|

| Maximum leverage: | 1:30 for retail clients and 1:200 for professional clients |

| Minimum Deposit: | 200 euros |

| Commissions/bonuses: | None |

| Mobile app: | Yes |

| Desktop app: | No, Web-based |

| Autotrading: | No |

| Demo account: | No |

| Education or Extra tools: | None |

Fortissio Products, Leverage, and Fees

When selecting a broker, fees, offerings, and leverage are crucial considerations. The key is to keep an eye out for these factors. Before investing, carefully review the broker’s costs and offerings.

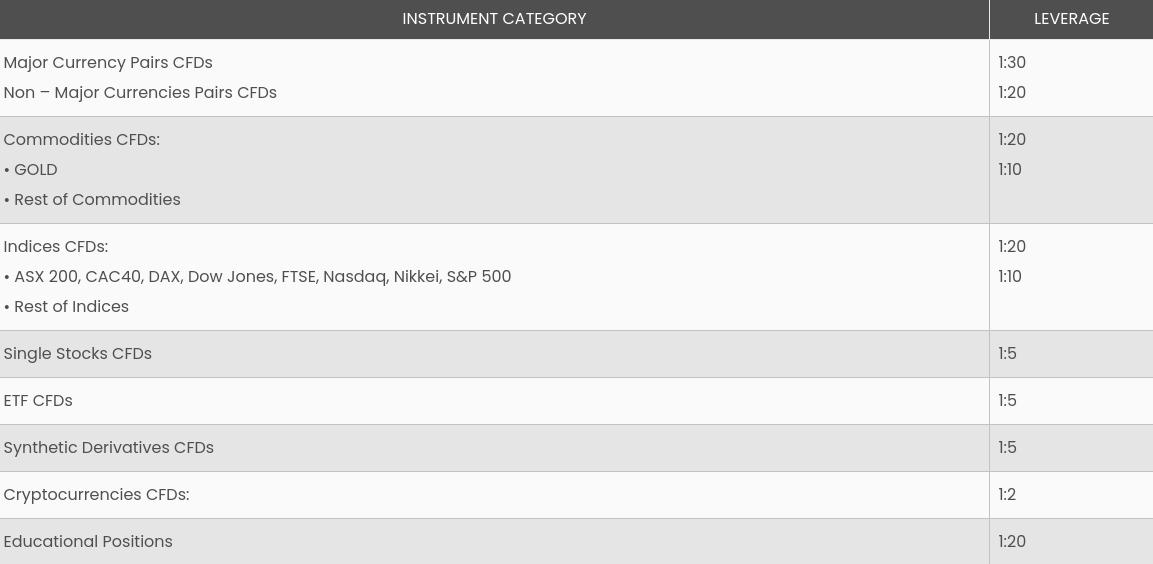

The spreads and fees you pay will vary depending on what you trade with. It also depends on whether you’re a retail customer or a business client. Depending on what you trade with, spreads might range from 0.01 pip to 2.5 pip and beyond. Leverage varies depending on the client and might range from 1:2 to 1:200 for business clients. Retail clients are limited to a maximum leverage of 1:30.

The open positions that were held overnight are subject to a rollover fee. It can range from 0.02% to 0.015% of the exposure from the previous night. If there hasn’t been any trading activity for at least three (3) months, there will be an administrative cost of 150 euros. The currency conversion charge is equal to 0.7% of the realized net profit or loss on the trade.

Is Fortissio Safe To Trade With?

To determine whether Fortissio is truly a safe option for trading, it is worth taking a deep dive into the experiences of its traders. Analyzing a variety of reviews, both positive and negative, can provide valuable insights into the strengths and weaknesses of the brokerage. By weighing the pros and cons of Fortissio, we can make a more informed decision about whether it is the right choice for our trading needs.

It is important to remember that safety is not the only consideration when choosing a broker. Other factors, such as ease of use, customer support, and available resources, should also be taken into account. By conducting a comprehensive analysis of all of these factors, we can make the most informed decision about which broker to trust with our investments.

Fortissio Review: Traders’ Thoughts and Opinions

While a total of 29 reviews on Trustpilot about Fortissio may not be sufficient to form a definitive judgment, they do provide some insight into the experiences of other clients. However, it is concerning that more than 70% of the reviews are negative, particularly highlighting issues with customer support being rude and incompetent, as well as difficulties with withdrawals.

One particular client mentioned that the customer service was initially pleasant until they invested. Subsequently, they faced challenges in reaching the customer service team and encountered difficulties retrieving their funds. Such experiences reflect potential shortcomings in Fortissio’s customer support and withdrawal processes.

A Look at Fortissio’s Traders They Serve

Since Fortissio is a regulated broker, we wanted to dig deeper and check where their traders come from. As unfortunate as it is, we found out that Fortissio is not regulated to operate from countries it is operating from and that raises red flags. The traders Fortissio serves come from:

- Sweden

- Poland

- Spain

To make sure the broker’s operations comply with local laws and regulations in each country, research is necessary before investing. Contact us today for more information.

Deposits and Withdrawal Methods

The payment methods Fortissio offers are:

- Visa and Master cards

- Maestro

- Sofort

- ecoPayz

- MyBank

- Skrill

- Rapid

- Neteller

- Bank Transfer

- PayPal

- Brite*

- Google Pay

Both deposits and withdrawals are possible with the above payments and whatever you used initially to make a deposit, that is where the withdrawal will go. So if you used a credit card, the withdrawal will be processed there. The withdrawal is processed within 1 business day and all you have to do is to complete the withdrawal form on Fortissio’s website.

Fortissio Pros and Cons

| Pros | Cons |

|

|

Insights from Our Trading Experts

Fortissio is a decent broker option for trading, with a dedication to regulatory compliance and a transparent fee structure. However, the lack of regulation in Poland, Sweden, and Spain prevents it from operating there. Potential clients from these nations should think about using brokers who are governed by different regulatory bodies.

Additionally, assessing the overall reputation of the broker for this Fortissio review is challenging due to the dearth of existing client testimonials. Fortissio provides certain benefits, but looking at alternative brokers with better trading terms, reduced costs, and a more robust regulatory presence may be a good idea. Contact us today for a free consultation and remember that it carries no obligation.

FAQ Section

Is Fortissio Legit?

Fortissio is a legit brokerage company due to being regulated, offering a compensation fund, and providing a transparent list of fees and products. Although there are better brokers, Fortissio could be a decent choice, especially for professional traders.

Does Fortissio Have Regulation?

Yes, Fortissio is regulated by the Hellenic Capital Market Commission (HCMC) and operates a branch in Germany under BaFin.

What Are The Payment Methods Of Fortissio?

The payment methods Fortissio offers are Visa and Master cards, Maestro, Sofort, ecoPayz, MyBank, Skrill, Rapid, Neteller, Przelewy 24, Bank Transfer, PayPal, Brite*, and Google Pay.

Is My Money Safe With Fortissio?

Fortissio offers segregated accounts, negative balance protection, and the Investor Compensation Fund (ICF), provided by the Hellenic Capital Market Commission (HCMC). Due to that, money is safe in case the company goes bankrupt or something similar.